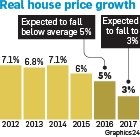

The growth in property prices is expected to be below the average 5% annual real house price growth this year – and could be even lower in 2017 as depressed economic conditions, including inflation and interest rates, are on the rise, property experts have said.

This comes after credit ratings agency Fitch, in its fourth annual Global Housing and Mortgage Outlook, warned that house prices in real terms were likely to decline by about 3% next year, driven by interest rate hikes.

The outlook released this week includes forecasts for house prices, arrears and mortgage lending for 22 countries, and compares trends between countries.

The agency said interest rates, which are expected to rise when the Monetary Policy Committee meets next week, would lead to “instalments on a typical mortgage loan increasing by 5% to 10% by the end of 2016”.

Cape Town-based estate agents say they have seen more interest from foreign buyers, which has peaked since the run on the weakening rand began last year.

Absa property analyst Jacques du Toit agreed with Fitch’s outlook and said growth could be 5% or lower this year, given that the inflation rate for December climbed to 5.2% compared with 4.8% in November.

“The impact ... will be evident in the property market in terms of depressed and subdued demand and supply conditions that will be reflected in low price growth this year,” said Du Toit, adding he believed it would be a buyers’ market “because price growth will be low and sellers will find it difficult to get the prices they are asking”.

“Sellers will most probably see a sizable difference between asking prices and the eventual prices they get.

“Obviously, buyers will have to be careful in terms of overcommitting themselves to relatively high levels of debt, especially against the background of high interest rates.”

Despite many households being overindebted, they were financially “sound”, said Du Toit – in particular those that had repaid their debt on a net basis.

“Financially sound people have the capacity to take up further debt and buy property and take out mortgage loans, but they will focus to a large extent on what they can really afford.

“Most consumers will not extend themselves beyond the point of what they can afford because of higher interests rates and having to avoid defaulting on their debt repayments,” said Du Toit.

House price inflation that is lower than consumer price inflation translates into a real decline for house prices.

FNB property analyst John Loos said there was nothing that could be done to boost the economy and raise house price growth.

“There are signs the markets are experiencing slow activity and the economy is still weak and deteriorating,” he said.

“We do not have a real boost left for the economy. We cannot cut interest rates and government has run up its debt-to-GDP ratio significantly in trying to stimulate this economy since 2008.

“There is nothing left in the pipeline that can be done.”

Loos said South Africa was facing a real risk of a recession after the International Monetary Fund lowered the country’s economic growth forecast to below 1%.

“House prices have to follow the economy, and so real house price decline will occur as well. If we have a recession, it can translate to nominal house decline and actual price decline too – not just below inflation,” said Loos.

“Prices are not going to grow as fast as in previous years. This will make prospective homebuyers more comfortable because the prices are not moving to such an extent that properties will be out of reach in a short period of time.

“It should become a buyers’ market. The real house market decline should [make house prices] theoretically more affordable over time.

“But if economic times are tough, job creation is nonexistent and job losses become reality, people will not be able to afford property despite real house prices having dropped,” said Loos.

He added that foreign interest in local property would increase, as rand depreciation meant foreigners with dollars, pounds and euros found it cheaper to buy in South Africa.

Cape Town-based estate agents said foreign interest in local properties had peaked since December, when the currency began its recent rapid decline.

Pam Golding Atlantic Seaboard area manager Basil Moraitis said: “There has been a whole wave of foreign buyers showing interest recently, but very few are committing.

“They are looking, but no concrete deals have been done because they are hesitant about the rand. They are waiting for more stability and predictability in the market to see if the rand will stabilise.

“At the moment, it is too volatile and it puts people off buying. They want more certainty on how the rand will be.”

Publications

Publications

Partners

Partners