The world’s tax havens and secrecy jurisdictions should have been closed down en masse “yesterday”, according to Finance Minister Pravin Gordhan.

The emerging international standards on fighting tax base erosion would work only if all countries, “irrespective of size, power or influence, adhere to these standards”, he said at a conference this week.

The meeting – on so-called illicit financial flows – was attended by tax and finance officials from across Africa, as well as major international organisations and nongovernmental organisations.

Gordhan took a swipe at rich countries that drive new tax standards, but still maintain tax havens.

“We can’t have double standards, where rules are imposed by one part of the world but that same part of the world chooses to exempt itself from those rules, either by law or by practice,” he said.

“Developed countries must show more resolve in dismantling all tax havens and disallow their territories and little islands from engaging in such practices.

“There is no point in having these meetings and conferences if the simplest of tasks – which is to close down tax haven practices – are not executed yesterday.

“We, as developing countries, must demand that,” said Gordhan. Multinational corporations also needed a “fundamental change in culture, habit and practice”.

“[They] must take active steps to stop aggressive tax structuring practices, and pay their fair share of taxes in countries where they generate their profits.”

The transition to new international tax standards dealing with base erosion and profit shifting would have victims, warned Gordhan.

“[They] will, in all likelihood, expose domestic banks and other institutions to significant punitive action, including massive fines,” he said.

Gordhan said there had been “several” tax adjustments of R1 billion each because of the state’s interrogation of transfer pricing practices.

Defend independence against 'forces'

Gordhan dedicated a large part of his speech to the danger posed by “forces” wishing to undermine independent institutions dealing with tax.

This echoes his statements following the Hawks’ investigation into his time as commissioner of the SA Revenue Service, which has been widely seen as an attempt by President Jacob Zuma and his allies to neuter him.

“We must always ensure that the right things are done, whatever the extractive forces in the private and public domain might be doing to sabotage genuine, peopleorientated democracies,” he said.

Institutions must “not be interfered with in any way – and those who have the intention of undermining these institutions must be controlled in some way,” he said, joking that the audience was free to applaud – which it did.

“No matter how well-drafted and well-intentioned our laws are, it is utterly useless if we do not have the capacity to enforce such laws,” said Gordhan.

“Those who are benefiting from these criminal activities don’t want governments to become effective. They don’t want effective institutions, don’t want people of integrity.”

“A lot of the emphasis must be placed on effective enforcement systems and the political will, whether they are people who happen to be somebody’s friends or not,” he said.

It has become common knowledge that Africa is losing $50 billion (R717 billion) a year to illicit financial flows. This figure is based on estimates by Global Financial Integrity (GFI), an NGO created by US businessman Raymond Baker.

The estimates were endorsed last year by a UN high-level panel led by former president Thabo Mbeki. Both the numbers and the whole concept were, however, heavily contested.

The main problem is how to classify abusive transfer pricing.

This is when things are traded across national borders by parts of the same multinational company or associated companies, but prices are manipulated to move costs to the jurisdiction with the lowest tax rate.

Transfer pricing makes up the bulk of illicit flows, but it is not necessarily illegal. This complicates the formulation of international tax agreements.

“It’s important to use the correct terms … it’s stealing money, actually,” Gordhan said.

It is not all that complicated, argued Adeyemi Dipeolu, economic adviser to President Muhammadu Buhari of Nigeria, who spoke at the conference. He said the key thing was that these transactions were intended to be hidden from authorities.

“Of course, it is difficult to estimate – they are meant to be secret,” he said.

Dipeolu was part of Mbeki’s panel.

Mbeki’s report also put the main emphasis on multinational corporations’ transfer pricing as opposed to illegal tax evasion and money laundering.

“There are concerns about this definition beyond the purely illegal,” Dipeolu said.

“Whatever definition we take will affect the policy responses. The point is that ‘illicit’ covers illegal as well as unethical behaviour.

“What is unethical this year might be illegal next year,” said Dipeolu, citing child labour and environmental pollution as practices that have become illegal over time.

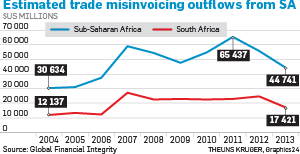

GFI’s research has gained enormous traction and shown a massive rise in estimated trade misinvoicing corresponding to the commodities boom up to 2008. Since then, GFI’s estimated flows have fallen back, at least for Africa.

The estimates for China, by far the biggest source of these outflows, has kept climbing.

The same researchers point out that the flows out of Africa are a relatively small part of the global total, specially since the end of the commodities boom.

The case for fighting it in Africa is, however, more urgent because the continent’s governments are already woefully under-resourced and dependent on corporate taxes as opposed to income taxes.

Publications

Publications

Partners

Partners