Garreth van Niekerk tries the newly updated 22seven app that puts all your money in one place, making saving simpler than ever

22seven

Free app

Available for Android and iOS

Google Play and iStore

If you’ve been trying to get a grip on your spending, the place you’re most likely to cut back first is the amount you’ve budgeted for your monthly savings plan, if you even had a savings plan or a budget in the first place. But before you decide to starve your nest egg, it might be worth your while to give 22seven a try.

The free app is designed to make budgeting and saving a whole lot easier for South Africans and, after using it

for a week, I can honestly say that it’s a game-changer.

The way 22seven works is that, after downloading the app, it asks you to link your bank accounts – all local banking and investment groups are partners with 22seven – by entering your online banking details. At first I felt that sharing access to my private banking information was a serious security risk, but after finding out that 22seven uses the same safety measures as banks, governments and the military; is completely encrypted; and that your private details are insured against fraud by the app (they will refund you for any irregular activity), I let down my guard and linked in.

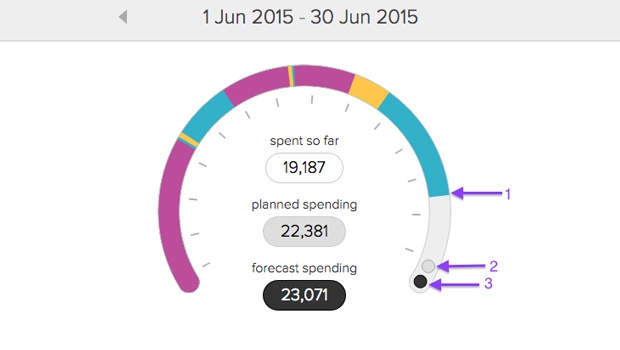

What happened next took my breath away. It automatically sorts each and every purchase you make into predetermined categories like eating out, groceries, entertainment, income and regular expenses, so you can see all your spending habits in one place. To say I was shocked at how much money I was wasting is an understatement.

In one graph, I could see how totally useless I was at being an adult, but at least now I could also see just how easy it would be to cut a bit

here and a bit there to get my savings back in order.

From there, you set a budget for each category by deciding how much you would like to ideally spend on each of them. The app will then notify you when you’re nearing your budget so that you don’t overspend. Goodbye excessive eating out! Then, with all the money you’ve managed to save every month, you can now invest from within the app. In under a minute, I had created a monthly debit order – I chose a higher-risk, but higher-growth, Old Mutual Top 40 fund instead of a diversified fund – and boom, my savings crisis was resolved.

There are, of course, a few improvements that can be made. It would be useful to be able to share my account with my partner so that we could see how the two of us are doing on our financial journey together. The app starts with only three months of banking history before sign-up, but a much longer period would give a clearer historical context to spending habits. And, even though the app is created in conjunction with Old Mutual, it would be great if they included other investment options like Satrix.

Go to www.22seven.com/cp to sign up

Publications

Publications

Partners

Partners