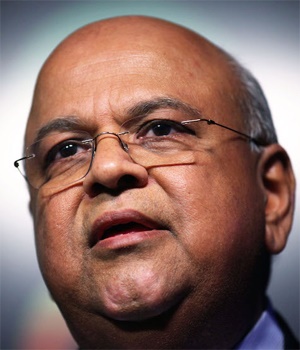

Tax experts say Finance Minister Pravin Gordhan may announce higher-than-expected tax collections when he delivers his budget speech, while sin taxes may outstrip the inflation rate and introduce the much-awaited carbon tax.

The tax team at Deloitte also expects personal taxes to shoot up by 1%, and for a levy on companies that have a turnover above R1 billion to be introduced.

The team held a round table discussion last week in anticipation of Gordhan’s budget speech on February 24, and said they estimate tax revenues to be higher than the projected R1.2 trillion collections for 2015/16.

The tax experts said that although the tax review committee, known as the Davis Tax Committee, recommended an increase in VAT, Gordhan was likely to leave it untouched because an increase could further antagonise trade unions, which are upset about the Tax Administration Laws Amendment Act, which in essence phases out provident funds as something different from pension funds.

Nazrien Kader, managing partner for taxation services at Deloitte, said no finance minister had previously been under so much scrutiny from all observers because expectations are high for Treasury to improve the country’s performance and stimulate growth.

“I go as far as to say no South African finance minister has ever had to walk a tightrope of this nature. Gordhan has promised to surprise his critics. That confidence is quite contagious. He sounds like he has a plan, and I think what’s different about it this time is that he actually sounds like he has the backing of government to execute his plan,” said Kader.

Gordhan was also under pressure to demonstrate how quickly government could implement the incentives and grants aimed at boosting foreign direct investment.

The forecast by the International Monetary Fund, which revised down South Africa’s economic growth projections to between 0.7% and 0.9%, far below the estimated 2% rate, low commodity prices, the volatile rand and an economy that was bordering on a recession, low savings, an increased government wage bill and food inflation brought on by the drought, had created a “near-perfect” storm, said Kader.

“It is perhaps the perfect time to launch reform, and tax reform is one sure way to stimulate the economy. Minister Gordhan’s commitment to offering incentives and grants to attract foreign direct investment and stimulate growth in the critical industries such as manufacturing, mining and agriculture is commendable. No doubt, investors will be judging the effect by how quickly the benefits of these incentives and grants offered through tax are felt,” said Kader.

But if Gordhan introduced tax hikes on personal income and goods, taxpayers would demand that he demonstrate how government would spend the extra cash efficiently, particularly at municipal level.

“We are also expecting spending efficiencies on the part of the government by avoiding wasteful expenditure, a zero-tolerance approach to corruption in the public sector, a more efficient municipal rates system to collect revenues and an overall culture of thriftiness,” said Kader.

Billy Joubert, tax director and transfer pricing leader, said any increase on VAT would be coupled with tax exemptions on foodstuff, and some of the money may go to the National Health Insurance scheme or universities to appease the #FeesMustFall movement.

“I don’t think there will be an increase on corporate income tax because government should think about cutting it to attract foreign direct investment. A wealth tax would be premature, but I don’t think VAT will increase this year,” said Joubert.

Izak Swart, director of carbon tax at Deloitte, said he expected Gordhan to announce strategic government interventions to accelerate economic growth.

“Some easy interventions would be to enhance current incentives offered by the department of trade and industry to accelerate the implementation of the Special Economic Zones Act,” said Swart.

He said that although a carbon tax could add an extra R20 billion to the fiscus, he believed government should postpone its implementation to allow industry and government to fully understand the effect a carbon tax would have on the economy.

Although South Africa was facing mounting pressure to introduce the tax after COP21 in Paris and the UN conference on climate change agreed to price carbon, while the World Bank said 12% of the world’s emissions were subject to tax, Swart did not believe South Africa was ready to implement it.

“The carbon tax proposal is complicated and would need emitters to find appropriate measurement criteria to deal with the compliance requirements of the proposed tax,” said Swart.

Publications

Publications

Partners

Partners