As we begin a new tax year, there is a significant drive around the importance of proper financial planning, says Lizl Budhram, a legal manager at Old Mutual.

“Consumers often fail to consider their financial plans efficiently at the beginning of the tax year. Now, in March, is when you are in your best position in terms of liquidity, so it makes sense that now is the time to think about planning your financial blueprint for the year ahead, instead of waiting until the last minute,” she advises.

Budhram outlines the following wise choices to make when allocating your bonus this year:

1 PAY OFF DEBT: Using part of your bonus to pay off your debt is not unwise.

“You should look at your short-term debt first because this type of debt usually carries the highest interest rates,” says Budhram.

For example, store cards typically carry the highest interest rates. You only score if you pay off your purchases within a six-month period, but if you take longer, the interest rate you are charged is extremely high.

Currently, the maximum interest you could be charged on your credit cards (including store cards) is 24.85%. If you have taken out an unsecured loan – for example, a personal loan – the maximum interest rate you could currently be charged is 34.85%.

Ideally, the best way to use a credit card is by paying the entire balance off at the end of the month. That way, you can ensure you score on the 55-day interest-free benefit that comes with a credit card. If you don’t think you are disciplined enough to do this, rather forgo a credit card to avoid temptation.

“A common mistake that we see consumers making is they use their bonus to pay off debt and then simply access more credit in the year ahead, so in the long term, there is no visible benefit from their bonus,” Budhram says.

She advises that if you use your bonus towards settling debt, you ensure that you stay out of debt and allocate further funds towards savings.

2 ANNUAL COSTS: With inflation and the cost of living rapidly increasing, you could use your bonus to settle one-off costs so that they don’t form part of your monthly budget.

For example, your insurer is likely to offer you a discount if you choose to pay your premiums as an annual amount rather than a monthly debit order. Or you could set aside part of your bonus for your car’s annual service and maintenance costs.

3 SAVINGS: You could use your bonus to save towards your retirement annuity if you have one. Or you could pay a lump sum amount into a unit trust fund or a tax-free savings account, which can form part of your medium- to long-term savings plan.

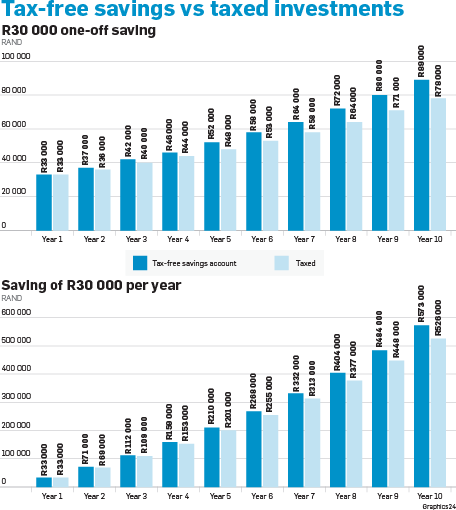

If we assume that you choose to save R30 000 as a lump sum amount in a tax-free savings account, you would have saved R89 000 after 10 years, compared with a saving of R78 000 if you had invested the same R30 000 lump sum in an investment that is not tax-free.

In a second scenario, Budhram assumes that you are investing a lump sum amount of R30 000 a year in a tax-free savings account every year for the next 10 years.

At the end of the 10-year period, you will have saved R573 000, compared with a saving of R526 000 in a similar investment that is not tax-free.

. Note that in both the above scenarios, the assumptions were approximate returns of 10% for the taxed investment and 11.5% for the tax-free investment as the approximate returns on a balanced fund.

The tax difference can be up to 1.5%, but this will not necessarily be the case. In scenario two, the assumption was no increase on the R30 000 annual limit for tax-free savings accounts or annual payments.

4 EMERGENCY FUND: If you don’t have an emergency fund, now is a good time to start one using part of your bonus.

This is basically a savings fund that you use to pay for emergencies – for example, the excess payment due on your insurance policy when you make a claim.

Ideally, you should have the equivalent of three to six months of your net salary in your emergency savings fund. If your bonus is not sufficient to cover this amount, use this as a good opportunity to start an emergency fund.

5 REDUCE THE INTEREST ON YOUR HOME LOAN: If you have a home loan, you can pay part or all of your bonus into the bond, which will have the welcome effect of reducing the overall interest that you pay in the long term. Any extra money you deposit into your home loan immediately reduces the capital balance and saves you interest. Even if you just deposit R10 000 into a R1 million mortgage, you’ll save R64 800 in interest over the 20-year period.

An added benefit is that it can also protect you against a possible rate hike. On a R1 million mortgage, a 100 basis point rate hike would increase your annual mortgage payment by R10 000, or R833 a month. By paying money upfront into your mortgage, you can create a buffer against future rate hikes.

6 SPOIL YOURSELF BUT NOT TOO MUCH: Of course you want to spend some of your bonus on yourself. After all, you earned by working hard! Allocate a reasonable sum of money towards rewarding yourself or your family and then make sure you don’t blow the rest of the bonus.

Publications

Publications

Partners

Partners