The UK’s exit from the EU rocked world markets, exposing SA to the possibility of a deeper economic crisis

South Africa’s vulnerable economy could be placed at greater risk of recession after the shock news on Friday of Britain’s decision to exit the European Union (EU).

A large current account deficit and negative economic growth mean the country can be tipped into a recession – defined as two consecutive quarters of negative growth – which would adversely affect jobs.

The Brexit is unlikely to deter the SA Reserve Bank from continuing to put inflation above economic growth.

“There are three transmission channels through which the Brexit can hit South Africa: the markets, trade and the currency,” said Rian le Roux, chief economist of the Old Mutual Investment Group.

“Firstly, there are the markets. Whenever there is a global shock, investors move straight to the safest asset, which is a US bond,” he told City Press.

All that money flowing into the US bond market comes from somewhere – emerging markets across the world shook on Friday as capital flight set in.

South Africa is particularly vulnerable to outflows because the country has a large current account deficit.

This means it needs money to continue flowing into its financial markets to keep the rand steady.

According to Neil Shearing from Capital Economics, a UK-based research consultancy, South Africa has a number of weaknesses that can expose it to Brexit damage if things do not calm down relatively soon.

If capital flight continues, “economies with large external funding requirements – notably, Turkey and South Africa – could be forced to raise interest rates”, he said.

“Assuming the dust settles in financial markets, the fallout should be limited.”

South Africa also falls among those emerging markets with banking systems that have a relatively high dependence on short-term funding in the capital markets.

On this score, South Africa joins Malaysia and Turkey in being particularly exposed to market trouble, said Shearing.

The fact that the rand did not drop even further on Friday came as a surprise to many.

“The rand was surprisingly stable. It fell in the morning, but then recovered,” said Le Roux, who was quick to point out that “it is early days, though”.

South African bond yields – defined as the rate of return on government debt – shot up sharply on Friday morning from 8.86% to 9.1%.

However, the rand recovered significantly through the day, after plummeting in the morning.

It started the day at about R14.37 to the dollar, then fell to R15.68, before later recovering to R14.89.

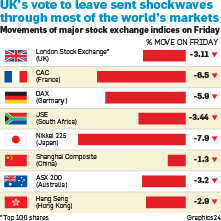

The JSE All Share index fell as much as 5.4% on Friday before being last quoted down 3.4% just near the close.

The second channel through which South Africa could feel the Brexit is through slower economic growth.

A slower global rate of growth will ultimately hit demand for local exports, growth and jobs.

Investec economist Annabel Bishop said that for this year, the bank was forecasting that South Africa could grow by just 0.2% – down from 1.3% last year.

In the first quarter, the local economy contracted by 1.2%.

Slower growth will also undermine South Africa’s credit rating, which is at the bottom of the investment-grade scale.

Le Roux said that the urgency to speed up local growth-enhancing structural reforms had just been ratcheted up another notch.

A more direct effect on South Africa’s economy comes from the British pound’s depreciation on Friday, when it fell 4% against the rand.

It also fell 8% against the US dollar and 6% against the euro, which could seriously damage its immediate economic prospects.

If this sticks, the British will pay more for everything they import, but theoretically increase the competitiveness of their exports.

The UK represents about 18% of all tourists visiting South Africa, and they may well stop coming, said Le Roux.

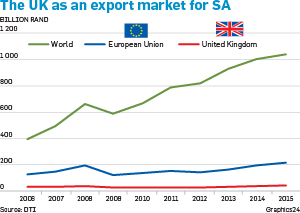

The UK also makes up 4% of all South Africa’s exports to the world, but 20% of South Africa’s exports to the EU.

Its importance is, however, completely disproportionate for a number of South African sectors, especially fruit exporters.

The UK buys 10% of South Africa’s exported wine, 10% of exported citrus fruit and 21% of exported grapes.

The UK will have two years to extricate itself from the EU, but the Brexit will ultimately completely upset innumerable institutional setups around the world.

For the UK, maintaining its trade access to the rest of Europe would be the number one concern, but its relationship to every other corner of the world is now also uncertain.

Gerhard Erasmus, a trade law expert at Stellenbosch University, echoes this.

The Brexit blows a hole in the new trade deal, which the EU and South Africa signed only two weeks ago.

“We just concluded this Economic Partnership Agreement, and the UK was a big part of that,” said Erasmus.

But, he added, “there is no immediate effect”.

The partnership agreement – concluded between the EU, the five-member SA Customs Union and Mozambique – is set to replace the trade-related parts of South Africa’s standing EU deal, namely the Trade and Development Cooperation Agreement.

Access to the UK market is an important part of both deals, but will now no longer be part of the package.

The same problem is going to come up with the partnership agreements that the EU has signed with the other regional African blocs.

National Treasury released a statement relating what could possibly fill this trade agreement void, saying the UK had several options.

Treasury seems to be hoping for one particular option open to Britain: to join the existing European Free Trade Area (Efta) for non-EU European states.

This gives the UK back its access to the EU market, with South Africa also benefiting since the customs union already has an agreement with Efta.

The UK could also simply choose to pursue bilateral trade deals on its own – something it has not done for decades.

Investec’s Bishop said that the EU would increasingly fear further exits by its members.

Publications

Publications

Partners

Partners