National Treasury moved a step closer to taxing big polluters last week when it published its latest carbon tax regulations, which could boost fiscal tax revenue by R13.7 billion a year.

The regulations explain how companies can offset their carbon tax liabilities by investing in projects that help fight climate change. Earlier this year, Treasury published the draft Carbon Tax Act, indicating it wanted to start taxing emitters at the beginning of next year.

The regulations are an addendum to the bill, setting out the conditions of the rebates and offsets, and explaining how it will work.

A carbon tax could be a lucrative income for the fiscus, adding R13.7 billion, according to Treasury estimates. It would start at R120 per ton of CO2, but be reduced with the rebates and offsets.

Carbon tax aims to put a price on pollution and encourage heavy emitters to change their ways, while also aligning South Africa with its international commitments to reduce its carbon footprint. Big industry in South Africa has been fighting against the controversial carbon tax for half a decade.

Thava Govender, Eskom’s group executive for transmission and sustainability, welcomed the inclusion of the offsets in the draft, but warned that the long lead times required to deliver these projects could limit their effectiveness.

The new regulations suggest that companies could reduce their carbon tax burden by between 5% and 10% of their total greenhouse gas emissions by investing in projects that reduce greenhouse gas emissions.

The projects must fall under international standards such as the European Union’s Clean Development Mechanism (CDM), the Verified Carbon Standard and the Gold Standard.

Govender said Eskom had several projects in the process of registration with international accreditation bodies, but the utility would have to examine their eligibility.

Green lobbyists are also sceptical. World Wildlife Fund SA said this week that on its own, the offset programme would not lead to a massive reduction, and nongovernmental organisation Earthlife Africa called it a false solution for climate change.

David Hallowes, an energy researcher at environmental justice nonprofit organisation groundWork, said the new carbon tax offset added unnecessary complexity.

“We think this is a disastrous policy largely driven by Treasury’s faith in markets.”

Hallowes said the offsets didn’t work, and that some CDM projects actually resulted in increased emissions. “They invite scamming of all sorts, as happened in the European Union [EU].”

Last year, green think-tank the Stockholm Environment Institute questioned the EU trading scheme, saying it “significantly undermined” efforts to tackle climate change.

In some projects, chemicals known to exacerbate global warming were created and then destroyed to claim cash.

Izak Swart, director at Deloitte, said that to get CDM and Gold Standard projects registered was burdensome and administratively complex.

Despite the lukewarm response to the new tax, the industry, including Eskom and major power users, believed that putting a price on carbon to cut emissions was the way to go. But they agreed that a carbon tax was not the solution.

Nevertheless, Swart said the world was moving towards putting a price on carbon.

According to the World Bank, about 12% of the world’s greenhouse gas emissions were subject to a carbon price in 2015, and this, Swart believed, would only grow in the future.

“I do believe that South Africa needs a form of carbon pricing,” he said.

“The recent Paris agreement will reinforce this. If we don’t have some sort of pricing mechanism, our exports to countries that do have carbon pricing may be jeopardised.”

The Energy Intensive Users Group of Southern Africa said that the instrument to price carbon should be determined based on global agreements to avoid certain countries having an advantage in trade.

Swart said the proposed carbon tax was ostensibly being introduced to change behaviour, but that there were better methods to do so.

“For instance, why not impose a realistic limit on what a company can emit? Should the company exceed the limit, it should be subject to a significant tax.”

Eskom also questioned the carbon tax, notwithstanding its “constructive engagements” with Treasury. Govender said carbon was already priced through a limit on carbon emissions.

Sasol spokesperson Alex Anderson also believed the carbon tax would not change behaviour.

“On this basis, we believe that the current carbon budget approach being implemented by the department of environmental affairs is the most appropriate instrument. Currently, carbon tax is not aligned with this.”

Themba Sepotokele, spokesperson for ArcelorMittal SA, said the carbon tax’s intended goal – to change behaviour – was limited in the steel industry because no alternative technologies were available to lower carbon emissions by the percentages called for.

“A proposal that would make more sense is an emission allocation system with fair allocations. If such an allocation is exceeded, then a tax can be levied,” he said. “Our engagement with government is continuing.”

Sepotokele said carbon tax would significantly affect the company’s bottom line. ArcelorMittal SA’s direct emissions are in the region of 11 million tons a year, making the company liable to pay R320 million in carbon tax. This takes into account the tax-free thresholds.

“We’ve not made a profit in more than five years, and the addition financial burden will further impede our drive to regain profitability.”

Eskom said its calculations showed that if a company takes advantage of all possible tax-free allowances, the value of a ton of carbon dioxide is expected to be R42.

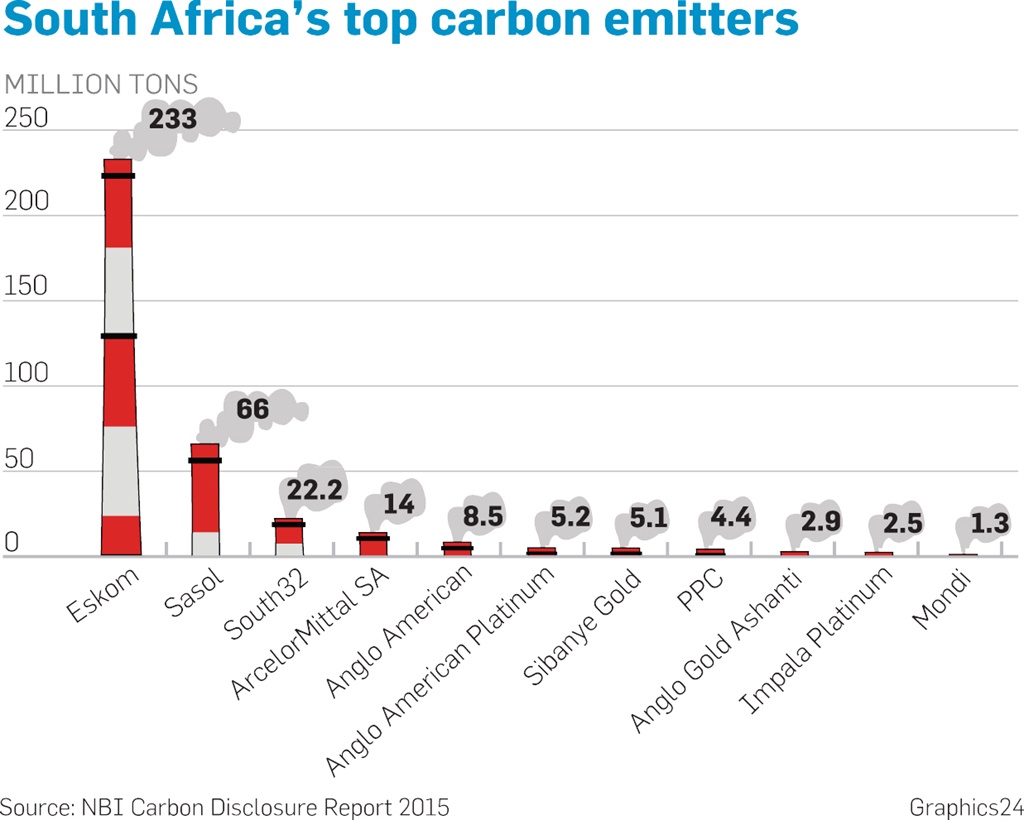

Based on Eskom’s reported emission to the JSE’s voluntary disclosure project, the state utility emitted 233 million tons last year, bringing its carbon tax bill to an estimated R9.8 billion a year.

Swart calculated that a company that emits 100 000 tons of greenhouse gases would, without the offset allowance, be subject to a carbon tax of R4.8 million.

“If the company qualifies for the offset allowance, and let’s assume it is 10%, the carbon tax would reduce to R3.6 million.”

Publications

Publications

Partners

Partners