The development of efficient capital markets is crucial for the advancement of Africa.

“There has never really been a story of a country growing without an efficient capital market, chief economist and head of research at the Official Monetary and Financial Institutions Forum, Danae Kyriakopoulou, told a GIBS forum.

In the same way that you have social and physical infrastructure, you really need the capital markets to connect savings and investment opportunities and enable countries to grow and access more funding,” she said at the launch of the Absa Africa Financial Markets Index.

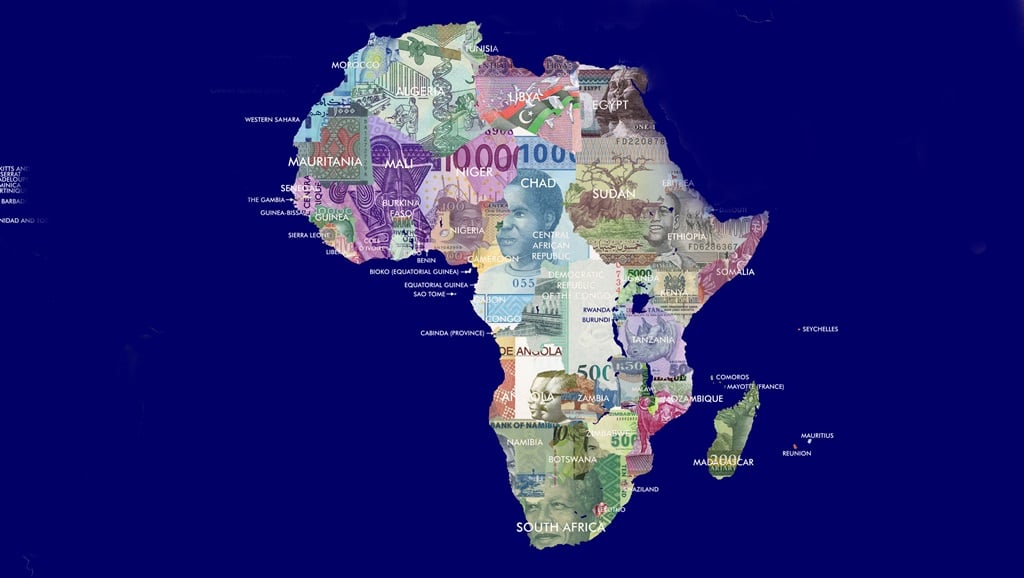

Now in its second year, the Index, which is produced by the Official Monetary and Financial Institutions Forum and Absa, records the openness to foreign investment of countries across the continent and is an indicator of the attractiveness of Africa’s capital markets.

The index tracks progress across six pillars:

• Market depth;

• Access to foreign exchange;

• Tax and regulatory environment and market transparency;

• Capacity of local investors;

• Macroeconomic opportunity; and

• Enforceability of financial contracts, collateral positions and insolvency frameworks.

The 2018 report found that capital markets in Africa have strengthened in the light of a more stable regional political and economic backdrop.

The five highest ranked financial markets of the 20 surveyed in the 2018 index were South Africa, Botswana, Kenya, Mauritius and Nigeria.

South Africa retained the top position of the countries surveyed, supported by strong financial market infrastructure and a robust legal framework.

However, the country’s macroeconomic performance deteriorated over the past year and it no longer tops the index across all six pillars as it did in 2017.

South Africa was surpassed by Kenya on access to foreign exchange and by Nigeria in market transparency, tax and regulatory environment. Nigeria was a new entrant to the top five.

Kenya, Morocco and the Seychelles improved their scores the most over the last year, particularly in terms of access to foreign exchange; while Mauritius and Namibia saw their scores deteriorate across most pillars.

This year’s report extended coverage to three additional countries – Angola, Cameroon and Senegal.

“A lot of markets have put policies in place to enhance the development of their financial markets, and there were also moves towards more open markets, flexible exchange rates and reducing capital controls. Overall, there is a willingness to open financial markets,” Kyriakopoulou explained.

The report found that the greatest area for improvement across the continent remains the capacity of local investors, as the lack of knowledge and expertise of pension fund trustees and other asset owners hinders the development of new financial products.

Head of markets for Africa excluding South Africa at Absa, George Asante, said local investor participation was an important backstop for financial markets in the case of foreign investor outflows.

However, “this pillar was where most countries had a very low ranking and presents an opportunity for what Africa can do to boost local participation in its markets”.

The pillar of macroeconomic opportunity refers to the quality of growth that different markets go through, as well as the transparency around the growth numbers Asante explained.

While South Africa still offers best practice on macroeconomic data publication and data release, both Egypt and Morocco had vastly improved the quality of data they supply to investors in the past year.

Macroeconomic opportunity and the enforceability of financial contracts are crucial for international investors who consider Africa as a real business opportunity, Asante added.

“Data is so tough and so complicated to get in Africa, it makes the Index extremely useful and relevant,” Manager of FIG advisory services for MEA & Africa at the International Finance Corporation, Riadh Naouar, said.

“Africa has many challenges, and is facing local currency volatility, increasing interest rates and economic growth uncertainty, but the solution will remain our capacity to develop local markets to fund our economies,” he added.

Head of investments projects development at the Public Investment Corporation, Monique Mathys-Graaff, explained it was crucial to be able to classify and manage risk when investing in Africa as “capital can only flow when there is a point of decision. We need information that is credible to be able to act and the Index represents credible, benchmarked information.”

Candice Dott, head of market development across Africa at Thomson Reuters explained that data was crucial to capacitate and facilitate financial markets at an intra-country and regional level.

Head of markets for Absa Group Limited, Garth Klintworth, said that while many international investors want to allocate money to the continent, “it is wrong that Africa should pay such a risk premium on raising money, and it has a devastating effect on what can be spent to build infrastructure. We had to find a way to be a catalyst to change the capital markets and let countries know what they should work on to reduce the risk premium so they could raise more money at a far cheaper price.”

Mathys-Graaff said the Index presented a “massive opportunity to join the dots to see where the gaps and bottlenecks are in order to best allocate capital to unlock the regional opportunities.”

A lot of work remains to develop an integrated, strategic approach to facilitate regional integration, Naouar said, and the Index would enable the sharing of learnings as well as positive competition among countries and regions.

- City Press is a media partner for the Gibs forums.

Publications

Publications

Partners

Partners