Capitec Bank was going to step up its expansion programme in the year ahead as it identified the stagnant economy as an opportunity to increase its business, CEO Gerrie Fourie said this week.

“The economy is under pressure and this is a massive opportunity for those looking for value. The client is going to be price sensitive and will be looking for value for money,” he said.

Fourie said Capitec expected that the local economy might not recover for the next three to four years.

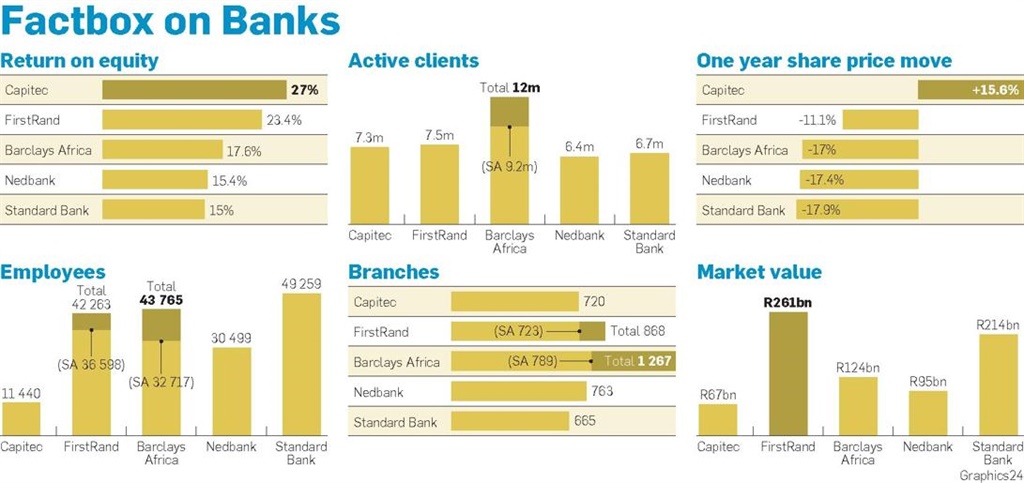

Capitec announced that for the year to February, its total active client base had increased by 16% to almost 7.3 million, which places the bank ahead of both Nedbank, which has 6.4 million customers, and Standard Bank, which has 6.7 million clients, and third overall behind Barclays Africa and FirstRand Bank.

At the same time, the company’s 12-month headline earnings rose by 26% to R3.2 billion.

Neelash Hansjee, an Old Mutual Equities banks analyst, said Capitec’s latest results were “pretty good”.

“It has made strong client gains while maintaining investment to support further growth,” he said.

If Capitec continued to grow its client base, it would maintain its revenue growth for the foreseeable future, Hansjee said.

Fourie said that Capitec was gaining between 80 000 and 100 000 new clients a month after subtracting client losses, so this would translate into another year of bumper client gains.

About 80% of Capitec’s new clients had a bank account elsewhere, and the bank was poaching most of its clients from FNB, followed by Absa, Standard Bank and then Nedbank.

“Every six months, Capitec was increasing its primary banking market share by 2%,” Fourie said.

In the year to February, Capitec hiked its capital expenditure by 70% to R704 million.

“The 70% year-on-year increase was due to the growing ATM and branch network, as well as the purchase of land and property,” Capitec said.

Fourie said in the year to February 2017, Capitec was going to be on a more aggressive capital expenditure drive than in the previous year. The bank was looking to grow its branch network by between 70 and 80 this year, as well as add another 700 to 800 ATMs.

This is on top of an 8% increase in branches to 720 at the end of February and a 31% hike in its ATMs to 1 236 during the same period.

Each branch cost between R1.5 million and R1.8 million to set up, Fourie said.

The major expansion that Capitec is pursuing is at odds with its four major local competitors, which are shrinking their branch networks.

As a result of its expansion, Capitec grew its staff by 1 179 to 11 440 at year-end. Fourie said the bank was recruiting 300 people a month.

At the same time, the tough economic conditions are hurting Capitec’s business.

Capitec’s loans rescheduled during the last six months of its financial year – which were in arrears at the time of rescheduling – grew by 75% to R1.5 billion.

“This is due to the expansion of our higher margin short-term book, and is also an indication of the economic challenges faced by clients,” Capitec said.

The movement in bad debt provisions rocketed by 476% to R1.27 billion.

Hansjee said that the increase in Capitec’s bad debt provisions was a concern, but it came amid a tough environment and reflected the pressure on the consumer.

On the other hand, Capitec management was being proactive about increasing provisions for bad debt and was also tightening the company’s credit model, he said.

Capitec was planning to launch a credit card with MasterCard later this year and was engaged in a staff pilot programme, Fourie said.

The launch of the credit card would attract higher-income clients and would help move Capitec’s image away from being a microlender to having a banking image, he said.

Fourie said Capitec was also investigating the possibility of launching insurance products.

Publications

Publications

Partners

Partners