SA’s business cycle reached a peak in 2013 and has trended downwards ever since. However, there is continued growth in domestic demand

South Africa is likely to break out of its economic downtrend when the leading indicator picks up, business confidence improves, investment is renewed, commodity prices rebound and global economic growth picks up.

South Africa’s business cycle reached a peak in November 2013 and has been in a downward phase since then, Iaan Venter, an economist at the research department at the SA Reserve Bank, said at the release of the central bank’s latest Quarterly Bulletin this week.

“Right now, the growth trend is lower,” Venter said.

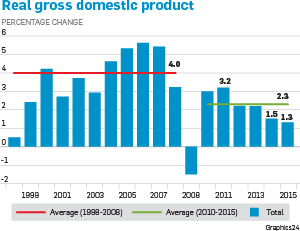

Stefaans Walters, a deputy head of economic research at the Reserve Bank, said that real South African economic growth had slowed after the 2008/09 financial crisis and growth was expected to moderate further.

In the 10 years to 2008, local economic growth averaged 4%, but after 2008, the local economy had grown at an average rate of 2.3%.

Johan van den Heever, the head of economic reviews and statistics in the research department at the central bank, said now was a “difficult time for the South African economy”.

The current account, which reflects the balance of the value of exports compared with imports, widened in the fourth quarter of last year to 5.1% of GDP from 4.3% in the third quarter.

Walters said the decline in the value of local merchandise exports was mainly evident in exports destined for Europe. There was also a significant decline in mining exports, especially platinum, manganese and chrome ore.

“The value of imports rose in the fourth quarter of 2015, reflecting increased demand for imported products and manufactured goods,” Walters said.

William Jackson, an emerging markets economist at Capital Economics, said that the larger-than-expected current account deficit in the fourth quarter of 2015 highlighted South Africa’s external vulnerabilities and meant the rand was likely to remain under pressure.

The increase in the local current account deficit was due to falling global commodity prices and lower export volumes.

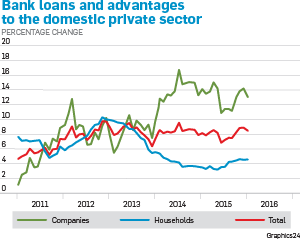

“There is little sign so far that the weakness of the rand has boosted exporters. Meanwhile, imports continued to hold up well, reflecting continued growth in domestic demand,” Jackson added.

The latest current account deficit figures, as well as consumer inflation – which has risen above the Reserve Bank’s target of between 3% and 6% – meant that South Africa faced “substantial monetary tightening this year”, Jackson said.

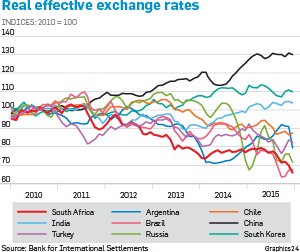

The rand weakened to R15.45 to the dollar on Tuesday after the central bank released its Quarterly Bulletin.

Jacques du Preez, a currency trader at Rand Merchant Bank, said the rand had weakened by as much as 1% after the current account figures were released, and was the worst performing currency on Tuesday, relative to its emerging market peers.

“Exports were substantially down, regardless of the rand weakness in the fourth quarter, when oil imports remained a key factor for the current account,” Du Preez said.

Nedbank economists wrote: “The current account deficit is forecast to narrow this year as the weaker rand dampens imports, especially for consumer goods, given the poor economic outlook.

“However, exports will also struggle, given softer global growth and domestic production constraints, and this might limit the extent to which the deficit will narrow.”

Turning to local employment, Walters said there had been slow progress with job creation in the formal sector over the past year and a half.

“Employment creation has been moving sideways for the past 18 months,” Walters said.

Publications

Publications

Partners

Partners