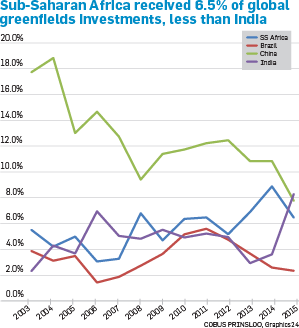

Sub-Saharan Africa received only 6.5% of all greenfields foreign direct investment in 2015, writes Dewald van Rensburg

The UN Commission on Trade and Development (Unctad) released its annual World Investment Report last week.

The global tally of all measurable foreign direct investment (FDI) once again shows that sub-Saharan Africa received less than 3% of all FDI, making it easily the most marginal region in the global economy.

FDI is defined as relatively lasting flows of money between countries that result in ownership of more than 10% in a company or asset. It can be roughly divided into mergers and greenfield projects.

From a developing world perspective, the flow of greenfields money has been relatively strong. But merger activity is concentrated in the developed world.

According to the report, sub-Saharan Africa received 6.5% of all greenfields inflows – but this has declined from 2014.

GOOD NEWS

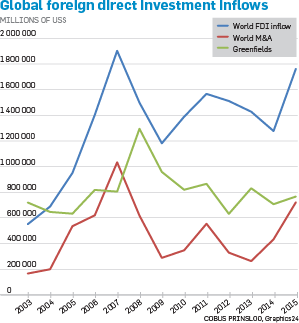

Global foreign direct investment (FDI) soared by 38% last year to reach a near record of $1.76 trillion (R258.51 trillion)

BAD NEWS

Much of it consisted of unproductive mergers and acquisitions like ‘tax inversions’ and other corporate restructurings – which move money across borders but have very little effect on the real world.

Most of that also involved flows between countries in the developed world

WORSE NEWS

Global FDI is expected to fall back by between 10% and 15% in 2016 as this wave of restructurings passes

WORST NEWS

While mergers and acquisitions soared, cross-border investments in bricks-and-mortar assets grew at a less breathtaking pace. So-called greenfields investments – the FDI that results only in changes in ownership – rose 8.5% to $765 billion; still only a little more than half of the peak of $1.3 trillion in 2008.

Actual capital expenditure by the world’s 5 000 largest multinational corporations, which includes investments in their home countries, actually dropped for the third year in a row to $1.9 trillion

The continent’s FDI inflows were roughly equal to that of India, but less than that of either Brazil or China.

The end of the so-called commodities supercycle has led to cutbacks in mining investment all over the world. These had been particularly important to Africa.

But not all investment is equal. Much of the FDI measured across the globe last year was of the kind that was less useful.

“In this context, a concern is the apparent pullback in productive investment by multinational enterprises,” says Unctad.

Theoretically, mergers and acquisitions (M&As) do have productive effects because new owners bring with them both technologies and international best practice, which increase productivity.

“Although FDI through cross-border M&As can boost productive investments, a number of deals concluded in 2015 can be attributed to corporate reconfiguration,” says Unctad in its report.

This is “particularly pronounced” in the US and Europe.

Tax inversions are when large conglomerates essentially buy themselves so they can relocate their head offices to friendlier jurisdictions.

“Tax has even become a driving force of M&A transactions per se, as witnessed by inversion deals in which US multinational enterprises redomicile through a transaction with a foreign company, making the foreign company the new parent entity,” Unctad says.

The structure of multinational corporations in the global economy is getting more complicated, the report says.

It is becoming increasingly difficult to assign a “nationality” to corporations – or even to discern which ones are local as opposed to foreign.

This matters because many of the world’s trade and investment rules are based on nationality.

“Investment policies ‘triggered’ by nationality and ownership are ubiquitous,” says the report.

About 80% of countries have one or more investment rules that bans foreign companies from owning 50% of a company in some or other sector. This is like the rule South Africa wanted to introduce for the private security sector.

And international trade deals usually have arbitration clauses that give companies from signatory countries the right to take other signatory countries to international arbitration if they act contrary to the deals.

The largest arbitration forum of this kind is the International Centre for the Settlement of Investment Disputes (Icsid), which is affiliated to the World Bank.

According to Unctad, a third of all the companies that lodge Icsid disputes do so in terms of investment treaties to which their home countries are not even party.

These disputes can be important. South Africa had to settle one with a group of Italian investors a few years ago to avoid having the country’s empowerment charter for the mining industry declared a contravention of a bilateral investment treaty.

Publications

Publications

Partners

Partners