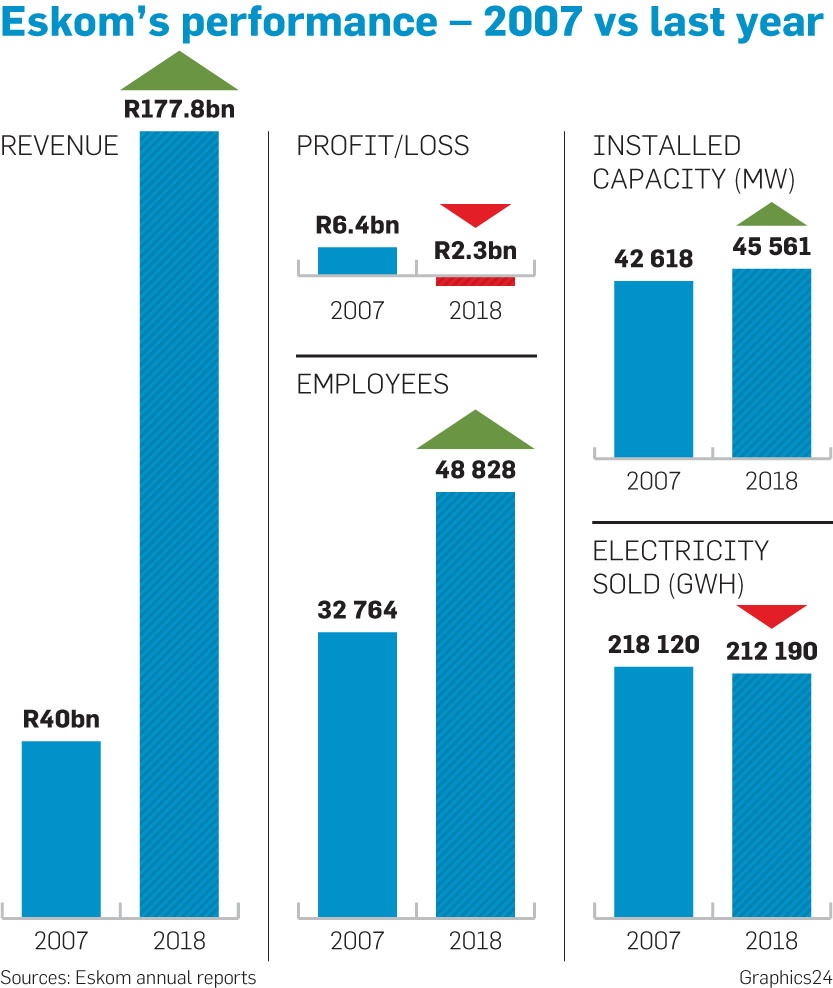

Slamming the power utility’s current fixed asset base as overinflated, experts want Eskom to be unbundled and IPPs to be responsible for generation

Eskom’s valuation of its assets has been called into question by a number of experts during the ongoing regulatory hearings being held nationwide – public hearings in which the power utility is seeking a huge hike in power prices over the next three years, as well as more than R21 billion to cover revenue lost in its last financial year.

Eskom’s Regulatory Asset Base (RAB), as well as the depreciation linked to it, is included in the formula used by the National Energy Regulator of SA (Nersa) to determine how much the power utility is allowed to charge for electricity.

A number of organisations and energy analysts believe that Eskom values its fixed assets at as much as twice what they are really worth, and that it is using its asset valuation, or RAB, to “game” the regulatory system.

Shaun Nel, acting CEO of the Energy Intensive Users Group of Southern Africa, said part of the group’s submission to Nersa – which will be made available when the Nersa hearings move to Gauteng in February – questions Eskom’s RAB value, calculated as the replacement value of its assets.

However, the assumption of replacement value relates to an ideal situation in which Eskom is profitable and well run.

As it stood, the RAB amounted to “really just regulatory gaming”, as many power stations should not be replaced.

Read: Economic growth in SA set to be better this year-if Eskom keeps the lights on

Any expansion plans should be “farmed out” to independent power producers (IPPs), and Eskom’s plants should be run on a cash basis, said Nel.

“Instead of accounting for the replacement of its assets, Eskom should [remove] returns and depreciation, and just calculate the operating costs until end of lifespan,” he added.

Part of the problem Nel identified was that the cost of building new power stations was factored into the tariffs charged to electricity consumers in order to fund the build.

With IPPs, however, the power producer finances the build and pays off the expenditure through sales over the lifespan of the plant.

Thus, new generation capacity should be provided by IPPs, instead of relying on the old model in which Eskom charges the consumer for its capital expenditure.

“The Eskom tariff is a blend of old and new generation as opposed to the marginal cost of new IPP generation, which is lower than the Eskom [blended] tariff,” said Nel.

Wayne Duvenage, CEO of the Organisation Undoing Tax Abuse (Outa), which made its submission to Nersa in Cape Town last week, said Eskom’s valuation of its assets was “a serious concern”.

Calling the power utility’s current fixed asset base – R645 billion as at September 2018 – “unrealistic”, Duvenage said: “International accounting standards allow for the revaluation of assets, but this needs to be done on the basis that these are achievable and to reflect fair value on the books.

“They have factored in the build of Kusile and Medupi, but no one is going to pay R300 billion for Medupi. This is where it becomes flawed.”

Duvenage said an overinflated asset base meant higher electricity tariffs as well as other inefficiencies.

He added that Outa was “horrified” to see that Eskom had pushed its asset base to more than R1 trillion, while its real asset base was more likely to be between R300 billion to R400 billion.

He agreed with Nel that Eskom’s model was “archaic” and that the power utility should be unbundled to become an electricity transmitter and distributor, with renewable energy-focused IPPs being responsible for generation.

But in its latest application, Eskom is motivating for a “so-called negative return” on its asset base, says Anthony Felet, a regulatory financial specialist and a partner at Johannesburg-based consultancy Genesis Analytics.

Eskom did the same thing in its application for the five years from 2013 to 2018, said Felet, claiming it represented a sacrifice of applied revenue.

“However, this negative return needs to be considered in the context of its whole application – that is, it is seeking to recoup ‘the return’ from other cost categories and it is recouping depreciation on the basis of inflated RAB values.”

Eskom’s application for tariff hikes calculates the RAB for 2019/20 to be R1.28 billion, which is 80% higher than the RAB value determined by Nersa for 2018/19, he noted.

The apparently inflated RAB means that although Eskom has claimed to be sacrificing revenue of R16.687 billion in 2019/20 and R2.765 billion in 2020/21, if the RAB value was halved – as Duvenage believes it should be – the depreciation value of the asset base would be halved.

Felet calculated that this would mean that the increase that Eskom is seeking for its 2020 financial year should be a 3% drop rather than a 15% hike.

The subsequent two-year increases would remain at about 15%, but would be applied from a significantly smaller tariff base.

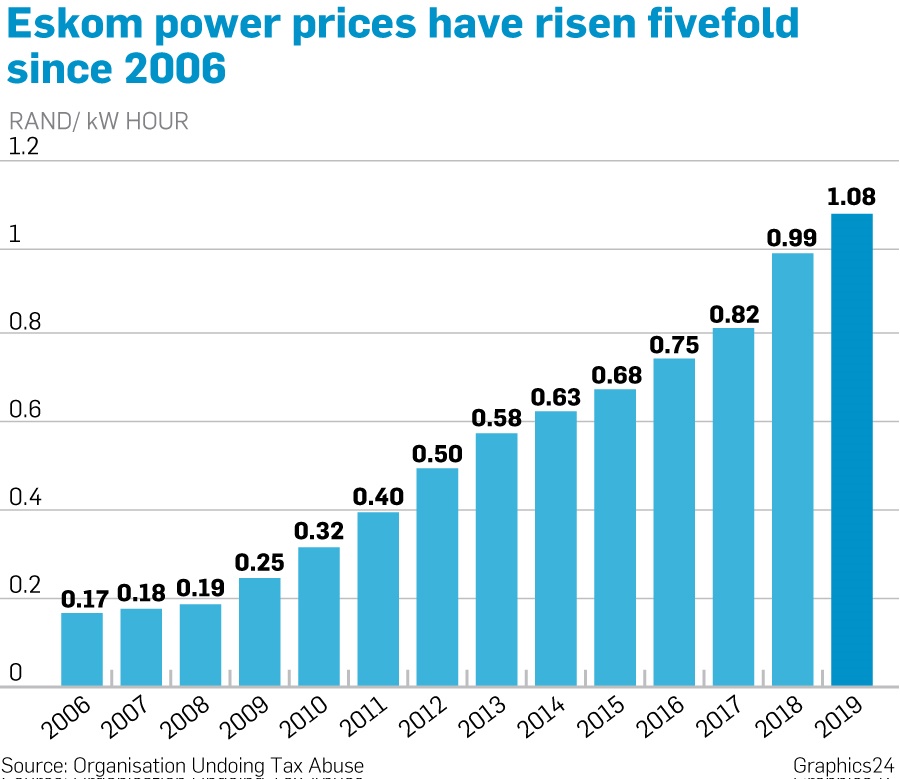

“So, under a halving of the RAB scenario, tariffs would increase from R0.94 (current) to R1.23 at the end of the three-year period, instead of increasing to R1.43. First-year tariffs would be R0.91 rather than R1.08.”

Felet said it was important to ask why Eskom was willing to operate on a so-called negative return basis and believed the application for a negative return was “disingenuous”.

“All the ‘fat’ appears to be in the other components of the revenue allowance,” he said.

For example, Eskom is applying for a 54% increase in primary energy costs and an 11% increase in operating expenditure in the first year of the application, yet tariff volumes (measured in kilowatts) are expected to remain relatively constant (an increase of 0.8%).

“The critique of Eskom’s cost estimates should therefore be the priority for Nersa,” said Felet.

Nersa spokesperson Charles Hlebela said that the power regulator would conduct a thorough assessment and analysis of Eskom’s application before a decision was made.

“Decisions of the energy regulator are based on facts and evidence. In this regard, all facts and evidence provided by stakeholders regarding the application will be taken into consideration. The application will be taken through the efficiency and prudency test – costs that are not deemed prudent or efficient will not be approved,” he said.

City Press sent questions to Eskom spokesperson Nto Rikhotso regarding the power utility’s valuation of its assets, but no response was forthcoming by late Friday.

Publications

Publications

Partners

Partners