Europe opens its doors but EU trading partners request concessions before investing in SA, including a relaxation of BEE rules

Bags full of goodwill and a willingness to negotiate characterised President Cyril Ramaphosa’s trip to Brussels last week for a summit with South Africa’s largest trading partner, the EU.

But going into last week’s summit – the first in five years – the Europeans wanted a long list of concessions to facilitate increased investment in the country from a federation that accounts for 25% of South Africa’s trade and about 75% of the country’s total foreign direct investment.

Top of the list was ownership rules under the broad-based BEE codes of good practice.

These, the EU said in its discussion paper, were onerous and disregarded the employment these companies created, which it put at more than 500 000 direct jobs.

According to the paper – compiled following a Black Management Forum (BMF) research report on the impact of EU investment on transformation and inclusive growth – other impediments to increased investment included localisation requirements, land expropriation and policy uncertainty.

After Thursday’s summit, Ramaphosa, accompanied by Finance Minister Tito Mboweni and Trade and Industry Minister Rob Davies, was at pains to ease investor fears on the land question, saying they had “nothing to fear”.

“The EU is South Africa’s largest trading partner and it has been so for a very long time. The value of trade between South Africa and the EU has increased four-fold since 2000. More than 2 000 European-based companies operate in South Africa,” he said.

Of the mood at the summit, Ramaphosa said: “We had a good sense that we are well supported as we make all attempts to grow our economy to address the issues of inequality, unemployment and poverty in South Africa. We know that Europe is our ally in this and they will want to support us every inch of the way as we embark on a number of initiatives.”

In an interview after the summit, Davies told City Press that, while there was plenty of room for discussion and negotiation on the issues, they told the Europeans that “we want to look more closely at what your concerns are, because all of these are areas where we need to be able to exercise our policy”.

“Localisation is not something we will be able to renounce. Nor are we going to be able to renounce BEE,” he said.

Davies said South Africa was becoming increasingly investor-friendly, and his department had asked the World Bank to look at the ease of doing business in the country, and what improvements could be made.

“At the same time, it doesn’t mean that we’re on a popularity show and bend over for every kind of requirement and hope that this is going to lead to a big surge in investment. I don’t think that’s what happens in other places.”

BMF REPORT

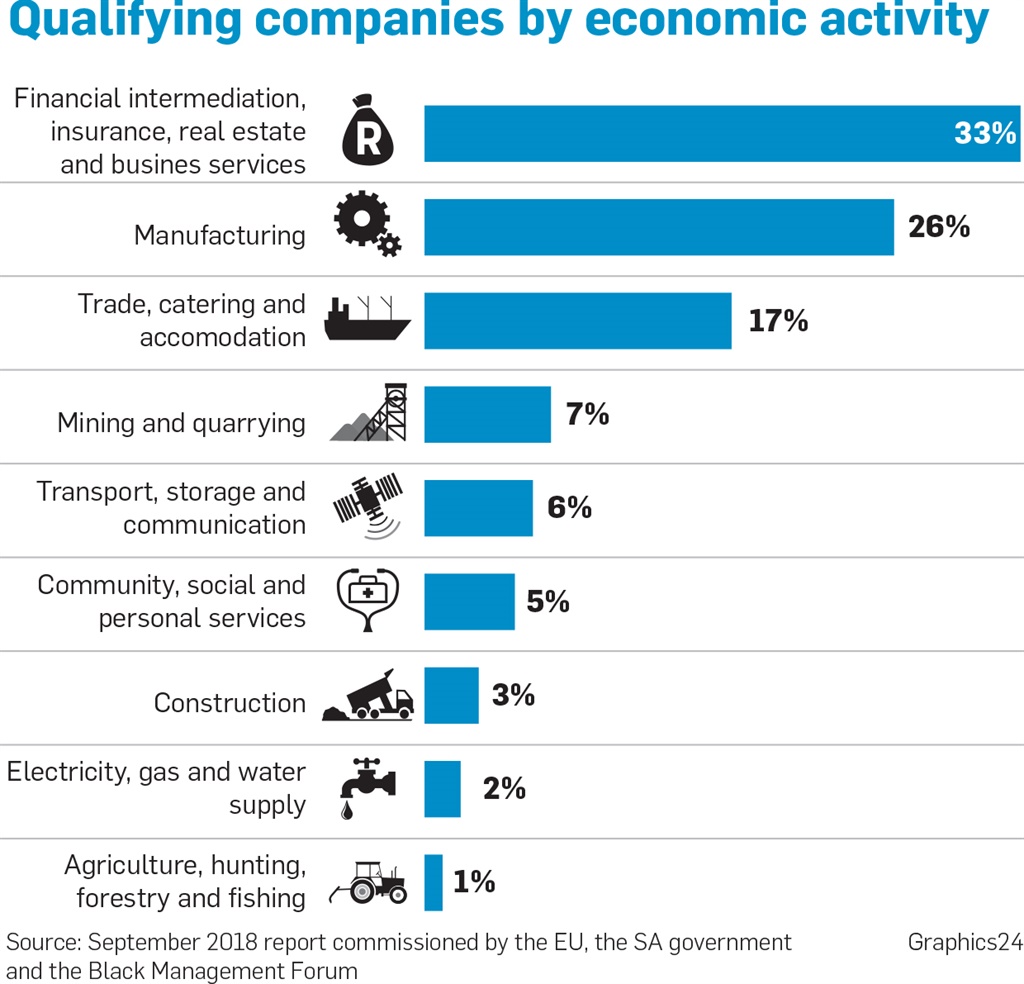

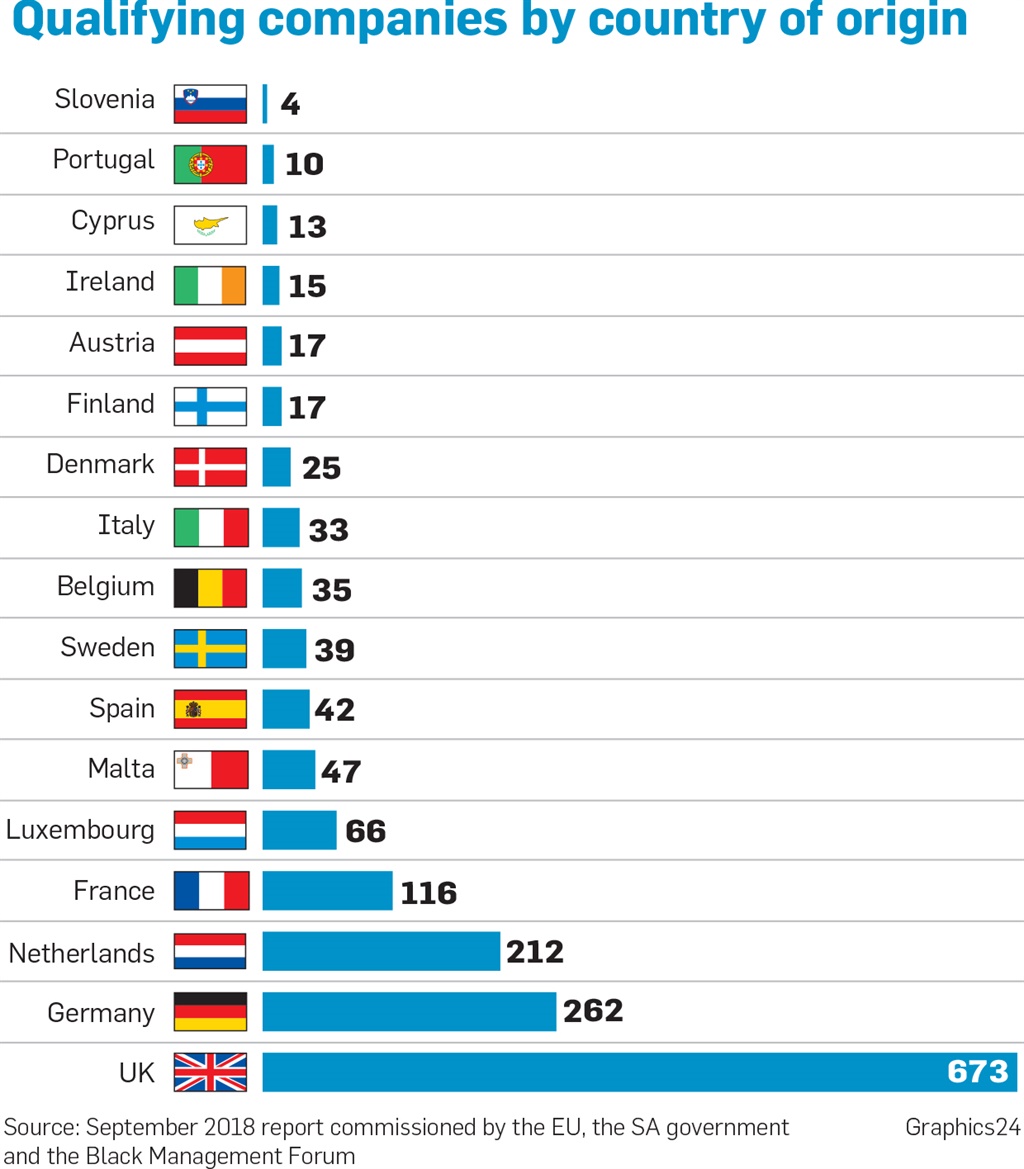

Ahead of the summit, the EU commissioned the report by the BMF. Researchers found that there were 1 611 majority-owned European companies operating in South Africa, of which 673 were British, 262 were German, 212 were Dutch and 116 were French.

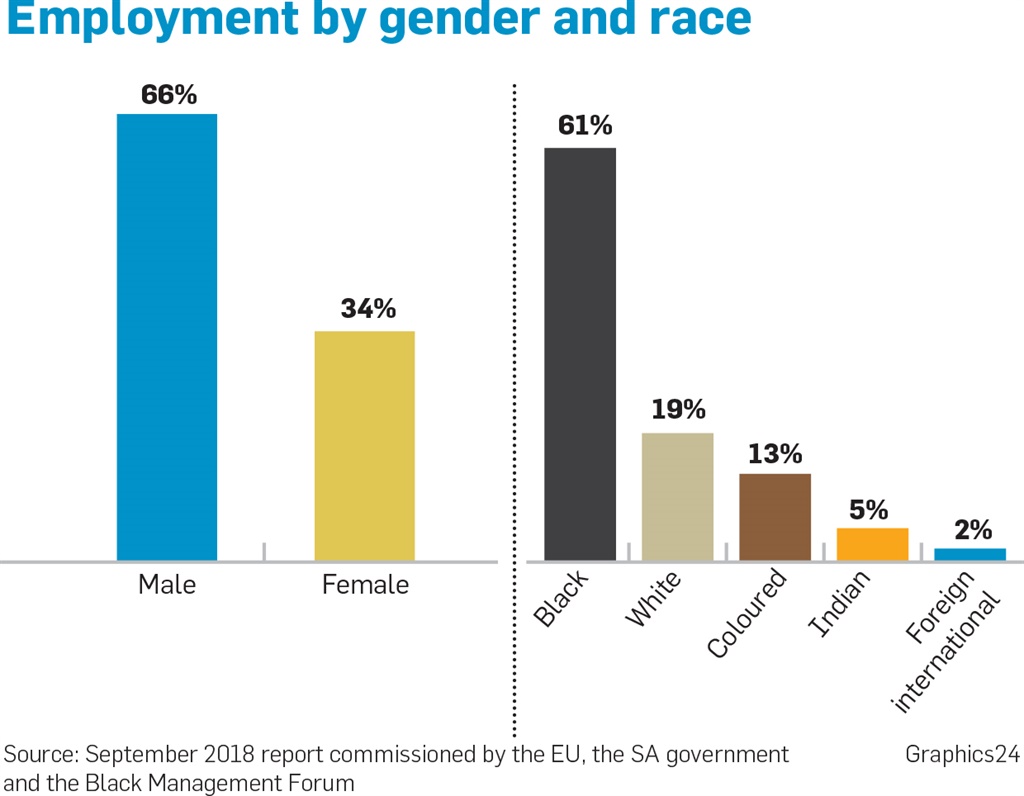

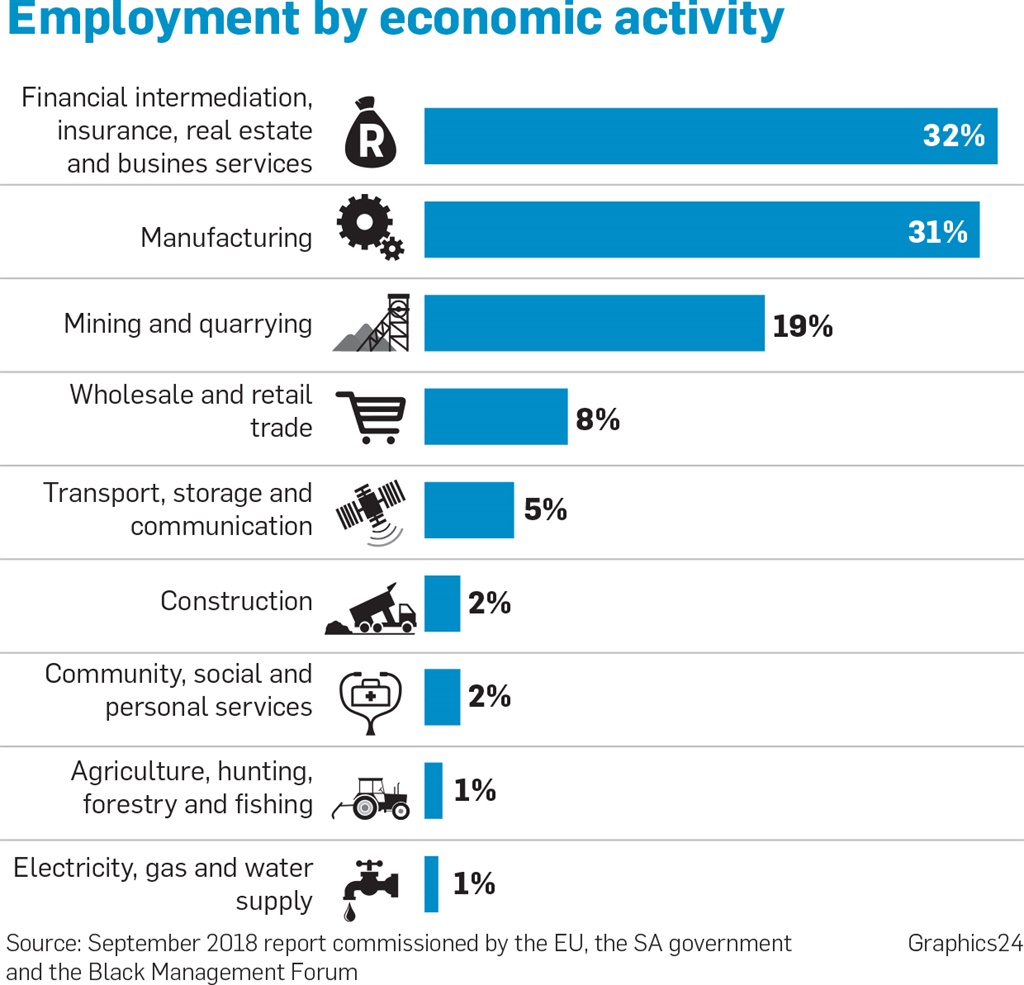

The report, dated September, found that 868 companies revealed their employment figures totalled 468 474 jobs, 95% of which were permanent. Of these jobs, 66% were occupied by men and 2% by foreign nationals. Most of the employees were semi-skilled, followed by skilled technical workers with academic qualifications.

The report also found that “almost half” of senior management jobs at these companies were held by white men, followed by foreign male nationals (16%) and white women (15%).

African men occupied the largest chunk (30%) of skilled technical and academically qualified positions, and African men and women made up most of the semi-skilled and unskilled employees. Participants spoke of a struggle to fill top jobs with black talent and then retain that talent.

The BMF report further found that two thirds of the companies were either not broad-based BEE rated or would not disclose their rating, but those who did scored highly on the socioeconomic development and skills development sections of their scorecards. However, black ownership was “almost non-existent”.

“In terms of employment as a measure of economic inclusion and inclusive growth, EU companies appeared to make a meaningful impact on the South African economy,” the report found.

BROAD-BASED BEE CODES ‘COMPROMISE’ INVESTMENT

While acknowledging the need for economic transformation, the EU discussion paper said that, although broad-based BEE codes were not compulsory for private companies, they were “increasingly necessary to do business with government institutions and state-owned entities” across the value chain.

“It is also increasingly mandatory where a government licence is required,” the paper said. “This has compromised prospective and existing investors’ ability to continue and/or expand their operations in South Africa. It has been particularly difficult for greenfield investors, for family-owned European companies and multinationals, who are often reluctant to dilute their control of assets.”

Instead, the EU proposed that black ownership requirements be temporarily relaxed for new foreign investors and for further investments by companies already in the country. It also proposed that the weighting of the ownership pillar of the broad-based BEE codes be reduced and that a job creation pillar be introduced.

“It should be highlighted that when certain state-owned enterprises applied a requirement of the 51% black ownership in their tenders without the pre-approval from the department of trade and industry back in 2016 and 2017, a number of EU investments were put on hold or even downscaled,” the paper said.

However, Davies said investors were already assisted with points through the Youth Employment Scheme, and investors were encouraged to approach the department directly for assistance with designing a BEE programme.

“All of our investment incentives are for job creation. You create more jobs, you get more incentives. Empowerment is not just about black people working for these companies – it’s moving away from the model of having a minor shareholding in somebody else’s company to moving into supply chains,” he said.

“You come into our country, we give you incentives; we have to ask for something in return. I don’t think we are asking for inordinate things. We want a balance.”

Localisation requirements ‘hinder competitiveness’

The EU’s discussion paper said that, while government viewed local content requirements as a tool for sustainable economic growth, “local content requirements can hinder productivity and competitiveness”, and “affect the ability of public authorities to get value for money in public contracts”.

“EU companies have also been frustrated about the unlevelled playing field in certain sectors. There have been cases where European foreign investors have been complying with their local content commitments as part of their large-scale contracts with the state-owned enterprises, while other investors have managed to evade their commitments without any penalties imposed.”

Davies said: “We’re now working towards greater enforcement, and greater consequence management and demand implementation of localisation commitments.”

However, he said the localisation programme was “critical” and “leads to investment and decisions made to manufacture in our country. The criterion is not ownership, but domicile. If you are a foreign-owned company and you come and invest here, you count. We have had foreign owners who have decided to manufacture in our country when they have never manufactured here, or even outside their own country, before,” he said.

HOLDUPS

The National Regulator for Compulsory Specifications (NRCS) was criticised in the discussion paper for inhibiting existing business and new investment, particularly regarding electrotechnical products.

“The compulsory certifications, which can only be issued by the NRCS, are burdensome and costly, with limited capacity among local testing and certification agencies,” the paper said.

“These critical delays have a negative effect on importers, as well as on the local manufacturing industry that uses imported electrotechnical products,” leading to the production of “outdated products”, higher prices and production delays.

“This loss of competitiveness is already leading, according to the local industry, to loss of revenue and jobs,” the paper said.

Davies, however, said that the national regulator was working on a risk-based system. “But we have to enforce minimum standards. We must not [give the regulator] a very short time that doesn’t allow it to do the work because we cannot be invaded by substandard products.”

Gules’ trip was sponsored by the EU

Publications

Publications

Partners

Partners