Local consumers should brace themselves for more aggressive rate hikes after the news this week that consumer inflation had reached its highest level since 2009.

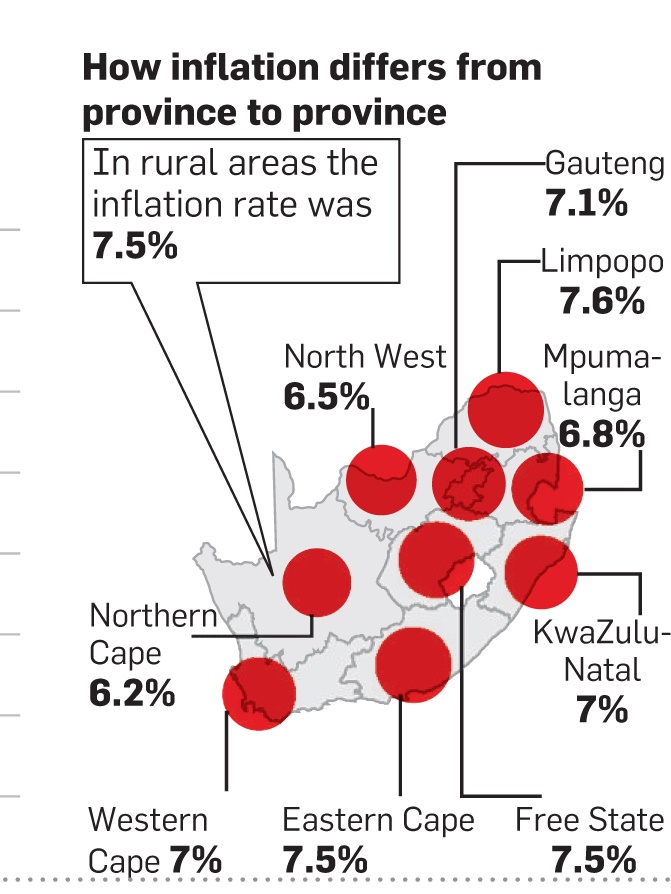

Annual consumer price inflation was 7% in February, up from 6.2% in January, Stats SA announced.

“This is the highest rate since May 2009, when the rate was 8%,” Stats SA added.

The latest inflation figure is above the SA Reserve Bank’s inflation target range of between 3% and 6%.

The central bank faces a double whammy in the form of stagflation – which is a situation of simultaneous slow economic growth, which is forecast at less than 1% this year, coupled with high inflation while unemployment remains high.

John Ashbourne of Capital Economics Africa said: “The surprisingly high South African inflation figure will probably lead the SA Reserve Bank to accelerate its programme of rate hikes. This will be very painful for an economy that is struggling to avoid a recession.

“The acceleration signals that the effects of the serious drought on food prices are being felt sooner than anticipated,” he added.

Nedbank economists Johannes Khosa and Dennis Dykes wrote in a note: “Food prices, the weak rand and administered prices will continue to exert upward pressure on inflation, pushing it above the 6% upper target for most of the next two years.”

The Nedbank economists forecast that inflation will end this year at 7.6% and will remain above the central bank’s 6% upper target until the last quarter of next year.

Peter Montalto, an economist at Nomura, said he was forecasting that inflation would peak at 8.1% in December.

Kamilla Kaplan, an Investec Bank economist, said in a note that much of the 7% rise in consumer inflation was attributable to the strong food price growth of 8.8%.

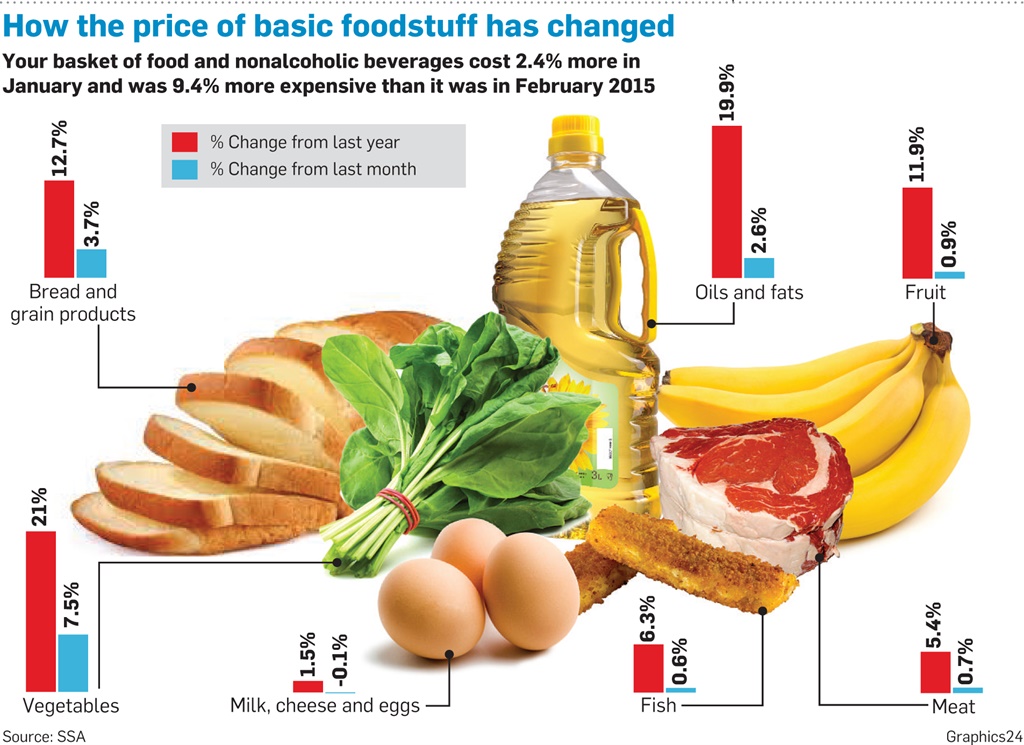

Within the food category, bread and cereals climbed by 12.7%, oils and fats rocketed 19.9%, fruit climbed by 11.9%, vegetables shot up by 21%, and sweets and desserts increased by 12.4%.

“Domestic drought effects are becoming more visible with the prices of bread and cereals, and fresh produce components are registering accelerations in the rate of inflation from February,” Kaplan said.

The food and nonalcoholic beverages component of consumer inflation shot up by 8.6% year on year.

“We expect food price inflation to accelerate over the course of the year, probably breaking into double figures in the third or fourth quarter,” Ashbourne said.

The alcoholic beverages and tobacco component rose by 7.6%, transport inflation soared by 8.7%, and the miscellaneous goods and services component climbed by 6.8%.

“Transport prices will almost certainly rise further as oil prices pick up and new fuel levies are introduced in April,” Ashbourne added.

The central bank might now have to increase the magnitude of hikes planned for later this year, he said.

“We expect another 0.25% hike in April,” Ashbourne said.

On the other hand, Investec is expecting a further 0.5% repo rate hike in July, followed by a 0.25% rise in September.

Nedbank is expecting further increases of 0.25% at each of the SA Reserve Bank’s next two meetings.

Publications

Publications

Partners

Partners