Newly minted Finance Minister Tito Mboweni is expected to unveil his first medium-term budget policy statement, which will show a worse than expected budget deficit due to the local recession.

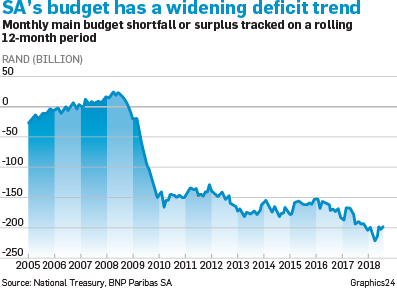

In February, the government was expected to reduce its budget deficit from 4.3% of GDP to 3.8% of GDP.

However, BNP Paribas South Africa economist Jeffrey Schultz wrote in a note that he expected the state’s budget deficit by the end of March 2019 to be adjusted to 4.2% of GDP when Mboweni issues his maiden mini budget statement, which outlines forecasts for the economy and government finances, this Wednesday afternoon.

Annabel Bishop, Investec’s chief economist, also expects the government’s budget deficit to increase due to above-budget government employee wage increases and tax revenue shortfalls.

The wider government budget deficit was likely to be funded by an increase in National Treasury bonds by the amount of R2 billion a month until the end of March 2019 or the government would draw down on its cash balances of about R260 billion to finance the wider-than-expected deficit, Bank of America Merrill Lynch published in a note.

Mboweni, who only took office on October 9, is expected to have had very little say on the contents this mini budget, but he is set to bring his own style to the delivery of it in Parliament.

He will be presenting the budget at a time when unemployment is at a 14-year high of 27.7%.

He is the fifth different finance minister in under three years after Nhlanhla Nene’s resignation was confirmed by President Cyril Ramaphosa earlier this month after Nene admitted that he had lied about meeting the Guptas, the scandal-plagued family close to former president Jacob Zuma.

Mboweni held a fairly substantial amount of political clout, given his election at eleventh position on the ANC’s national executive committee at the party’s conference in December 2017, Momentum Investments economists Herman van Papendorp and Sanisha Packirisamy said.

He would have his work cut out to reprioritise R50 billion in expenditure on infrastructure while maintaining fiscal discipline close to what the February budget speech forecast, Schultz said.

The finance minister was likely to rejig local and provincial government spending to achieve the R50 billion in reprioritisation.

“Done credibly, this should buy the sovereign some rating reprieve until at least the first quarter of 2019,” said Schultz.

In the first five months of the fiscal year, tax collections had shown some resilience, he added.

Overall tax revenue for the five months is up by 11.2% to R503 billion, boosted by a 20% hike in value-added tax collections to R132 billion for the five months, due to the increase in the VAT rate from 14% to 15% from April 1.

If the SA Revenue Service (Sars) continued to grow its revenue collection by 11.2% then it could achieve a total tax revenue of R1.353 trillion for the fiscal year ending March 2019, which would beat the target by R8 billion, and would be the first time in years that Sars would exceed the tax target set in the prior budget speech.

A change of Sars leadership in the first quarter of 2019 would have the effect of clawing back some of the tax collection efficiency losses experienced in recent years, Schultz said.

“One of the most concerning parts of the year to date revenue performance, however, is the corporate income tax collections … These are up a lacklustre 2.8% year on year, and highlight ongoing profitability pressures,” Schultz said.

For the first five months of the tax year, corporate income tax collection is at almost R77 billion.

In his speech, Mboweni may address some of the more controversial posts he made on Twitter, like his calls for a state bank, his backing for 40% government ownership of mines and the creation of a sovereign wealth fund.

Capital markets and financial services researcher Intellidex said hopefully Mboweni would provide a response to the August recommendations of the VAT zero-rating committee.

The Momentum Investments economists said that, given the government’s commitment to attracting $100 billion in new investments over five years, this would appear to rule out the possibility of an increase in company income tax to preserve the country’s investment attractiveness.

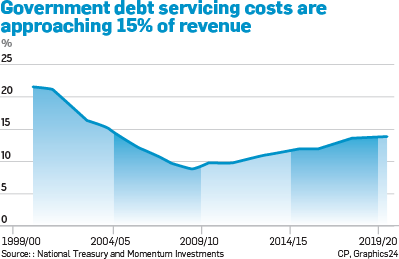

The country’s debt servicing costs are the highest growing expenditure item in the budget.

“As a share of revenue, debt servicing costs are approaching 15%, which is a key level monitored by the rating agencies ... Although there has been an overhaul in the leadership of key state-owned enterprises, the financial position of a number of parastatals remains precarious,” the economists added.

The likes of SAA, Denel, SA Post Office, SABC, Eskom and SA Express are looking for bailouts.

“While Treasury anticipates that the ratio of South Africa’s net debt to GDP will increase to 52% by the 2020/2021 fiscal year, the additions of provisions and contingent liabilities (including guarantees) take the ratio of overall debt to GDP higher to 73% by the 2020/2021 fiscal year, which is significantly higher than the 60% limit often quoted as a threshold above which fiscal sustainability is threatened,” explained the economists at Momentum Investments.

Bank of America Merrill Lynch put the government’s contingency liabilities at R765 billion.

Moody’s Investors Service this week said it would downgrade the South African government credit rating to “junk” status if the state failed to stabilise its debt and lift economic growth, and there is an increase in the chance that state-owned enterprise contingent liabilities could become the government’s problem.

TALK TO US

What do you think should be the priority in this year’s medium-term budget? What would you like to see done above all else?

SMS us on 35697 using the keyword BUDGET and tell us what you think. Please include your name and province. By participating you agree to receive occasional marketing material

Publications

Publications

Partners

Partners