Overblown fake invoices and moving millions of rands through SA in a shoebox are just some of the ways

Money stolen from Small and Medium Enterprises (SME) Bank Namibia, via South Africa, until 2017 is only a part of the cash moving through a “money laundering machine” – moving up to R500 million a month in Johannesburg, claim the SME Bank’s liquidators.

A new legal application was launched in a Namibian court last week, with an affidavit by liquidator Ian McLaren containing precise details of cash deliveries around South Africa’s commercial capital.

The alleged mastermind behind the defrauding of SME, shareholder Enock Kamushinda, insisted on getting his money at The Maslow hotel in Sandton and sometimes deposited cash at bank branches at Bedfordview mall.

This is according to new testimony by the man delivering the cash, Johannesburg businessman George Markides.

Markides testified at a commission of inquiry into the theft at SME Bank, which held its most recent session in January.

The transcript is attached to the new court application.

According to Markides, he received the cash from a Springs-based company called Asset Movement and Financial Services (AMFS) – which, in turn, came from Kamushinda.

Kamushinda’s allegedly stolen money from Namibia would, in effect, be delivered as cash to him in Johannesburg.

AMFS was “nothing but a vehicle used ... to steal and distribute the SME money,” said McLaren in his affidavit.

The liquidators initially froze R80 million in AMFS’s bank account, but have subsequently settled with this company to repatriate R30 million back to Namibia.

The company’s manager at the time of the alleged money laundering was Kalandra Viljoen. She has since emigrated and the company has been sold.

Asked at the inquiry why AMFS needed a middleman to give Kamushinda money when AMFS could just directly deliver the money, Markides said that Kamushinda “likes to deal with one person; he is funny like that”.

City Press attempted to contact Kamushinda via his South African lawyer, without success.

SME Bank’s liquidators are constantly discovering more missing money.

By now, they are chasing almost R500 million, of which R247 million moved through South Africa.

At least R69 million disappeared to Dubai, while yet more disappeared elsewhere.

Kamushinda’s lawyer is Victor Nkhwashu, who also represented Brian Shivambu, younger brother of EFF deputy president Floyd Shivambu, after both Shivambus were recently implicated in the forensic report titled The Great Bank Heist, probing the looting of the now defunct VBS Mutual Bank.

HOW TO LAUNDER MONEY ON THE SLY

Markides’ testimony provides fascinating insight into how money laundering works in Johannesburg, from malls to high-end Sandton hotels.

Markides claims that Kamushinda insisted on meeting in a specific room at The Maslow hotel’s conference centre at least 10 times to collect physical cash.

It would be transported “in a bag or something nondescript, something that doesn’t look like cash”, Markides testified.

“You can’t walk around Joburg with cash,” he added.

The kinds of packets used were Checkers shopping bags or cardboard ones – “something that is not flimsy, but one mustn’t be able to see through it”.

“It would always be big amounts. It was millions; it was R2 million here, you know,” said Markides.

He said R1 million in R200 notes fits more or less in a shoe box.

Sometimes money was taken to bank branches to make deposits.

Cash deposits into bank accounts were usually done at Bedford Centre, Markides said. These would be smaller amounts.

“You can’t really walk into a bank and deposit big amounts. It is very difficult.”

In addition, Markides sometimes sent his employees to deliver the cash and also made electronic transfers for Kamushinda.

Kamushinda and his colleagues also came to Markides’ office in Bedfordview, said Markides.

He said that he did not have a cash-in-transit company but was paid a 0.5% commission for delivering cash.

The inquiry commission has asked Markides to provide bank, phone and email records, but this has become near impossible: he testified that his own records were all lost in a burglary late last year.

“I think it was orchestrated by Mr Kamushinda,” Markides said.

He also told the liquidators that he last met Kamushinda at Eastgate Shopping Centre in January, on the eve of his testimony at the inquiry. At the meeting, Kamushinda told him not to testify.

“This is Enock’s nonsense, not mine. He must deal with it,” said Markides.

“I am just a normal oke here ... I’ve received all this money of Enock and I’ve given it to him ... Maybe you want me to pay the money; I’ve got none.”

THE SCHEME

The scheme to rob SME Bank implicates Kamushinda as well as the bank’s former CEO, Tawanda Mumvuma, and most of SME’s finance department.

They all fled Namibia for their native Zimbabwe in February 2017, when SME was placed under curatorship.

They left some trivial personal effects at the office. These included, ironically, a book called Money Laundering Affects Us All – a guide produced by South Africa’s Financial Intelligence Centre (FIC).

The FIC is investigating the apparent money-laundering operation in South Africa.

The alleged fraud in Namibia involved creating overblown fake invoices for IT services and “investments” with Mamepe Capital, a company owned by Mauwane Kotane, who is a close friend and benefactor of VBS CEO Andile Ramavhunga.

Seemingly fake VBS statements were provided to SME Bank to show that the money was safe in a VBS account.

In addition to this fake VBS account, statements were also used to pretend that the money was safe.

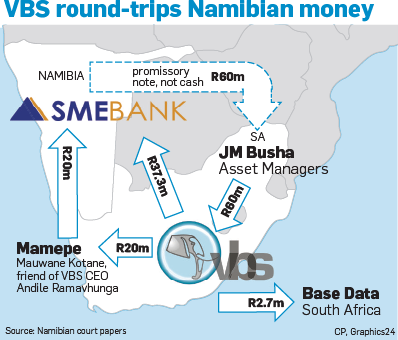

The new affidavit also sets out the involvement of VBS in the suspicious round-tripping of money between Namibia and South Africa (see graphic).

SME Bank issued a R60 million promissory note to a South African asset manager called JM Busha. This is a promise to pay at some later date.

JM Busha then paid R60 million into a VBS bank account. From there, VBS later paid R37 million back to SME.

Another R20 million was paid by VBS to Kotane, the VBS CEO’s friend. Kotane then paid it to SME.

The remaining R3 million mostly went to a mysterious company called Base Data.

This whole process apparently left SME owing JM Busha R60 million, while a real R60 million was round-tripped from Namibia to South Africa and back to Namibia, for no apparent reason.

Publications

Publications

Partners

Partners