It has now reached a point when the income on investments is not sufficient to provide for pensions being paid, as well as for the total costs of the fund

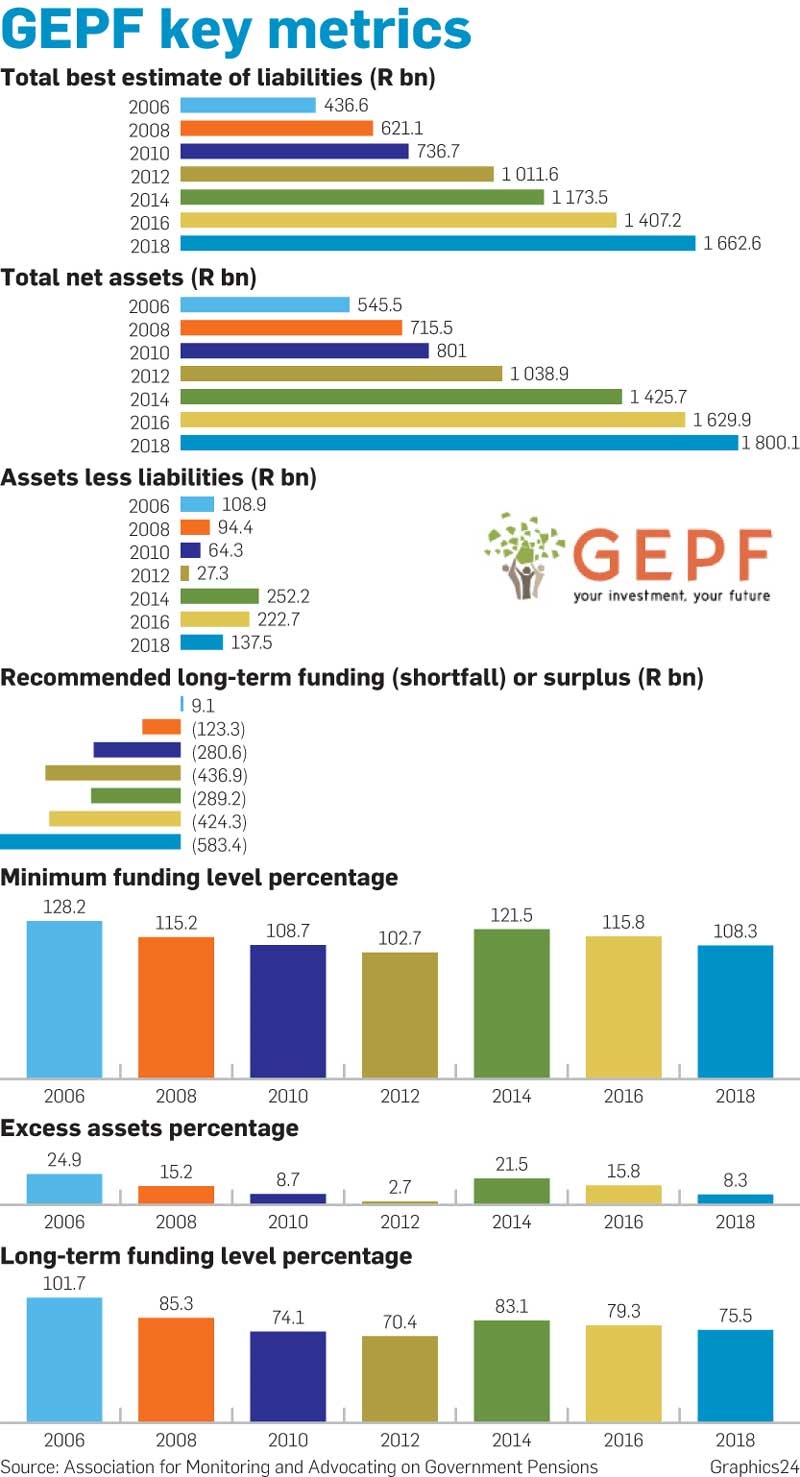

The Government Employees’ Pension Fund (GEPF) faces a record long-term funding shortfall of R583 billion, partly due to bad investment decisions.

This gap might ultimately have to be plugged by under-pressure taxpayers.

This emerged from the fund’s latest actuarial valuation at the end of March last year, prepared by Alexander Forbes Financial Services in November last year. Minister of Finance Tito Mboweni approved the public release of the actuarial valuation in February, said the fund’s spokesperson, Matau Molapo.

“As at the valuation date the fund meets the minimum funding level, but as the contingency reserves are only partially funded they do not meet its long-term funding objectives,” the valuation said.

Christo van Dyk, an independent auditor and fund pensioner, said that if the fund continued as it was its liabilities could equal its assets as early as next year, leaving itself without a buffer.

The fund has 1.281 million active members and 441 633 pensioners and is a defined benefit pension fund, which means the government, and ultimately taxpayers, will cover any shortfall in the benefits of the fund’s members or pensioners or their beneficiaries.

DOWNWARD SPIRAL

Ivan Fredericks, the general manager of the Public Servants’ Association of SA (PSA), said this week that the pension fund’s actuarial valuation showed that it was “on a steep downward spiral if this trend continues unchecked”.

The PSA is a trade union that represents more than 230 000 public sector employees.

The valuation determines the pension fund’s capacity to fulfil its obligations towards members, as well as to retired public servants, in the medium and long term.

Read: Why state employees are cashing in pensions

According to the valuation, the fund could still meet its minimum obligations, but its position was worsening.

In particular, the latest long-term funding shortfall reflected a steady decline in its financial position.

In 2006 the fund had a long-term funding surplus of R9.1 billion.

Two years later, in 2008, the fund had a R123 billion long-term funding deficit. By 2012 that deficit had widened to R436.9 billion before climbing to R583 billion by March last year.

In a bad sign for taxpayers, the fund’s actuarial valuation recommended that the government contribution to the fund increase from 16% to 18.9%, as a percentage of pensionable emoluments for state workers employed in the SA Defence Force, the SA Police Service, the Correctional Services and the State Security Agency; for all other state employees the actuarial report recommended the government hike its contribution from 13% to 14.4% of pensionable emoluments.

These recommendations meant the taxpayer’s burden related to the fund was likely to increase, Fredericks said.

However, for now taxpayers were safe because, in the February budget speech, the fund was listed by Treasury as a potential contingent liability; but from the 2008/09 to the 2021/22 fiscal years no value was assigned to this contingent liability.

A contingent liability is a potential liability that might occur depending on the outcome of an uncertain future event, according to Investopedia.

CONTINGENT LIABILITY

A contingent liability is recorded in the accounting records if the contingency is probable and the amount of the liability can be reasonably estimated.

“The situation has now reached a point when the income on investments is not sufficient to provide for pensions being paid, as well as for the total costs of the fund. Administration costs, especially investment costs, have been increasing from an unacceptable level since 2014,” Fredericks said.

“It is clear that the government should no longer be allowed to use the fund as its personal piggy bank. Reckless investments and speculative adventures, such as Independent Media and Ayo [Technology Solutions] should also stop summarily,” he said.

Van Dyk said the trend had been negative since 2014 and might well get worse.

“At a particular point, there is no buffer to protect the fund in respect of solvency and the peace of mind of 100% inflation adjustments for pensioners,” he said.

A large amount of money, such as the fund had, could be misleading because it was not an indication of the ability to give increases linked to inflation every year, Van Dyk said. He said there was still time to intervene.

“But if there is a plan to change the trend, it’s a secret. And it’s the silence of the fund that is worrying pensioners and people who are being required to go on early retirement.”

André Prakke, a forensic auditor, said if the fund couldn’t turn the ship around, it could lead to a similar debacle as the one involving Transnet’s Second Defined Benefit Fund, in which assets could not provide pensioners with inflation-related increases.

The Association for Monitoring and Advocacy of Government Pensions, a nonprofit organisation that aims to help protect members of the pension fund’s benefits, was concerned that it was not investing all the contributions it received.

In the four-year period between 2015 and last year only R150 billion of the fund’s contributions of R257 billion went to new investments.

Adamus Stemmet, a spokesperson for the association, said just 59% was being invested. Previously, all contributions were invested.

At the minimum-funding level, the pension fund had 108.3% of its requirement as at March last year, meaning it exceeded its minimum funding level of R1.6 trillion by R137 billion.

However, this level of meeting its minimum funding was the lowest since 2012 when the fund had a 102.7% minimum funding level.

The difference between the minimum funding level and the long-term funding level is the number of contingency reserves that are included in the long-term funding level, including a mortality improvement reserve, pension increase reserve and a solvency reserve.

These contingency reserves were costed at R721 billion by the latest fund actuarial valuation.

The total long-term funding level was put at R2.38 trillion at March last year. However, the fund had assets of only R1.8 trillion.

The long-term funding level was at 75.5% at the valuation date, based on fully funded contingency reserves. At the previous valuation it was 79.3%.

A long-term funding level of less than 100% did not mean the fund would be unable to meet its obligations, because it received new contributions and the assets that were invested well would grow.

That was why the fund used the so-called “minimum funding level” to give a short-term indication of fund stability. This ignored reserves and other factors and examined only present assets.

Molapo said on Friday that the fund would not respond to questions and it would elaborate on the actuarial valuation and downward trend at a later stage.

Alexander Forbes pointed to various factors that contributed to the fund’s worsening trend:

. Weak returns, even before the controversies surrounding the Public Investment Corporation (PIC), which invested money on behalf of the fund, came to light in the PIC inquiry. One of these was the R4.3 billion invested in Ayo Technology Solutions, which had been ordered to repay the money by the Companies and Intellectual Property Commission.

. Last year was a tough investment year for most investors due to poor stock market performance. By March 31 the fund’s annual return for the previous two years was 6.4% a year; the trustees had been seeking a 12.5% annual return.

. The fund’s unrealistic expectations. When the trustees determined how much money the state should contribute, they accepted their investment in shares would grow by five percentage points more than the return on the long term, which was about 8.6%. Alexander Forbes said three percentage points would be realistic.

. The fund annually paid out more benefits to the 441 633 pensioners than the 1.2 million working members and the government contributed.

This led to a cash-flow shortage of R13.6 billion a year. This could be made worse if the state continued with plans to send employees, who earn large salaries and make significant contributions, on early retirement.

. The government simply was not contributing enough to make the fund sustainable.

Publications

Publications

Partners

Partners