Standard & Poor’s Global on Monday cut the South African government’s credit rating to “junk status” for the first time in more than 17 years following the move by President Jacob Zuma to reshuffle his Cabinet last week.

“In our opinion, the executive changes initiated by Zuma have put at risk fiscal and growth outcomes,” S&P said on Monday evening.

The last time that S&P had South Africa on sub investment grade or “junk status” was before February 25 2000 – that day S&P gave the country its first investment grade rating for the first time.

S&P Global reduced its rating for South Africa from BBB- to BB+ and maintain a negative outlook, which meant there was a risk of more downgrades.

“The negative outlook reflects our view that political risks will remain elevated this year, and that policy shifts are likely, which could undermine fiscal and economic growth outcomes more than we currently project,” S&P said.

The news on Monday caused the rand to weaken to 13.74 to the US dollar, the local unit’s weakest level since January. The South Africa 10-year bond yield rose to 9.125%, its highest level since November 2016.

Last Monday, March 27, the rand touched 12.31 to the US dollar before news broke that Zuma had recalled then finance minister Pravin Gordhan and his national treasury team from an international road show.

That news caused speculation to become rife that Zuma would fire Gordhan as part of a Cabinet reshuffle, which was ultimately put through just after midnight on Friday morning. Zuma replaced Gordhan with former Home Affairs Minister Malusi Gigaba, and replaced Deputy Finance Minister Mcebisi Jonas with Sfiso Buthelezi.

Read: Horror as Zuma fires Gordhan in late-night reshuffle that ‘wasn’t discussed’

Since early last Monday, the rand has depreciated by as much as R1.43 to the US dollar. The substantially weaker rand will make the cost of imported goods such as petrol more expensive, boost consumer inflation, which is a key measure used to set interest rates, and place consumer spending under pressure but it will boost exporters like the mining industry.

“The downgrade reflects our view that the divisions in the ANC-led government that have led to changes in the executive leadership, including the finance minister, have put policy continuity at risk,” S&P said.

“This has increased the likelihood that economic growth and fiscal outcomes could suffer. The rating action also reflects our view that contingent liabilities to the state, particularly in the energy sector, are on the rise, and that previous plans to improve the underlying financial position of Eskom may not be implemented in a comprehensive and timely manner,” S&P said.

The agency believed that higher risks of budgetary slippage would also put upward pressure on South Africa’s cost of capital, dampening already-modest growth.

“Internal government and party divisions could, we believe, delay fiscal and structural reforms, and potentially erode the trust that had been established between business leaders and labour representatives [including in the critical mining sector],” S&P said.

“An additional risk is that businesses may now choose to withhold investment decisions that would otherwise have supported economic growth. We think that ongoing tensions and the potential for additional event risk could weigh on investor confidence and exchange rates, and potentially drive increases in real interest rates.”

S&P was concerned about the increasing risk associated with the government’s contingent liabilities.

“This reflects the increased risk that nonfinancial public enterprises will need extraordinary government support,” the agency said.

State guarantee utilisations could reach R500 billion in 2020, or 10% of 2017’s GDP.

“The utilisations are dominated mainly by Eskom, which benefits from a government guarantee framework of R350 billion – about 7% of 2017 GDP. We estimate Eskom will have used up to R300 billion of this framework by 2020,” S&P said.

The state energy regulator, Nersa, has capped Eskom’s permitted 2017-2018 tariff increase at 2.2%. This would have with negative implications for Eskom’s financial performance.

“Eskom will fund the resulting revenue gap via borrowings of up to R70 billion, of which up to half may utilise government guarantees. Other state-owned entities that we think still pose a risk to the country’s fiscal outlook include national road agency Sanral, which is reported to have revenue collection challenges with its Gauteng tolling system, and South African Airways, which may be unable to obtain financing without additional government support,” S&P said.

S&P said it was also concerned with South Africa’s slow pace of economic growth and this remained a ratings weakness.

“It continues to be negative on a per capita GDP basis,” the agency added.

Finally, S&P warned that if South Africa’s fiscal and macroeconomic performance deteriorated substantially from its baseline forecasts, they could consider lowering the ratings.

“We could revise the outlook to stable if we see political risks reduce and economic growth and/or fiscal outcomes strengthen compared to our baseline projections,” S&P added.

The treasury said the rating announcement called for South Africans to “reflect on the need to sustain and act with urgency to accelerate inclusive growth and development so that we can reverse the triple challenge of poverty, unemployment and inequality”. It said that reducing reliance on foreign savings to fund investment and relying less on debt to finance public expenditure would secure South Africa’s fiscal sovereignty and economic independence.

“The government remains committed to making sure that its work with business, labour and the civil society continues in order to improve the business confidence and implement structural reforms to accelerate inclusive economic growth.”

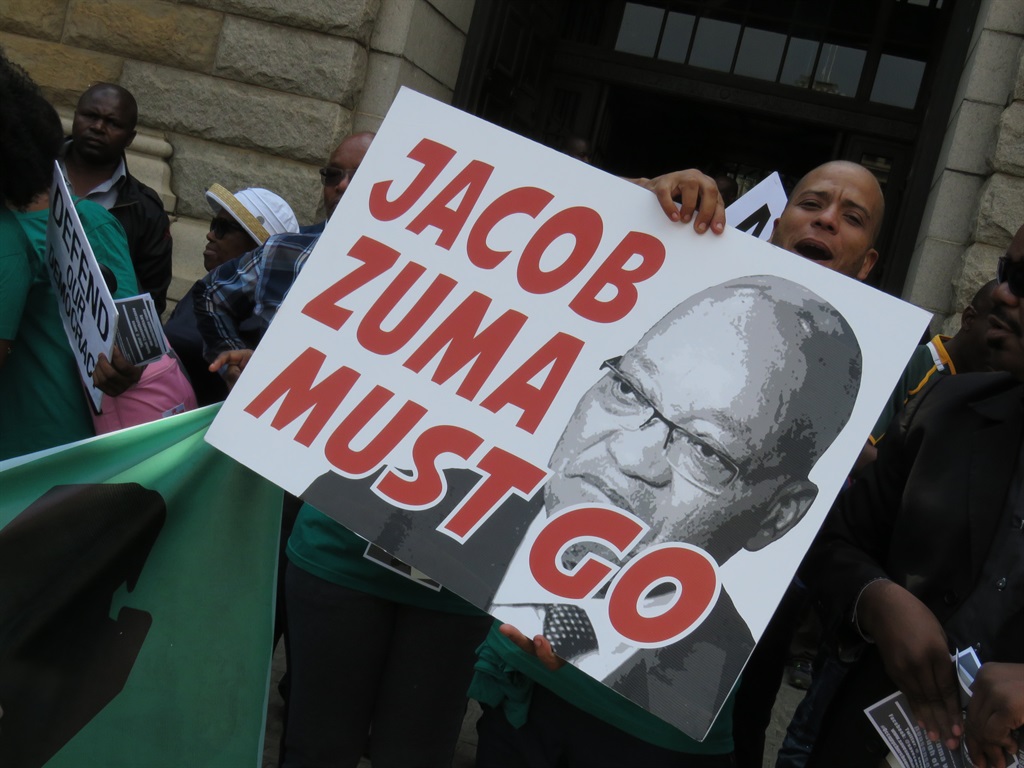

Democratic Alliance leader Mmusi Maimane called the downgrade “a clear vote of no confidence in President Zuma, and a direct result of his decision to fire Pravin Gordhan and Mcebisi Jonas last week”. He called on Zuma to resign.

This call was echoed by Mkhuleko Hlengwa, Inkatha Freedom Party spokesperson on finance, who said that the downgrade “was actively engineered by Mr Zuma because of his hard-headed attitude and arrogant approach to rational thought about what is good for South Africa”.

“The economy is bleeding and the poorest of the poor will bear the brutal brunt of this downgrade which could have and should have been avoided.”

Gigaba indicated that he would engage with journalists tomorrow “to discuss this outcome”.

|

| ||||||||||||

| |||||||||||||

Publications

Publications

Partners

Partners