The Bank of England this week responded to the post-Brexit doldrums by setting off a new quantitative easing bomb.

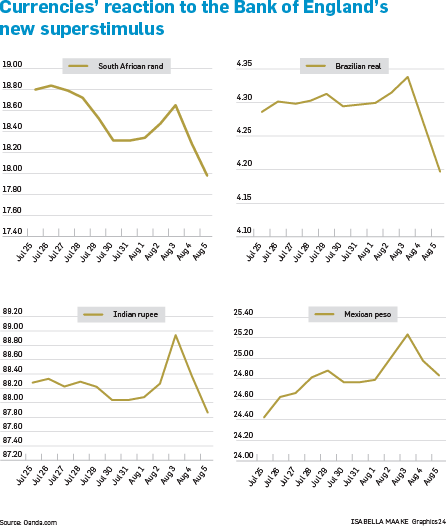

Currencies in developing countries across the globe shot up, including the rand, which hit its strongest level against the dollar in almost a year.

Against the pound, the rand hit its strongest level since April last year. So did most currencies.

The British central bank’s monetary policy committee cut its bank rate, equivalent to what the SA Reserve Bank calls its repo rate, to 0.25% – virtually zero.

With inflation in the UK expected to hit 2% this year, this means a negative interest rate.

The central bank also announced that it would buy up another £60 billion (R1 trillion) in government bonds and £10 billion in corporate bonds from the secondary markets, pushing down interest rates and opening the space for the private sector to issue new debt instruments.

The Bank of England previously bought £375 billion in government bonds with its quantitative easing programme.

What this achieves is lowering the yield on government bonds, which hopefully pushes funding into real investments.

Unfortunately, banks cannot cut interest rates much lower than they have, so the central bank created a new monetary policy instrument called the Term Funding Scheme.

This will give banks access to funding from the Bank of England “close to” the bank rate, as long as they in turn lend the money to the real economy, meaning households and companies outside the financial sector.

As has historically been the case when rich countries announce an extraordinary monetary stimulus, a lot of the effect is felt in the financial markets in the developing world.

On Thursday, the central bank’s monetary policy committee said most of its members expected to cut the bank rate right down to “close to, but a little above” zero later in the year, depending on economic data.

Publications

Publications

Partners

Partners