Despite the country successfully retaining its investment-grade status, GDP figures indicate a downturn is on the cards

Evidence of a downturn in the economy this week bodes ill for the ordinary person and for the prospect of South Africa maintaining its key investment-grade status for the rest of the year.

On the other hand, the positive news this week was that Fitch Ratings joined Moody’s Investors Service and S&P Global Ratings in keeping South Africa’s credit rating at investment grade.

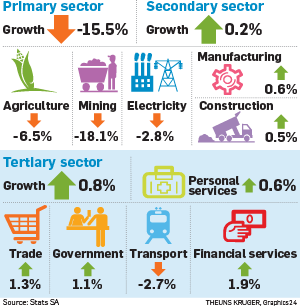

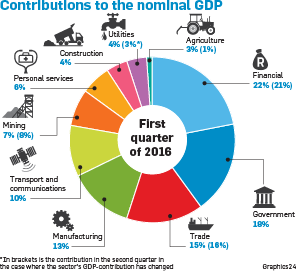

Stats SA this week announced the growth figures for the first quarter of 2016 – a 1.2% drop quarter on quarter. The big drop was mainly caused by the mines, where production fell by a staggering 18% on an annualised basis.

SIZWE PAMLA - COSATU SPOKESPERSON

Everyone is focusing on the credit ratings. For us, it is about job losses. Farms, mines and factories are getting rid of the workforce.

RICHARD DOWNING - SACCI CHIEF ECONOMIST

The GDP figure was no surprise. Everything has indicated zero or negative growth.

NATIONAL TREASURY

The [Fitch] decision affords South Africa a narrow window to demonstrate further concrete implementation of reforms that are already under way, and are aimed at turning around the growth path and placing public finances on a more sustainable path.

MOHALE RALEBITSO - BLACK BUSINESS COUNCIL CEO

We are disappointed by the contraction in economic growth.

The fall in production came mostly from the platinum sector, but there were also significant drops in coal and iron ore output.

Nedbank group chief economist Dennis Dykes said the downturn reflected by the latest GDP figures would have a negative effect on jobs and would lower consumer income.

The GDP figures could cause the SA Reserve Bank to keep interest rates unchanged next month, Dykes said.

The usual response to a downswing was that the government would avoid tax hikes, he said.

However, the government had committed to fairly stringent reduction in the state’s budget deficit, so this would complicate the direction of taxes, Dykes added.

UK-based Capital Economics’ John Ashbourne said South Africa was in danger of experiencing a recession, which is two consecutive quarters of GDP contraction.

However, Azar Jammine, Econometrix chief economist, said first-quarter GDP had been negative partly because of the number of public holidays.

“This meant the workers could take off three days of work for a total holiday of 10 days. This didn’t happen in 2015,” he said.

The growth in the second quarter of the year was likely to be positive, Jammine said.

On an encouraging note, the key mining and manufacturing sectors were looking up as production for these industries for the month of April showed improvement.

Standard Bank joint CEO Sim Tshabalala told City Press that the fact that the GDP decline was centred in the primary sector was bad news.

“It was largely caused by very large declines in mining and agricultural output. These are the two sectors on which we depend for much of our export earnings,” he said.

“Both sectors are also very labour intensive, so declines in these sectors mean more losses of lower-skilled jobs, with particularly bad effects on poorer South Africans.

“The news that we were not downgraded will probably strengthen the rand and improve the cost of capital in the short term, but these prices will soon start to reflect market perceptions about what may happen in December,” he said.

Since the S&P and Fitch decisions, the rand has firmed against the dollar and government bond yields have strengthened.

So what will happen in December?

“We can do a lot over the next months to avoid a downgrade,” said Tshabalala.

The agencies, local analysts, organised business and government largely agreed on the diagnosis of what was wrong, he said.

“I think we’re getting some real traction in sectors including tourism and agriculture, and I also think there’s a good possibility of further announcements on state-owned enterprise reform over the next several months.

“It would help if there was an announcement of good progress in the ongoing negotiation at the National Economic Development and Labour Council around a national minimum wage and new measures to reduce strikes,” he said.

“The conduct and outcomes of the local elections will also be very important,” he added.

“It’s essential that South Africans prove to ourselves – and to the world – that we can run highly competitive elections peacefully and fairly, and that smooth transitions of power will take place if and when the voters decide on that.”

This week’s GDP numbers would not have changed things very much on the ratings front, said Donna Nemer, director of capital markets at the JSE.

The agencies were well aware of the data release schedule, she said, referring to shock GDP numbers released minutes before Fitch affirmed South Africa’s rating.

“The question is what can be done by policymakers. The ratings agencies will focus on what reforms and actions we will see from the collaboration between government and business, as well as the medium-term budget [in October].”

Nemer said it had been easier to predict the recent ratings decisions than it would be to predict what the agencies would do in December.

While there has been positive market reaction to the ratings decisions, Nemer said that global factors needed to be kept in mind.

Brazil, Russia and China all face serious problems, which, “for now”, make South Africa a good place to put money when investors chase higher yields.

“Some large global investors have their mandates tied to the ratings. Some don’t even use them and do their own research,” Nemer said.

Cas Coovadia, managing director of the Banking Association of SA, said: “The 18% drop in mining tells us there is some urgency in getting the [Mining] Charter and the resources bill sorted out.”

“With the state-owned enterprises, there is nothing new. Business has volunteered to provide capacity ... We need to work together.

“Discussions are being had with industry and some announcements will be made. It is market-sensitive stuff,” he said, declining to elaborate.

Colin Coleman, head of Goldman Sach’s South African office, said his group expected GDP growth to improve.

“The question is how steep the climb is. We scored a hat-trick and won six months to prove our ability to turn a corner,” Coleman said.

“It is a six-month reprieve from more expensive debt for government and the corporate sector. We can do a lot in six months.”

It is vital that South Africa avoids a downgrade to “junk” status or sub-investment grade.

Standard Bank economist Goolam Ballim said last month that a downgrade of South Africa’s credit rating to junk status would unleash a “shock” that could knock the country into a recession and place 200 000 jobs, plus a further 600 000 related dependants, at peril.

Financial markets tended to convulse before a downgrade, but “the real economy smashes afterwards”, he said.

If South Africa had been downgraded to junk, the local economy could contract this year to a negative 0.3% in growth compared with the 0.6% that Standard Bank is forecasting for this year without such a downgrade.

Dykes said that for South Africa to maintain its investment-grade rating, the government needed to have more investor-friendly policies.

What was also vital was for government to implement growth policies contained in the National Development Plan.

Jammine said that there were those in government who opposed the National Development Plan as a neoliberal scheme that favoured business.

So where there was an ideological divide between those who favour socialism versus those who favour capitalism, there would be limited implementation of the National Development Plan, he added.

A consensus needed to be reached about a way to grow the economy, Jammine said.

Dykes said: “The government needs to create an investor-friendly environment. There is a lot of lip service to this, but government needs to roll out the red carpet amid a global economy that is struggling, rather than give investors a list of conditions before they invest in the country.”

A key point that the ratings agencies had also raised was that government should avoid putting in place investor unfriendly legislation, he added.

Dykes said that government could boost supply in the energy sector by deregulating the industry.

In the labour market, when it comes to economic growth and the ratings agencies, it was important for the country to avoid a major strike in the mining or metals sector.

The release of a new draft of the Mining Charter was also viewed by the ratings agencies as investor unfriendly, Dykes said.

“The government should be focussing on win-wins and not standoffs,” he added.

Ratings agencies had also made clear their disquiet about the apparent tension between President Jacob Zuma and Finance Minister Pravin Gordhan, and it was important that the finance minister wasn’t fired.

Jammine said there were three key areas that needed to be attended to so that South Africa could avoid a downgrade.

Firstly, the government had to have a proper plan in place to balance its spending with tax and other revenue.

Secondly, state-owned enterprises needed to be properly managed so that they wouldn’t be a drain on state resources.

Thirdly, the country needed to boost economic growth – this resulted in increased spending and higher tax revenues.

Jammine said that the lack of growth was the most problematic of these three key areas.

TALK TO US

Publications

Publications

Partners

Partners