Our Money Makeover candidates are all parents, so estate planning is a particularly important part of their financial plans. What happens to the children if the parents are no longer around?

We challenged the candidates to get their estate planning in order and up to date, here's what they learnt.

READ: Financial lessons from ordinary South Africans and their families

CREATE A TESTAMENTARY TRUST

Make sure you have a will in place that includes a testamentary trust. This is a trust that comes into effect on either your death or the death of both parents. This protects the children’s inheritance until they reach the age of maturity, or later, depending on the age selected.

A single mum: As construction entrepreneur Bellah is a single mother, Absa adviser Stacey Coulson advised that her testamentary trust provides for the children until the age of 25.

“We have set up a trust so Absa would be in charge of the children’s funds until the age of 25, only releasing funds for education purposes and to maintain the children on a monthly basis,” says Coulson.

READ: Owning a home can be more pricey than you think. Here are the ‘hidden’ costs

Legally, the biological parent becomes the guardian, however, Coulson says one can stipulate a different guardian in the will, and Bellah has appointed her cousin to this role.

One should first discuss the nomination with the guardian and make sure they agree because they can refuse even if legally appointed.

Children from other relationships: Both producer Nono and consultant Peter have children from previous relationships, and this needs to be dealt with separately in the will.

“I was advised that, as I had a child from a previous relationship, my will needed clear instructions for the estate, and that would cater for all the children and their needs in case of my death,” says Peter.

Nono’s daughter Khanyi, whose biological father is deceased, lives with Nono’s parents. Although Nono recently married and the new couple is expecting their first child, Khanyi is considered part of her family.

READ: Side hustles – the new security

“As much as Khanyi is from a previous relationship, this is something that is very sensitive to us because we have cemented in her the thinking that she is ours, mine and my husband’s. We maintain a very close relationship with her.”

Nono has made provision for Khanyi to one day own the apartment she kept after buying a home with her husband. Not all families are as close as Nono’s; provision needs to be made for children from other relationships, including guardianship and financial support.

Married couple: Area manager Colen and his wife have set up a testamentary trust should they both pass away. Trustees have been appointed in addition to the guardian to ensure the money is managed correctly.

“An example of good management is that school fees will be paid directly to the school and not to the guardian,” says Absa adviser JP van der Merwe.

READ: Love and money | How to talk about finances with your partner

INSURING THEIR FUTURE

Estate planning would be a lot easier if we knew our futures; if we knew if and when we would need life cover or disability cover to make planning easier. Van der Merwe says that, in dealing with Colen’s estate, they planned as if Colen has passed away today until the youngest child would have finished university.

Van der Merwe calculated that Colen would require R20 000 a month to provide for his children, and his insurance has been aligned accordingly.

“Ensuring the future of the children is not only important if Colen passes away, but it is just as important should he lose his ability to earn an income [become disabled]. Many people forget about this aspect and are not able to meet the family and/or children’s financial needs on becoming disabled. We have used the same figures as with death for this instance.”

When you are trying to pay down debt, invest for your own retirement and save for your children’s education, it can be difficult to find the extra money for life cover. One should at least have some cover so that the children are not left financially destitute.

READ: How to avoid the slippery slope of credit dependency

In Bellah’s case, adviser Coulson identified her requirements, but, as the premiums were too high for Bellah, she elected for a lower amount that will be increased when she can afford it.

Executive PA Catherien had to review whether they should purchase insurance policies to cover their children’s university costs.

“This type of insurance is extremely expensive and we just cannot fit this into our budget currently. We are also reviewing the need for sending them to university, because, during lockdown, we have realised that there are so many online options at a fraction of the price.”

Your retirement fund is not governed by your will, but paid out to financial dependants determined by the retirement fund trustees. Make sure you have updated the beneficiaries.

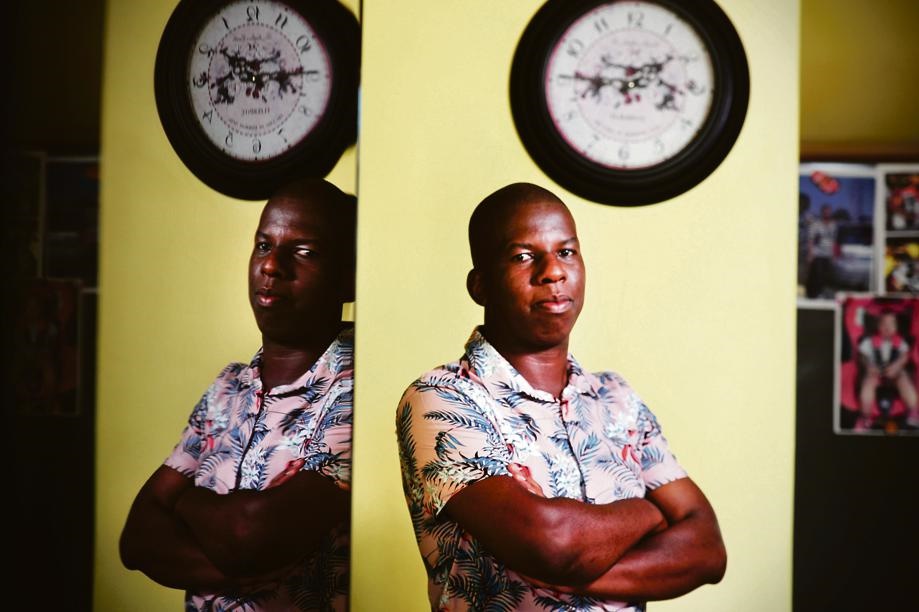

When communications manager Mishack and his wife gave birth to twins, the couple updated the details on their Government Employees’ Pension Fund (GEPF).

It is important to add your pension value or benefits to your estate planning. For example, having been a member of the GEPF for more than 10 years, his wife will be entitled to a spousal allowance for the rest of her life. There is also a benefit for minor children.

COVERING DEBT AND TAXES

You need to ensure that your life cover provides for your outstanding debts, taxes and fees, otherwise it will eat into your children’s legacy. You should at the very least ensure you have cover that will settle all debt if something happens to you.

Currently, estate duty of 20% is payable on the value of an estate that exceeds R3.5 million, and capital gains tax applies on any gain of more than R300 000, apart from the primary residence, which has an exclusion of R2 million capital gain.

Leaving assets to a spouse: According to van der Merwe, as Colen is bequeathing everything, including his properties, to his spouse, there will be a section 4(q) deduction and a section 3A abatement at his death. Under current law, there is no estate duty or capital gains payable when you leave your assets to your spouse.

The R3.5 million estate duty exemption is rolled over to the spouse’s estate. This means that, on her death, her estate would have both her abatement of R3.5 million as well as Colen’s R3.5 million – so estate duty would only become payable on an amount above R7 million. However, there would be a cost for reregistering the properties in his wife’s name.

READ: Lessons in planning a successful property portfolio

“A property needs to be registered in the name(s) of a living owner. Many individuals believe that this will be bypassed if a property is registered jointly, however, this is not the case and it will have to be reregistered if an owner passes away,” explains Van der Merwe.

Leaving assets to a child: If you are a single parent or plan to leave assets to your children, such as Nono bequeathing her daughter her property, she would have to consider any estate duty if her assets exceeded R3.5 million, and capital gains tax could apply because the property would be considered a “deemed” sale to her daughter.

Estate fees: Van der Merwe says executor fees of 3.5% plus VAT and master fees should be calculated.

“Estate duty fees can be negotiated in some instances, especially if you have a reasonably big estate value.”

Master fees are also payable on estates worth more than R250 000. This is on a sliding scale, starting at R600 and going up to a maximum fee of R7 000, which is reached on an estate valued at R3 600 000.

| ||||||||||||||||||||||||||||||

|

Publications

Publications

Partners

Partners