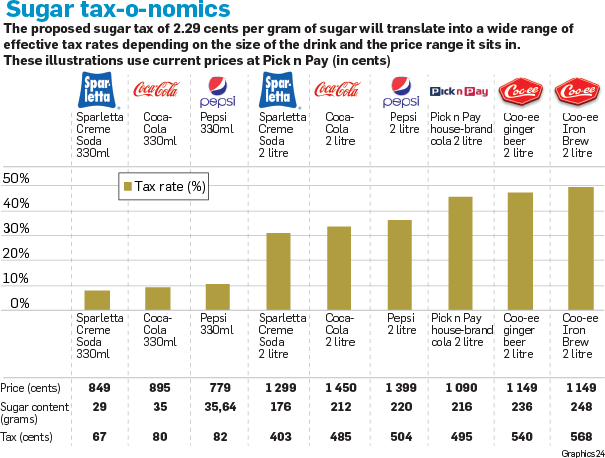

National Treasury’s proposed sugar tax will discriminate sharply between different parts of the soft drink market, with an effective tax rate of anything between 8% and 50% on different products.

This could complicate the industry’s fight against the tax because Treasury’s plan might actually benefit some producers over others by eroding the competitive position of cheaper brands, mostly to the benefit of Coca-Cola Beverages SA.

Treasury’s stated target is a tax rate on sugar-sweetened beverages of roughly 20%.

However, it used the current retail price of a 1-litre bottle of Coca-Cola to establish what 20% amounts to, which has far-reaching consequences (see box below).

In reality, it means small units like 330ml cans will be taxed at negligible rates.

Because the industry discounts larger units like 2-litre bottles, the tax could amount to about 50% on large bottles of cheaper soft drinks.

This is sure to be one of the points of attack on what the industry body, Bevsa, calls the “worst punitive option” adopted by Treasury.

“It is not a 20% tax,” said Mapule Ncanywa, executive director of Bevsa.

“We are not happy at all,” she told City Press this week.

The effect on any individual company would depend on the mix of its sales between the different sizes, as well as its pricing practices.

According to Coca-Cola Beverages SA spokesperson Wendy Thole-Muir, an in-house analysis showed that its products would get taxed at an average of “just over 20%” under Treasury’s proposal when big and small units were averaged out.

This dynamic could hurt SoftBev, which bottles PepsiCo products in South Africa, but also bottles lower-cost local brands such as Coo-ee and Jive.

Coo-ee is usually priced lower than Coca-Cola products and sold only in large units.

At the current price, the tax would be up to 50% on some Coo-ee products.

SoftBev did not want to comment on the sugar tax outside of the common position being formulated by Bevsa.

Standard Bank this week sounded the alarm on this inherent problem with the proposed tax, predicting that it would lead to less competition in the sector by squeezing out “B brands”.

It is hard to gauge how the industry will respond to the tax.

In a perfect world, they would reformulate their offerings to contain less sugar, but it is more likely they will absorb some of the tax as a new cost and pass some of it through to the consumers.

“For the tax to have the desired behavioural impact on consumption, there has to be some pass through of the excise tax,” Treasury said in an emailed response to questions.

However, government had not made any presumptions about how much of the tax would ultimately get reflected in consumer prices – or how that would affect consumption, it added.

The extent to which this happens would not only depend on consumers’ willingness to bear the cost, but also on the “degree of competition” in the sector, it said.

Another leg of the industry’s defence will be that soft drinks are being irrationally singled out when people also consume a great deal of other unhealthy things, including sugary snacks.

Coca-Cola Beverages SA told City Press that it did not “believe that punitive taxation is effective in achieving the desired behaviour outcomes among consumers”.

“Furthermore, we are concerned that the targeted taxation of SSBs [sugar-sweetened beverages] places a disproportionate burden on one sector,” it said.

Ncanywa echoed this, calling the proposal “extremely punitive” and accusing Treasury of chasing “low hanging fruit”.

The soft drink sector is very concentrated, making the administration of the tax easy.

National Treasury justifies going after soft drinks first on the basis that they are more harmful than other products.

They contain enormous amounts of sugar but, unlike biscuits, sweets or chocolates, do not really contain anything else.

“Liquid sugar is particularly harmful – more so than in confectionery etc,” Treasury said.

Soft drinks were also not necessarily where the tax would stop, it said.

“Tax on SSBs is the first step. We will consider further measures, depending on the policy position as determined by the department of health,” it said.

“The merits of this exclusion will be debated during the consultation process. There are health experts who question this exclusion,” admitted Treasury.

The rise in the consumption of soft drinks has been one of the most significant changes in the national diet since the 1990s, according to a paper by researchers at Stellenbosch University that was published last year in the SA Journal of Science.

South Africans have over time cut down on buying sugar itself, but at the same time have rapidly increased their consumption of sugar through soft drinks, and packaged foods and snacks.

Using figures from Euromonitor, a global consumer market research agency, they show that South African consumption of carbonated soft drinks rose 55% per person between 1999 and 2012.

This means the average annual consumption of 43.7 litres in 1999 rose to 67.5 litres in 2012.

Treasury has chosen a relatively unusual method for its sugar tax: to tax per gram of sugar content. Of the various existing sugar taxes around the world that Treasury cites in its proposal, only one, in Mauritius, also works this way.

The rest involve a flat tax rate per litre.

More importantly, Treasury has proposed a tax of 2.29c per gram of sugar, based on the going retail price and sugar content of a 1-litre bottle of Coca-Cola.

The idea was that the tax should be 20%. Since 1 litre of Coke contains 106g of sugar and retails for roughly R11.50, this led to a proposed tax level of 2.29c per gram. This, however, translates into a massive range of actual tax rates on different products.

Size matters because the soft drink industry charges a premium on small cans compared with large bottles.

A 330ml can of Coke goes for R9 at Pick n Pay, but 2 litres cost R14.50. The proposed tax would end up being a relatively ineffectual 9% tax on the can of Coke, but a 33% tax on the 2-litre bottle.

The tax will fall disproportionately on the shoulders of producers targeting the low-cost end of the market.

Coca-Cola and Pepsi contain more or less the same amount of sugar, but Pepsi is generally priced a little lower than its rival. The upshot is the proposed tax would be 33% on 2 litres of Coke, but 36% on 2 litres of Pepsi (using currently advertised Pick n Pay prices).

Pick n Pay house brand cola costs R10.90 for 2 litres. It would attract a higher sugar tax of 45.5%, despite containing less sugar than the same amount of Coke.

Taxing sugar instead of the water in the drinks makes sense. If Treasury simply put a 20% tax on all sugary drinks, it would cause the opposite problem to penalising big bottles of soft drinks, and would instead incentivise the consumption of bigger portions of cooldrink, which is arguably the complete opposite of the point of the tax.

*Update: A previous version of this article stated that pure fruit juices would be except from the proposed tax. This was removed after the National Treasury clarified that it would tax fruit juices too.

Publications

Publications

Partners

Partners