Finance Minister Tito Mboweni faces an uphill battle to get the country’s finances under control, contain spending and boost growth and employment in a country struggling to achieve any of these objectives.

The national budget comes in at R1.95 trillion this year. That’s a lot of money that appears to not be getting anywhere very fast.

The options open to the national fiscus are extremely limited. The economic outlook since the medium term budget policy statement in October last year has deteriorated, the growth outlook has been downgraded to 0.9% and the tax shortfall has widened to R63.3 billion.

The deficit as a percentage of GDP is now at 6.3% and rising. Debt servicing costs are astronomical – R0.15 of every rand is spent on debt servicing.

To add fuel to this blazing consumptive fire, the wage bill sucks up another 35.6% of the budget.

But South Africa is not yet at austerity, and this is not an austerity budget.

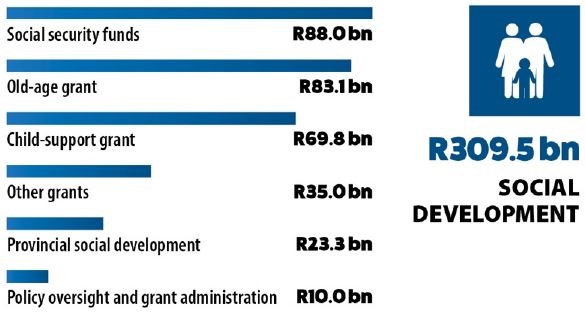

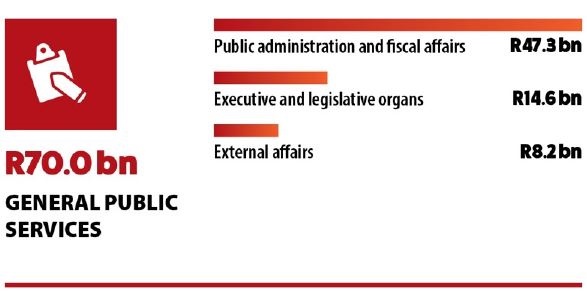

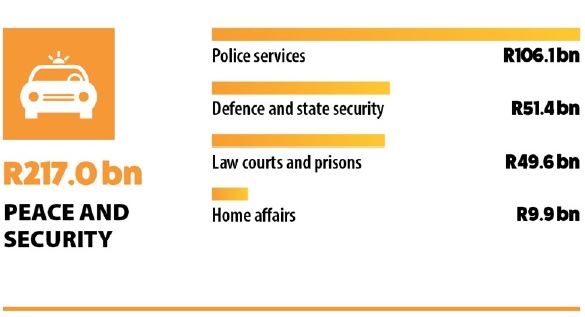

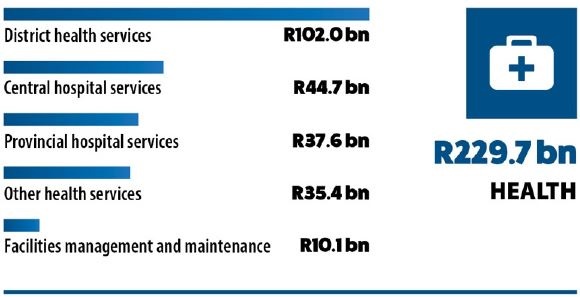

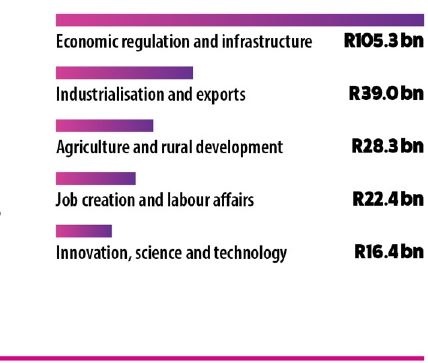

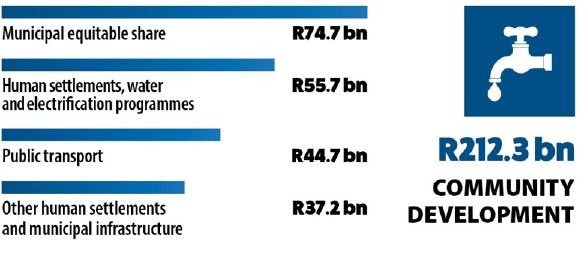

The 2020 Budget proposes total consolidated spending of R1.95 trillion in 2020/21:

- The largest allocations going to learning and culture (R396.4 billion);

- Health (R229.7 billion) and;

- Social development (R309.5 billion).

“The International Monetary Fund is of the view that South Africa and Argentina are the two countries within the G20 that have limited fiscal space. I’m not happy about the comparison with Argentina, but we are in a difficult space. We cannot have all the things we want at the same time. But we are cleaning house,” says Mboweni.

Against this bleak backdrop, the finance minister is trying to stand tall and take decisive action to stem the bleeding. To this end, some structural economic reforms have been proposed.

Most notably in the supply of power where, as announced in the state of the nation address, regulators will beat a path to allow private power generation in an effort to maintain a stable supply and boost growth.

Additionally, the reform of state-owned enterprises is crucial.

Public Enterprises will push ahead with the restructuring of Eskom into three parts, each with their own organisational structures.

Minister @Titomboweni tables the National Budget Speech in parliament #Budget2020 https://t.co/hrN5I0gBcj

— Tito Mboweni (@tito_mboweni) February 26, 2020

According the national budget: “Over the next three years, government will transfer R112 billion to Eskom to enable the utility to meet its short-term financial obligations. Annual electricity sector production declined by 1.4% in 2019.

“Eskom’s energy availability factor, which measures the ratio of available power to the maximum amount that could be produced on a scale of 100, fell from an average of 71.8 in 2018 to 67 in 2019 – and below 60 in December 2019.

“A range of factors contributed to the decline, including operational failures at Medupi and Kusile, unreliable coal and diesel supply, and weather-related problems. Scheduled power cuts are expected to persist over the next 12 to 18 months as Eskom conducts urgent maintenance.”

Constrained power supply remains a clear and present danger to the country’s growth prospects, affecting the ease of doing business and the basic ability to do business itself.

“The Eskom story is a bit tired now,” says Mboweni, “but we have announced our plans and the details are in the budget.”

SAA will have to wing it as best it can under the business rescue process.

“The SAA Sword of Damocles has now fallen on us,” says the finance minister. The airline will be given an additional R16.4 billion to pare down guaranteed debt and allow it to be able to service additional debt obligations. It is no longer feasible to bail out an entity that has produced losses of R32 billion since 2008/9.

In addition, as part of the structural reforms suggested, a new law will introduce a regulatory framework for public entities and SOEs to limit excessive salaries and bonuses.

Minister @tito_mboweni, along with the top finance officials walk up to the National Assembly carrying the famous Aloe Ferox plant ahead of #Budget2020 speech pic.twitter.com/UyXlvcfNUk

— South African Government (@GovernmentZA) February 26, 2020

Wage bill

The biggest elephant in the room is the state as the country’s largest employer. Public service wage growth has accelerated by 40% over the past 12 years, putting the wage bill on an unsustainable trajectory. The minister has drawn a line in the sand, committing to reducing this bill by R160.2 billion.

This will no doubt draw deep union ire. Furthermore, the minister has proposed a 0% wage hike for the 2020/21 fiscal year to mitigate the rising bill.

“The 2020 budget proposes a reduction in the compensation budgets of national and provincial departments, and entities that receive transfers directly from national government. These reductions amount to R37.8 billion in 2020/21, R54.9 billion in 2021/22 and R67.5 billion in 2022/23. The revised amounts will guide government in forthcoming talks in the Public Service Co-ordinating Bargaining Council.

These reductions can be achieved through a combination of modifications to cost-of-living adjustments, pay progression and other benefits. Wage bill growth outside the public service is also contributing to fiscal pressure. During 2020, government will legislate a remuneration framework for public entities and state-owned companies. The framework will improve alignment of pay scales with the public service, and contain excessive salaries and other payments.”

Mboweni says: “We are interacting with labour unions etc. There may be agreements and disagreements, but the R160-billion saving must be found. We are all in this together. But wage is not an isolated item. We must look at other expenses. Why must people fly economy class? People are stealing; they should be locked up and go to jail.

“Ministerial perks and benefits must be looked at. We pay a salary, why must we buy cars, cellphones etc?

“There is too much wastage in the government sector. The whole state system is a problem. It will be tough. It’s like going to the dentist to have teeth extracted without anaesthetic. But there is lots of cleaning up we can do.”

Ratings agencies

Broadly, the budget says of fiscal risks:“Persistently weak economic growth is the central factor limiting improved public finances.

- Insufficient progress on Eskom reforms and its financial position, and demands from other financially distressed state-owned companies;

- Outcomes of the renegotiation of the existing wage agreement and the following round of wage talks;

- The Road Accident Fund is government’s second-largest contingent liability after Eskom. A decision on the Road Accident Benefit Scheme Bill is required to pave the way for a more affordable system;

- Clarity on government’s position on the user-pay principle as it relates to e-tolls. Declining e-toll revenue will have to be offset by other measures to repay South African National Roads Agency Limited debt. It could also affect funding for other investment projects.

When asked how ratings agencies would respond to the budget, the finance minister was clear.

“They will react to our fiscal stance. Although the deficit is rising there are plans to pare it back. The response will be positive – we may get a klap – but I don’t think they will do anything untoward. We must get our house in order. It will be difficult. Sometimes painful but sometimes joyous.”

Proposals

The 2020 Budget proposals mark an important step on the road to fiscal consolidation.

In comparison with the 2019 Budget, government proposes to reduce its expenditure by R156.1 billion – primarily through a decrease in its compensation bill.

Public-service employees should be fairly remunerated, but government is obligated to balance its wage bill with the broader needs of society.

Other reductions are being applied, wherever possible, to poorly performing or underspending programmes.

Reductions of this magnitude will inevitably have negative consequences for the economy and social services. But these short-term costs are necessary to put the country on to a more sustainable footing.

Rapid and sustained economic growth is the central requirement to build a prosperous and equitable South Africa. This remains our core policy objective. Achieving this requires decisive steps to build confidence, promote investment and job creation, reduce anti-competitive practices and eliminate regulatory blockages. The most immediate and crucial reform is to ensure adequate electricity supply for businesses and households.

The president has announced the first steps to enable greater private-sector participation in electricity generation. A series of regulatory adjustments will follow.

Taxes

For consumers, there may be a sigh of relief as there are no tax increases in personal income tax for this financial year.

“It would be foolhardy to increase tax in this time of hardship,” says Mboweni.

Contrary to expectations, there will be some tax relief introduced. Including no VAT increases and inflation linked levy increases on fuels.

However, the public will be expected to cough up for the vices that they engage in. Excise taxes – on cigarettes, beer, spirits, wine, pipe tobacco and cigars – all rise.

In addition, a tax will be imposed on vaping and e-cigarette products.

- Tax revenue is projected to grow by 4.9% in 2020/21.

- The main tax proposals include personal income tax relief through above-inflation adjustments in all brackets, along with increases in the fuel and Road Accident Fund (RAF) levies to adjust for inflation. Corporate interest deductions will be limited to combat base erosion and profit shifting.

- The revitalisation of the South African Revenue Service is under way, and this is expected to contribute to increased tax revenue over the medium term.

In line with this approach, government will review tax incentives over the medium term, and repeal or redesign those that are inefficient or inequitable.

- Providing personal income tax relief through an above-inflation increase in the brackets and rebates;

- Further limiting corporate interest deductions to combat base erosion and profit shifting;

- Restricting the ability of companies to fully offset assessed losses from previous years against taxable income;

- Increasing the fuel levy by 25c/litre, consisting of a 16c/litre increase in the general fuel levy and a 9c/litre increase in the RAF levy, to adjust for inflation;

- Increasing the annual contribution limit to tax-free savings accounts by R3 000 from 1 March 2020; and

- Increasing excise duties on alcohol and tobacco by between 4.4% and 7.5%.

Corporate income tax

To promote economic growth, government intends to restructure the corporate income tax system over the medium term by broadening the base and reducing the rate. Broadening the base will involve minimising tax incentives, and introducing new interest deduction and assessed loss limitations. Rate reductions will be implemented in a revenue-neutral manner.

Government has broadened the corporate income tax base since the early 2000s by taxing foreign dividends, imposing capital gains tax and introducing the controlled foreign company regime. In contrast with many other countries, however, South Africa’s corporate income tax rate has remained unchanged at 28 per cent for more than a decade. As the gap with our trading and investment partners grows, the country’s relative competitiveness declines. India, the US and the UK have all recently reduced their corporate income tax rates below 28%.

Reducing the corporate income tax rate will encourage businesses to invest and expand production, improve the country’s competitiveness as an investment destination, and reduce the appeal of base erosion and profit shifting.

Taxing the digital economy

In today’s digital economy, many businesses are able to generate significant profits in a country, without a physical presence. The Organisation for Economic Cooperation and Development (OECD) secretariat has proposed a unified approach to taxing multinational firms.

This approach considers multinationals as a whole, and recognises that consumers and intangible assets contribute to global profits. Under the proposal, multinationals would be required to report a portion of their global profits in all countries where they have a sustained and material market presence. The proposal

forms the basis for negotiations and a hoped-for consensus in 2020. South Africa participates in these discussions as a member of the OECD’s inclusive framework steering group.

Publications

Publications

Partners

Partners