Markets have reacted positively to the election of Cyril Ramaphosa as South Africa’s fifth president after drawn-out discussions within the ruling party to remove President Jacob Zuma from the high office.

This development comes as Finance Minister Malusi Gigaba is preparing to deliver the national budget on Wednesday. Many international observers will be watching this budget closely.

What Gigaba, assuming he retains his position, says will have an effect on the rand: we need to see indications that the deficit will be narrowed, and that borrowings will not increase.

The finance minister has to deal with the fact that revenue will be about R50 billion lower than what was anticipated in the February 2017/18 budget, which was presented by then Minister Pravin Gordhan.

Value Added Tax (VAT) has been a lever that the National Treasury refused to pull for years, likely because of its political consequences, but a two percent increase in VAT would create the much-required cash.

An increase in VAT is expected to signal government’s commitment to addressing the issue of fiscal slippage.

An alternative to increasing VAT in a linear manner would be to remove the zero rating for VAT on fuel sales. We anticipate that this could raise up to R18 billion.

Given that this would increase the retail price of fuel, if not offset by a cut in the general fuel levy, this means that National Treasury would need to get creative around this for it to be palatable for consumers.

The Davis Tax Committee has studied alternatives available with respect to taxing the wealthy in many different ways, and it had an opinion, which was against measures such as a luxury rate of VAT.

On the upper end of the tax spectrum, tax rates are 45%, which is viewed by some as punitive.

In a country like South Africa where the top 5% of the wealth bracket carries the bulk of the tax burden, the risk of the top end retaliating against more taxes is becoming a reality.

National Treasury is expected to introduce measures to increase the pace of the deficit reduction.

The ability of National Treasury to address primary budgetary issues, if done right, will be a game changer, not only for the capital markets but also for the man on the street.

Consumer and business confidence could start the cogs turning for economic recovery.

The fiscal slippage has been startling as the deficit has been more than a percent higher than what was tabled in February 2017.

The public sector wage burden has been a significant detractor as the wage bill has spiraled out of control over the last decade.

The current wage agreement is expiring in the next month and a new three-year deal increasing at a rate of inflation should be expected.

This has not been confirmed, and could derail the anticipated expenditure numbers should there be any change in the rate of increase.

To add another spanner in the works, former President Jacob Zuma skillfully threw in the promise of free-education during the December ANC conference and this is now a promise the party needs to figure out how to fulfil.

It is estimated that up to R60 billion would be necessary to allow for free tertiary education.

Governance issues and clarity around the funding of state-owned companies, namely Eskom, SAA and the Post Office remains a top priority.

Close to R35 billion is required in bailouts, with Eskom taking up around R20 billion of this amount.

The state-owned companies have put a major strain on contingent liabilities, as the government continues to give guarantees when these entities borrow.

This has been the focal point of concerns raised by international rating agencies.

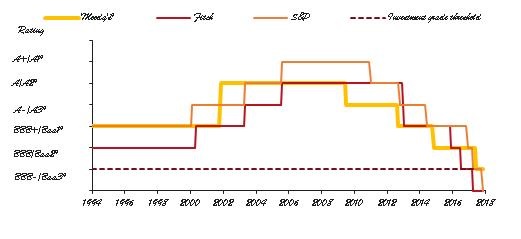

Moody’s is the only rating agency which has South Africa above investment grade.

The negative outlook it placed on the country’s rating will expire at the end of February, allowing enough time for its analysts to digest the budget and make a final decision.

SA Inc doesn’t need another negative rating. We need to capitalise on our great resources, for the benefit of this great continent.

While it might be too late for this year, great expectations lie ahead for the medium term budget speech tabled for October. What is clear is that the winds of change are blowing, a new South Africa awaits.

• Tsitsi Hatendi-Matika is Head: Retail Investment Specialist at Absa’s Wealth and Investment Management unit.

Publications

Publications

Partners

Partners