The R5-trillion banking sector is to receive a new conduct standard

South Africa’s 70 or so banks, with total assets of more than R5 trillion, face a new conduct standard that, for the first time, intends to iron out weaknesses identified in the sector over the past decade.

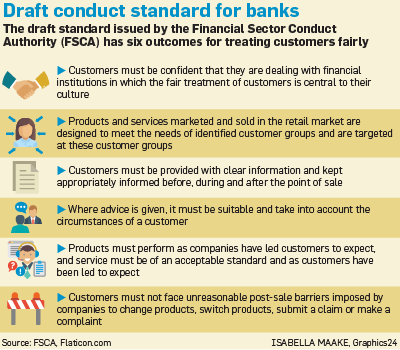

The Financial Sector Conduct Authority (FSCA) has issued a draft conduct standard for all locally based banks.

The banks have until this Tuesday to comment on the draft code and it is set for implementation from October 1.

Cas Coovadia, managing director of The Banking Association of South Africa, which has 37 member banks, said that the draft conduct standard codified the way they have been doing business.

“There will now be more robust oversight because we have a market conduct regulator,” Coovadia said in an interview with City Press.

The FSCA said that: “Over the past decade a number of conduct weaknesses have been identified in the South African banking sector.

In 2008, the banking inquiry of the Competition Commission (Jali Commission), made a number of findings and recommendations with regard to poor customer outcomes being experienced by the customers of retail banks and highlighted a clear gap in the regulation of market conduct of retail banks.”

The FSCA was established in and has the mandate to regulate and supervise the conduct of banks.

“In 2016/17, the National Treasury commissioned the World Bank to undertake a diagnostic [exercise] focusing on the identification of potential deficiencies from a fair-treatment perspective in the banks’ provision of transactional and fixed-deposit accounts, and whether and how any identified fair-treatment deficiencies could appropriately be addressed through market conduct regulation, taking into account international good practices and the South African market context,” the FSCA said.

“The retail banking diagnostic report was issued in 2018, with various recommendations to be considered.

“The draft conduct standard is therefore the first step towards rolling out a comprehensive market conduct regulatory framework for the banking sector.”

Coovadia said that the association was “overall reasonably okay with it”.

“This is the first time that banks are actually subject to this sort of market conduct regulation. To a certain extent it is a learning period for both the regulator and us.”

He added that the FSCA had a lot of work to do as they had yet to appoint a person to head the regulator.

He said that the six proposed treating customers fairly (TCF) outcomes covered what banks do anyway.

The draft code sets out minimum standards for advertising, including the governance processes that must be in place for the approval of advertisements.

Coovadia said that: “The conduct authority wants to be satisfied that what the banks advertise is what they deliver and that the advertisements are not so complex that people can’t understand them. Secondly, they don’t unduly want to encourage people to take credit products and so on and go into debt without due consideration.

“What the Twin Peaks environment has also created is to relook at the whole area of how ombudsmen in the industry are structured.”

The Twin Peaks model of financial sector regulation has created the Prudential Authority, which is housed at the South African Reserve Bank and the FSCA.

The implementation of the Twin Peaks model has two fundamental objectives.

Firstly to strengthen South Africa’s consumer protection and market conduct in financial services, and secondly to create a resilient and stable financial system.

Coovadia said: “We have an Ombudsman for Banking Services that we think works very well.”

He went on to say that the Banking Association would be advocating the merging of the FSCA’s draft banking code and the banking ombudsman’s code of good banking practice.

The code of banking practice is a fairly sizeable document covering 46 pages while the FSCA’s draft conduct standard is 23 pages.

This would create one unified mechanism that banking customers could look at, and it would indicate where customers could refer complaints to, Coovadia said.

The draft code sets out all the disclosures that must be made to a financial customer in order to ensure that they are aware of and understand the relevant facts relating to the financial product or service.

The FSCA said it acknowledged that the implementation of the draft conduct standard could have a cost implication for banks.

Coovadia said that he was sure that there would be extra costs.

“If we think that the costs are unreasonable, we would want to have the opportunity to discuss that with the regulator.”

Ross Linstrom, a Standard Bank spokesperson, said that the bank had “long anticipated this code, as it is part of government’s implementation of the Twin Peaks model of financial sector supervision, and is a precursor to the conduct of financial institutions legislation.”

Lytania Johnson, FNB chief risk officer, said that “The TCF outcomes have been known to the banking industry since 2011 when the FSCA [then the FSB] published its treating customers fairly road map. FNB has incorporated the TCF outcomes in its governance and conduct risk management frameworks and structures.”

The spokespersons for Capitec, Absa and Nedbank all said that they largely supported the draft conduct standard.

|

| ||||||||||||

| |||||||||||||

Publications

Publications

Partners

Partners