The numbers are dizzying, and the deals are a sign of confidence.

After major local and international corporates took turns in pledging R290 billion towards investment in South Africa and in shaking hands with President Cyril Ramaphosa at the SA Investment Conference on Friday, there was little detail as to where the money would go.

The corporate chiefs took turns to pledge various amounts of investments on stage as a sign of their public commitment, but during the various working sector groups – nine in total – details were scarce.

At the close of the summit, Ramaphosa said investment announcements worth nearly R290 billion had been made and this is on top of the R400 billion that governments of various countries had pledged in the past six months.

The deals include: AngloAmerican (R71.5bn), Vedanta (R21.4bn) and Mercedes Benz SA (R10bn).

In their report-back media briefing session, various ministers mentioned amounts pledged to their sectors – but none could specify if the investments were in the pipeline, had already started or were even at proposal stage.

LEADING THE DRIVE

In his opening address, Ramaphosa said local companies needed to lead the investment drive.

He reassured investors that the government was doing all it could to make the country an investment destination of choice.

READ: Here's why Ramaphosa believes SA is 'a compelling investment'

“We have emphasised the need for more South African companies to lead the investment charge, demonstrating that they have confidence in this economy and in its ability to deliver decent and reliable returns,” he said.

However, despite the uncertainty about the impressive amounts, various businesspeople expressed optimism that the target set by the president of $100 billion (R1.5 trillion) over five years, would be exceeded.

Black Business Council (BBC) president Sandile Zungu said he was confident that there would be good investment inflows into South Africa.

Sinayo Securities CEO Babalwa Ngonyama said the conference was important in profiling the country in a good light, especially after large outflows of investment from the stock market over the past three months as most investors opted for better-performing economies.

OPTIMISM

Ngonyama said she was optimistic that the set target for investment would be reached.

Masingita Group founder and veteran property developer Mike Nkuna said he was delighted that there was so much eagerness to invest in the country and that, as a developer, he was hoping a significant portion would find its way to his sector.

During the press briefing by ministers, Tourism Minister Derek Hanekom said the country was blessed with many competitive characteristics that made it a tourist destination of choice for many.

He said more than 10 million people visited the country last year.

Agriculture, Forestry and Fisheries Minister Senzeni Zokwana said exporting would be made easier for the agriculture sector.

“It is not helpful to be in production as a farmer if you don’t have access to markets – either local or export markets,” he said, adding that fisheries in particular was a subsector that needed more transformation.

Minister of Telecommunications and Postal Services Siyabonga Cwele said government was receiving positive feedback from investors over the decision to release more spectrum. He pointed out that the mining sector had indicated that as it improved its infrastructure, it would need data costs to be lower.

Cwele said he was hopeful that by 2020 the country would be the leader in ICT infrastructure.

READ: SA can't be competitive until connectivity is everywhere, for everyone

Energy Minister Jeff Radebe said Bidvest had committed a R1 billion investment into Richards Bay and that his department was drafting a gas-oriented masterplan that would accommodate that region as well as the country.

In his briefing, Mineral Resources Minister Gwede Mantashe said the mining sector was back on track now that the revised Mining Charter had been approved.

He said more than R100 billion was committed at Friday’s summit, but added that work still needed to be done to create more policy certainty in the sector.

He said mining houses were complaining about the price of electricity and port fees.

“We do not demand black economic empowerment on exploration,” he said, adding that the 30% policy requirement would only be required at later stages.

Water and Sanitation Minister Gugile Nkwinti said his commission emphasised that the time it took to process applications was too long.

The Development Bank of Southern Africa said it had set up a R1.3 billion green climate funding facility to support private banks.

GROWTH BOOST

Two days before the start of the investment summit, Finance Minister Tito Mboweni presented his first medium-term budget policy statement to Parliament.

National Treasury was hoping that all the interventions that the government had put in place under Ramaphosa would result in the economy performing better, said Deputy Minister of Finance Mondli Gungubele.

“One of things that we are crossing fingers about is that, given a lot of interventions – including the Jobs Summit, this investment conference and other inventions by leadership under this president – we expect the economy to perform better,” he told City Press.

The private sector had responded well to government’s initiatives under Ramaphosa, Gungubele said, adding: “We are hoping this will unlock more investment.”

The mini budget had allocated R1.4 billion to turn the SA Revenue Service (Sars) around and revive its ability to perform “in the manner it is supposed to in the short term to improve revenue”, Gungubele said.

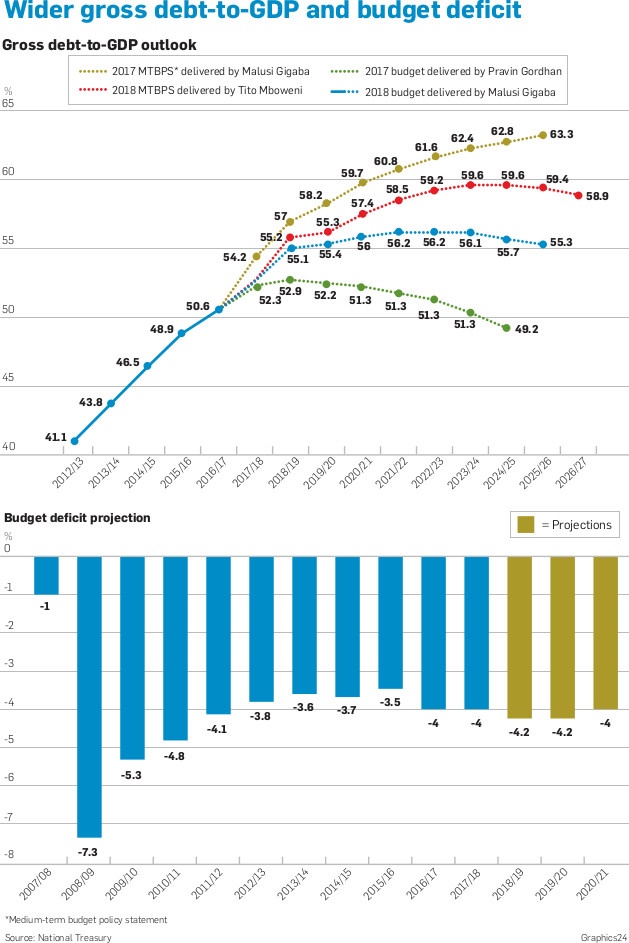

He added: “The rise in our debt-to-GDP ratio is largely attributed to the depreciation of the rand. Because we are sticking to the anchor of the budget ceiling and also investing in reviving Sars … we anticipate that [the debt-to-GDP ratio] will stabilise up in the 2023/24 tax year [at just under 60%].”

At a media conference, Mboweni said the anticipated climb in government debt to GDP to just under 60% “is not very good”.

Regarding the ratings agencies, Gungubele said: “Generally, we are worried. There is no way we can’t be worried about the numbers. The fact that [2018] growth has been revised down from 1.5% to 0.7% is not something we are happy about.

“What makes us confident is that we still have no doubt about the commitment by the current leadership of taking the economy out of its situation. We are projecting growth of about 2% by 2021 and we see it getting better based on business confidence and investment.”

On the outlook for taxes, Gungubele said unless something fundamental happened, the government had no intention to touch taxes next year.

S&P Global director Ravi Bhatia, who is the agency’s primary South African analyst, said S&P, which rates South Africa at “junk” status, would be releasing its next review of the South African government rating on November 23.

Prior to the Investment Summit, Finance Minister Tito Mboweni presented his first Medium Term Budgetary Policy Statement (MTBPS) to parliament on Wednesday.

The National Treasury has its fingers crossed that all the interventions that the government has put in place under Ramaphosa would result in the economy performing better, Deputy Minister of Finance Mondli Gungubele said.

“One of things that we are crossing fingers is that – a lot of interventions including the Job Summit and the investment conference and other inventions by this leadership under this president – we expect the economy to perform better,” he added this week during an interview with City Press.

The private sector had responded well to the government’s initiatives under Ramaphosa, Gungubele said.

”We are hoping this will unlock more investment.”

The (MTBPS) indicates that R1.4 billion has been allocated to fix the South African Revenue Service (Sars).

This amount should be enough to turn Sars around and revive the tax agency’s ability to perform “in the manner it is supposed to in the short term to improve revenue”, Gungubele said.

Gungubele highlighted that the National Treasury was sticking to its expenditure ceiling, which is an overall limit that enables the government to manage spending levels.

He said: “The rise in our debt to GDP ratio is largely attributed to the depreciation of the rand. Because we are sticking to the anchor of the budget ceiling and also investing in reviving Sars…we anticipate that [the debt to GDP ratio] will stabilise up 2023/2024 [tax year at just under 60%].”

At a media conference, Mboweni said that the anticipated climb in government debt to GDP to just under 60% ‘is not very good”.

Turning to the credit rating agencies, Gungubele said: “Generally we are worried. There is no way we can’t be worried about the numbers. The fact that [2018] growth has been revised down from 1.5% to 0.7% - it is not something we are happy about. What makes us confident is that we still have no doubt about the commitment about current leadership of taking the economy out of its situation. We are projecting a growth of about 2% by 2021 and we see it getting better based on the business confidence and investment.”

Sanisha Packirisamy, an economist at Momentum Investments, said that she wasn’t expecting a downgrade, by the end of the year, by the three major rating agencies.

On the outlook for taxes, Gungubele said unless something fundamental happened the government had no intention to touch taxes next year.

In response to the MTBPS,

Ravi Bhatia, S&P director and the primary South African analyst, said during an interview with City Press that given the recession in the first half of this year it wasn’t surprising that the MTBPS had revised down the government’s revenue forecasts.

S&P, which rates South Africa ‘junk status, would be releasing its next review of the South African government rating on November 23, he added.

Fitch Ratings said that National elections in 2019 were likely to see National Treasury hold off on further fiscal discipline, said, Fitch, which also rates South Africa at ‘junk’ status.

However, the government could announced measures to enhance fiscal discipline after the elections, particularly if tax revenue disappointed.

Moody’s Investor Services said that the South African government unveiled a weaker fiscal outlook than in the February Budget.

Publications

Publications

Partners

Partners