Beneficiaries of a multibillion-rand employee trust are fighting in court for it to be dissolved owing to concerns about a lack of transparency and because it is allegedly not benefiting them.

Ukhamba Trust, an employee benefit scheme set up in 1998 for employees of automotive and logistics company Imperial, is being taken to court by a group of the trust’s beneficiaries.

The trust has 15 553 beneficiaries.

According to Oshy Tugendhaft, the lawyer representing the trust, from law firm Tugendhaft Wapnick Banchetti and Partners, Imperial provided initial capital of R15 million for the creation of Ukhamba.

Acting on behalf of 1 100 beneficiaries in the matter, which is before the Johannesburg High Court, Reuben Malabela, one of beneficiaries, has filed court documents, of which City Press has copies, that apply to the court to dissolve the trust and distribute the money held therein.

The trust owns a 10.1% stake in Imperial and holds funds worth more than R2 billion, according to Malabela.

“We want the trust dissolved because the beneficiaries are not benefiting. The trust has been amended several times without the knowledge of the beneficiaries and they were never given a chance to elect their representative among the trustees.

“There are also a lot of people who were left out even though they were employees of Imperial and there was never a reason given for that,” he said.

“Another issue is that a lot of beneficiaries have since died and their next of kin were never alerted of the trust benefits even though we are told they employed a tracing company, but no one was ever traced,” he said, adding that only employees employed before March 2004 qualified for the shares according to the trust deed.

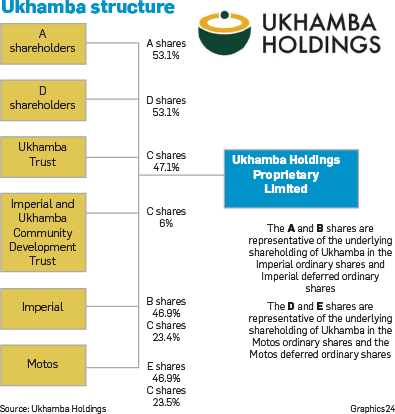

Ukhamba Holdings is an investment holding company whose shareholders are the Ukhamba Trust, which owns 47.1%; Imperial, which owns a 46.9% stake; with the remaining 6% belonging to the Ukhamba Community Development Trust.

According to Tugendhaft, there was nothing untoward about the trust.

Tugendhaft lambasted Malabela and said his assertion that the trust had ensured that most of the legal representations the beneficiaries sought always ultimately decided against continuing with the matter, allegedly after being coerced by the trust.

“This is an absurd and defamatory allegation that is devoid of truth. Our client is not aware of any other lawyers whom, it is alleged, represented any beneficiaries,” he said.

He also pointed out that Malabela has instituted an application to review and set aside the decision in the arbitration.

“When our client was initially approached by Mr Malabela, it established that of the beneficiaries he claimed to represent, all had been paid their dividends due to them and the majority had elected to dispose of their ‘A’ shares,” he added.

Tugendhaft said the beneficiaries of the trust received their units in the trust from Imperial for free and the company also issued Imperial deferred shares to Ukhamba for free.

Companies use deferred shares as part of employee compensation plans.

The deferred Imperial shares convert to ordinary Imperial shares in annual tranches, Tugendhaft said.

About 15 056 029 Imperial shares have been converted and the remaining deferred shares would convert in equal tranches each year until 2025, up to a total of 21 million Imperial shares.

The main underlying asset of the trust is represented by its 47.1% shareholding in Ukhamba, comprising the ordinary shares and deferred shares in Imperial.

“In 2013, in response to beneficiaries wishing to realise their interest in the trust, Ukhamba created an A share that is representative of the underlying Imperial ordinary shares and Imperial deferred shares, which A share was listed on a trading platform and can be traded,” Tugendhaft said.

“There are 6 483 beneficiaries, who have retained their A shares, since the remaining 9 070 beneficiaries elected to dispose of their shares, once the A shares were listed in 2013,” he said.

Ukhamba received dividends from the Imperial ordinary shares and then in turn declared and paid dividends to the A shareholders, Tugendhaft said.

“There is a growth in the underlying Imperial deferred shares and the Imperial ordinary shares held by Ukhamba, but that growth is only realised if and when the A shares are sold,” he added.

“The total dividends declared by Ukhamba to its shareholders ... to date ... amount to R850 million, of which the trust received 47.1% – [about] R400 million for its beneficiaries.”

He said the beneficiaries of the trust each received an average R25 485 and at listing each received 1 206 A shares, which, at R25 per share, were worth R30 150 in total.

Publications

Publications

Partners

Partners