Disputing finance minister’s 2020 forecast, SA economists offer their reality check, predicting the percentage will be much lower

The 0.9% economic growth that Finance Minister Tito Mboweni is expecting for South Africa this year may well be hopelessly optimistic.

So say a number of economists who were polled about Mboweni’s forecast, announced in his budget speech on February 26.

The growth estimate seems particularly unlikely when one considers that the economy grew by a meagre 0.2% last year, say the economists.

In addition to this dismal growth percentage, which was announced by Stats SA on Tuesday, its figures also showed that GDP shrank by 1.4% in the fourth quarter of last year.

It was the second consecutive quarter of negative economic growth, which means that the country is in a technical recession.

ECONOMISTS’ GROWTH PREDICTIONS FOR 2020:

- Mike Schüssler, economists.co.za: -0.3%

- Emile du Plessis, Finometrica: -0.1%

- Abri du Plessis, Gryphon: 0%

- Jeff Schultz, BNP Paribas: 0.5%

- Lara Hodes, Investec: 0.5%

- Matlhodi Matsei, FNB: 0.6%

- Jannie Rossouw, Wits University: 0.5%

- Richard Downing, Econodow: 0.5%

- Johan Rossouw, Vunani Capital: 1%

- Dawie Klopper, PSG Wealth: 1.1%

- Christo Luüs, Ecoquant: 1.1%

GROWTH EXPECTATIONS FOR 2020 BY FINANCIAL INSTITUTIONS:

International Monetary Fund: 0.8%

World Bank: 0.9%

Treasury: 0.9%

SA Reserve Bank: 1.2%

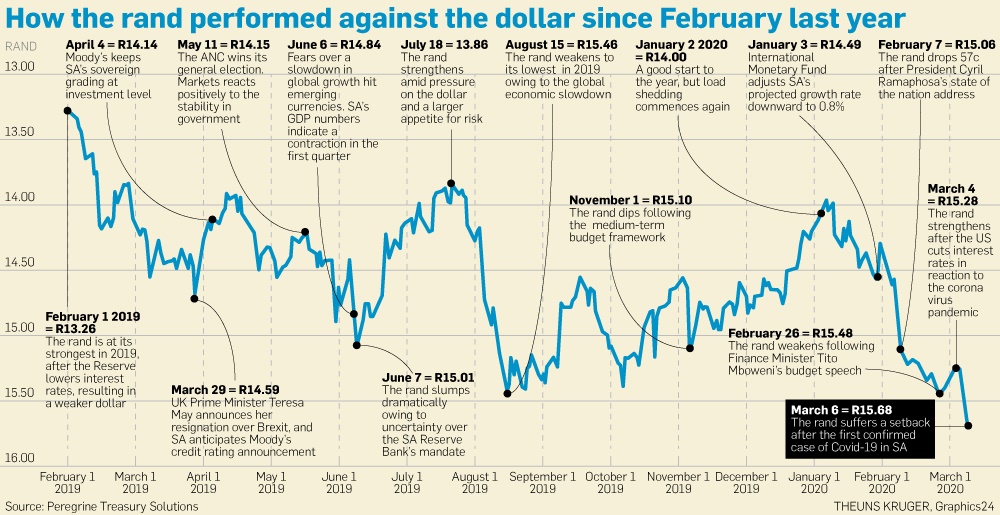

Bianca Botes of Peregrine Treasury Solutions said the negative growth was far worse than the market had expected, and showed the extent of the damage that the shortage of electricity was doing to the economy.

Stage 6 load shedding hit the country for the first time in December.

Lara Hodes, an economist at Investec, attributed the grim figures to a combination of global and domestic factors, including electricity shortages and policy uncertainty – both of which were suppressing business and consumer confidence.

Raymond Parsons, a professor at North-West University’s School of Business and Governance, said the figures projected for this year – as well as for next year and 2022 – would have to be adjusted downwards.

As things stand, National Treasury expects 1.3% growth next year and 1.6% growth in 2022.

Parsons said the expectation was that South Africa’s average growth rate for the next three years would be below 1% – the lowest of all the economies in sub-Saharan Africa.

Asked to predict what the country’s 2020 growth rate would be, participants in the Economist of the Year competition – jointly run by Media24’s five Afrikaans dailies, namely Netwerk24, Beeld, Die Burger, Rapport and Volksblad – put the figure at 0.57%.

This prediction was made before Mboweni’s budget speech.

Maarten Ackerman, chief economist at Citadel, was doubtful that South Africa would reach a growth rate of 0.9% this year.

The first quarter of this year is already looking bleak, with continued load shedding on the cards and a considerable decline in China’s economic activity as a result of Covid-19.

Ackerman said this indicated that recessionary conditions could continue for at least part of the year, given that China was one of South Africa’s biggest trading partners, and that its purchasing managers index had fallen to its lowest level since 2004.

Peter Baur, an economics lecture at the University of Johannesburg, said the poor growth was bad news, especially because the population was growing at about 1.4% a year, much faster than the economy.

This meant that South Africans were getting poorer.

He said that, if the economy were to grow as a result of higher productivity, this would counter unemployment.

However, he added, South Africa did not have the growth that could advance job creation.

Low growth means that not enough people are absorbed by the labour market.

The 0.2% growth last year is also much lower than predictions of between 1.7% and 2.1% that were made by financial institutions such as the International Monetary Fund, the World Bank, the SA Reserve Bank and Treasury just 18 months ago.

Business Day newspaper recently reported that economic growth projections had repeatedly been incorrect over the past five years and had frequently been revised downwards.

Professor Jannie Rossouw, head of the School of Economic and Business Sciences at Wits University, said the GDP figures were not exact and would be adjusted as more figures and data became available, and as circumstances changed.

Stats SA is set to adjust the weighting that certain sectors contribute to the calculation used to determine the GDP in September.

Rossouw said this was in keeping with international practices aimed at reflecting changes in the economy.

New industries are included and older industries are excluded.

An example would be the way in which the value of cellphones in the economy has changed over the past decade.

Parsons said the risk of lower growth this year could also negatively affect other budget estimates, such as debt as a percentage of GDP and tax revenue.

Referring to ratings agency Moody’s Investors Service’s decision on South Africa’s sovereign debt rating, which is expected later this month, Parsons said the agency would probably focus less on the weak historical GDP figure and more on its confidence in government instituting structural reforms soon to put the country back on the right track.

“The challenge for South Africa is to break free of its low-growth trap without landing up in a debt trap,” said Parsons.

TALK TO US

Do you agree with the economists’ predictions for 2020?

SMS us on 35697 using the keyword GROWTH and tell us what you think. Please include your name and province. SMSes cost R1.50. By participating, you agree to receive occasional marketing material

| ||||||||||||||||||||||||||

Get in touchCity Press | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Rise above the clutter | Choose your news | City Press in your inbox | ||||||||||||||||||||||||||

| City Press is an agenda-setting South African news brand that publishes across platforms. Its flagship print edition is distributed on a Sunday. |

Publications

Publications

Partners

Partners