For anyone considering buying an investment property, the good news is that we could be seeing the first signs of improvement for rental yields after several years of weak performance.

According to FNB property economist John Loos, since 2013 the gross average yield on properties has been declining, falling from 9.22% to 9.07% in early 2016.

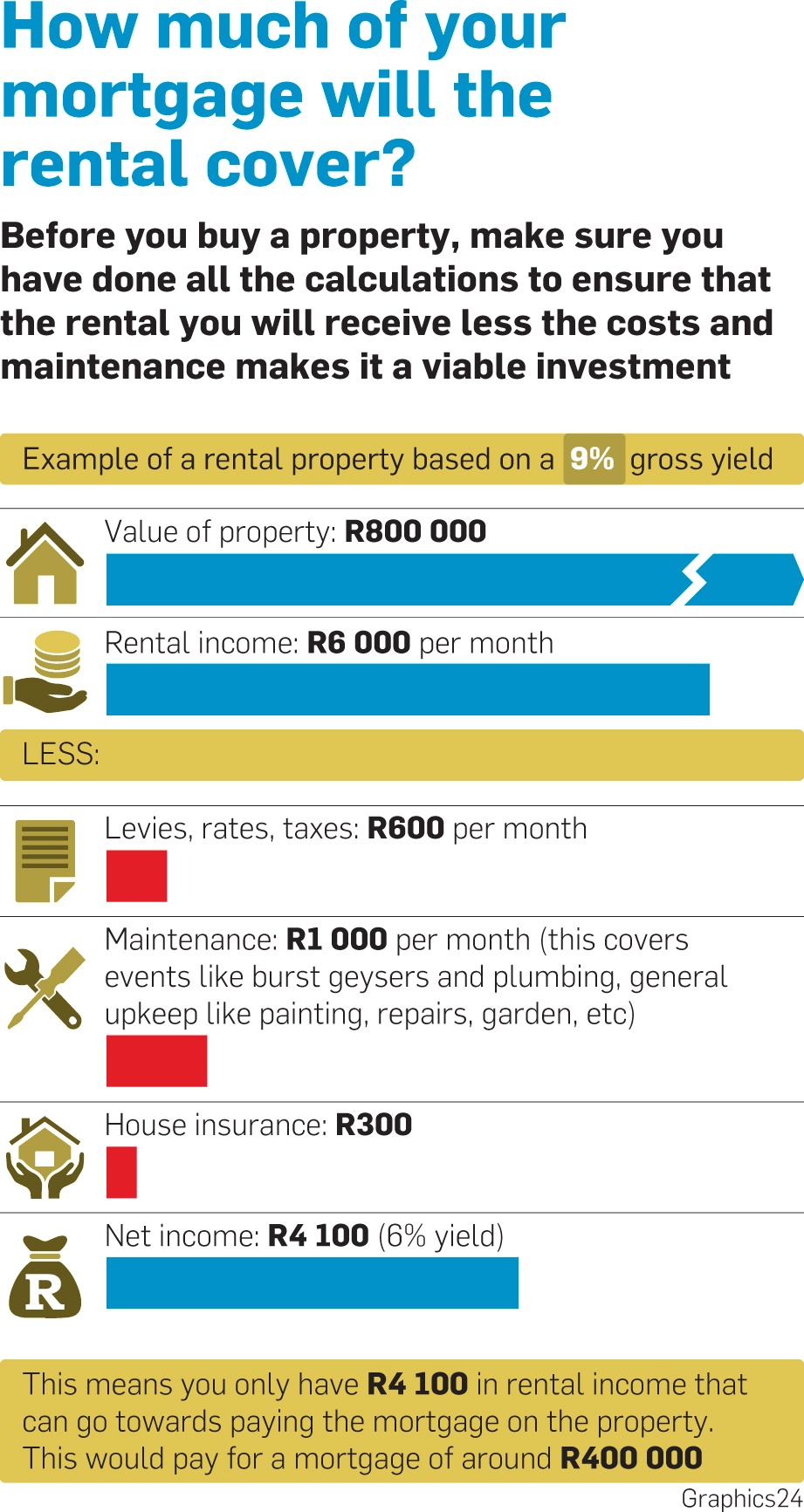

The yield is determined by the rental income relative to the value of the property.

As property prices strengthened, the rental income relative to the value declined. However, Loos believes that as property prices start to weaken this year, so the relative yields will start to rise.

There are also indications that rental escalations are starting to increase with rental inflation outpacing weak house price inflation.

Due to a weaker economy, rental escalations fell as low as 2.8% year on year in 2015, yet recent figures show rental escalations increasing to around 4.25%. Given these increases, Loos expects average gross yields to gradually increase to 9.3% during 2017.

However, head of credit at FNB Home Loans Tommy Nel warns against trying to time the market when deciding to invest in property.

“The best approach in my opinion is not to get carried away with the braaivleis talk and get-rich-quick tips being shared and looking at property to make a quick buck.”

Nel says that, for an individual who has a least a five-year time horizon in mind, property can deliver a reasonable return, as long as you are not buying into a property bubble or the area in which you bought did not go into decay.

It also requires that good occupancy levels are achieved when rented out.

Andrew van der Hoven, Standard Bank’s head of home loans, says it’s important to fully understand one’s financial position before making the decision to purchase.

“Owning multiple homes also has costs that should be taken into account, such as insurance, renovations, garden services, and rates and taxes.

“If the property is a sectional title, then levies need to be factored in,” says Van der Hoven, who adds that it is important to also make sure you have at least three to six months’ worth of payments in reserve to cover you if there is a rate increase, or if a tenant defaults or instances where a tenant cannot be found to occupy the property.

“Consideration should not only be given to finances, but to the property itself. One should, for instance, find out more about the area in which the house is situated, the average value of properties in the suburb and take time to have the house examined for possible defects such as poor plumbing, potential electrical problems and structural concerns.”

Before buying a property, find out about rental demand in the area – for example, areas close to universities or large call centres may have a higher demand for rental accommodation.

Investigate what you could realistically get for the property in terms of rental by going through advertisements for rental properties to give you an idea. Keep in mind, though, that a landlord may get less than the advertised amount.

Also remember: estate agents can hype up the potential rental return in the bid to sell the property.

You also need to be realistic about your annual rental increases. Based on information from Tenant Profile Networks, escalations are only around 5% per annum currently, even though running expenses such as levies and rates may be increasing at a faster rate.

WILL THE BANKS LEND YOU THE MONEY?

Gone are the days when you could just borrow money to buy an investment property. With the new affordability rules set out in the National Credit Amendments Act (NCAA), the banks have to follow a strict set of criteria when assessing affordability and that does not necessarily include your rental income.

While the bank does not call for additional deposits simply because a property being acquired is for investment purposes, Nel explains that the banks cannot consider any potential income streams from the property.

Nel says even if you purchase a property with an existing tenant, the seller would have to provide bank statements to show they actually received rental from the tenant.

“Once a formal lease agreement is in place, and the regulatory requirement of being able to validate the income a landlord receives under the lease, then FNB will use the rental income earned in doing our NCAA compliant affordability assessments.”

What this means in summary, is that the rental income can only be taken into consideration once the tenant is paying, so, in most cases, rental agreements can be used in affordability assessments to buy further properties, but not your first.

This means that if you want to buy an investment property, you will have to put down a pretty big deposit and be able to fund the monthly instalment from your salary. If you have an existing home in which you are living and which is financed, it is unlikely that you will have the spare money to fund an investment property.

However, if, for example, you have an existing apartment and you want to buy a bigger property or move in with a partner, you could find a tenant for your existing apartment and use that income as part of your application for a new property.

Ewald Kellerman, chief risk officer at Absa Retail, says it is important to keep in mind that the income you receive from a rental property is taxable. “Interest on a bond and some maintenance costs are often allowed to be deducted as an expense, which can reduce the taxable amount considerably.

Certain capital gains exemptions also only apply to your primary residential property, but not to an investment property.

Make sure that you take this into account when calculating total return, and consult a tax practitioner to understand the full tax implications.

If you have a residential home and an investment property, you want the bulk of the mortgage to be on the investment property in order to benefit from the tax deductibility of the mortgage.

Publications

Publications

Partners

Partners