The economy is set for a shock from the combined blows of Eskom’s move to hike the cost of two of its biggest new power stations by almost R83 billion and the utility’s rising multibillion-rand debt.

This is likely to result in the power utility pushing for above-inflation increases in energy prices – to the detriment of businesses, households and economic growth.

At the same time, Eskom’s higher costs are set to place extra pressure on the parastatal and government’s creditworthiness.

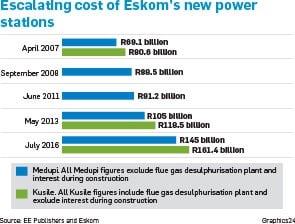

“Ongoing schedule delays and insufficient time for front-end planning have affected the total cost of projects, especially at Medupi and Kusile. The board has approved revised business cases, thereby increasing the available amount to R145 billion for Medupi and R161.4 billion for Kusile [previously R105 billion and R118.5 billion, respectively],” Eskom noted in its 2016 annual report, which was released this week.

This means that the utility expects the combined cost of the two new power stations will rise to R306.4 billion, as opposed to R223.5 billion.

This week, National Treasury director-general Lungisa Fuzile said that Medupi and Kusile were examples of how the government had planned “too optimistically”.

“We hadn’t built power stations in a long time and we lost capacity. First, the prices quoted were nominal prices. It’s a basic thing. It means that with inflation, every year the price will change. That does not necessarily mean a cost overrun.”

He said that the contracts for the stations did not spell out clearly enough the consequences of nonperformance in terms of time and costs.

“We got it right with the 2010 World Cup stadiums … writing good contracts. It sounds very basic, but you don’t find it in the contracts [for the stations], so there are no consequences for overruns,” he said at a Gordon Institute of Business economic outlook conference.

If South Africa proceeded with building nuclear power stations, it would draw from the lessons learnt at Medupi and Kusile, he said.

Shaun Nel, spokesperson for the Energy Intensive User Group of Southern Africa, which represents the country’s largest industrial power consumers, said Medupi and Kusile were the most expensive coal-fired power stations in the world.

Nel said Eskom was in a “death spiral”, where the costs of its new power stations were significantly increasing and rising power prices were shutting off local power demand, which, in turn, would make it difficult for Eskom to recover its costs from local customers.

An inability to recover costs would likely see government having to bail Eskom out again in the future, he said.

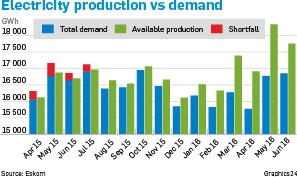

Eskom’s recent annual report reveals that, in the previous financial year, “electricity sales in key segments, such as industrial, mining and commercial sales, are relatively stagnant, either at or nearing a 15-year low”.

Eskom’s power generation has declined for five consecutive years, and the utility’s energy output dropped 7% this year after peaking in 2011 at 237 430GWh.

Kamilla Kaplan, an Investec economist, said that continued above-inflation power price hikes would boost local consumer inflation, which is the key measure the central bank uses to set interest rates.

She said the hikes would also constrain the economy’s production, given the weak economic growth environment.

“There can’t be any further delays in the building of Eskom’s new power stations as insufficient electricity supply is considered a structural constraint on potential economic growth,” she added.

In another development, Chris Yelland, managing director of EE Publishers, said this week that, according to his estimates, the combined cost of Kusile and Medupi could increase by a further R113.6 billion.

His calculations take into account interest accrued during construction and outstanding contractor claims – and in the case of Medupi, the cost of installing a process to remove sulphur dioxide – making the total cost of both power stations as much as R420 billion.

But Eskom spokesperson Khulu Phasiwe said the utility would not be commenting on Yelland’s estimates. “We comment on facts,” he said.

Paul Marty, lead analyst for Eskom at Moody’s Investors Service, said it was no surprise that Eskom had increased the expected price tag for Medupi and Kusile, adding that the extent of the extra outlay “wasn’t insignificant”.

Marty said the key driver of Eskom’s credit rating was its support from government, which earlier this year fended off a downgrade to junk status, or sub-investment grade, from three major ratings agencies, including Moody’s.

Anoj Singh, Eskom’s chief financial officer, said that if the country’s credit rating was cut to sub-investment grade, it wasn’t expected to have a major effect on Eskom, which was already assessed at sub-investment grade.

Moody’s and S&P Global both rate Eskom’s creditworthiness at junk status, or at the first notch of sub-investment grade. Fitch still has Eskom’s credit rating two notches above investment grade.

However, without government support, Fitch and Moody’s rate Eskom’s creditworthiness six notches below investment grade, while S&P rates Eskom seven notches below investment grade.

Marty said: “Eskom is in a challenging position. On a stand-alone basis, Eskom’s baseline credit assessment is close to a default position, and the company is surviving because of government support.”

But Singh said Eskom had its credit rating under control.

“The ratings agencies [of Eskom] had raised a number of key concerns that could result in a further ratings downgrade ... We are confident that our financial plan adequately addresses these concerns,” he wrote in Eskom’s latest annual report.

“A potential [South African sovereign] downgrade is already priced into Eskom’s debt,” Singh said.

“Debt servicing is anticipated to increase over the next five years, driven by increases in interest repayments, as well as debt repayments as loans mature,” he said.

An S&P spokesperson said the company had no comment on Eskom beyond its most recent published research.

Fitch spokesperson Peter Fitzpatrick said the agency couldn’t comment as its lead analyst on Eskom was away.

Publications

Publications

Partners

Partners