New Finance Minister Tito Mboweni has his work cut out to clear a big to-do list, starting with delivering the key medium-term budget policy statement later this month.

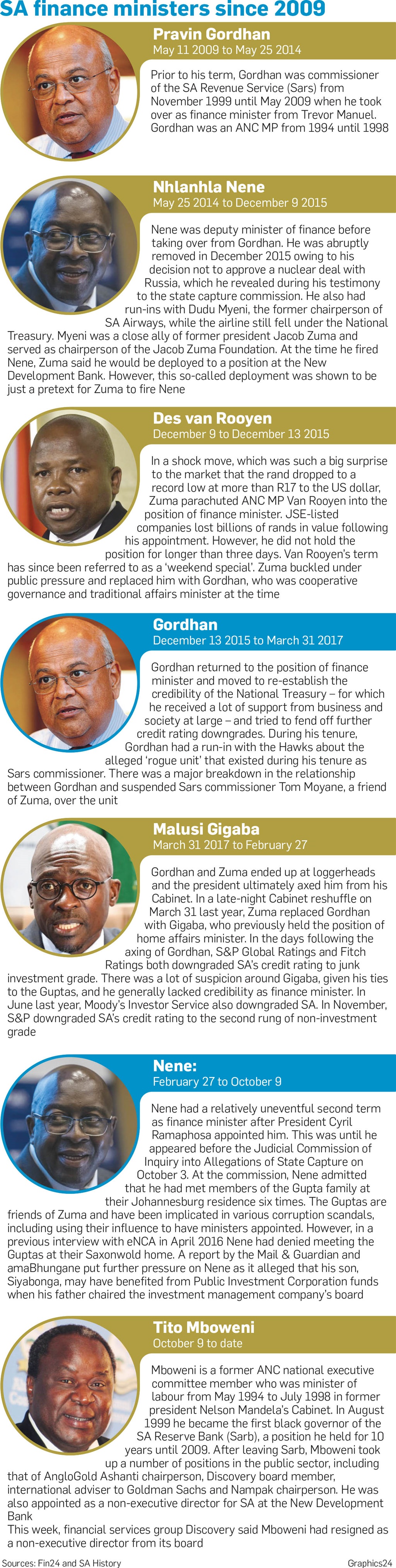

Mboweni was sworn in as head of Treasury this week when Nhlanhla Nene’s resignation was confirmed by President Cyril Ramaphosa. Nene admitted he lied about meeting the Guptas, the scandal-plagued family close to former president Jacob Zuma.

On October 24 Mboweni will present the budget statement, which outlines the future of the economy and government finances.

Mboweni will have to get to grips with the complex issues related to the budget and deliver the statement in an effective and credible way.

BNP Paribas economist Jeffrey Schultz said as part of the budget Mboweni would have to reallocate R50 billion worth of expenditure in line with Ramaphosa’s stimulus package. This relocation of resources will not be an easy task, he said.

Mboweni is likely to unveil reduced growth forecasts for this year and next year, he said.

In February Treasury forecast this year’s growth at 1.5%. However, more economists are now forecasting growth for this year of between 0.5% and 1%. It forecast next year’s growth at 1.8% but this could be too optimistic.

Dykes expressed concern about a Twitter post by Mboweni in April when he said he backed a 40% government ownership of mines and the creation of a sovereign wealth fund.

London-based Capital Economics said it did not expect Mboweni to bring “a big shift in fiscal policy”.

But the National Union of Metalworkers of South Africa (Numsa) said it was disappointed by the decision to appoint Mboweni as finance minister.

“As Numsa we celebrated when Tito Mboweni’s term as Reserve Bank governor came to an end. This is because Mboweni is hostile to the working-class majority. During his tenure as governor, he bent over backwards to champion the neoliberal macroeconomic policies of the governing party,” the union said.

The rand gained more than 50c to the dollar this week, partly because of Mboweni’s appointment.

A key issue that Mboweni will have to attend to will be to try to get the economy out of recession and aid job creation.

It will be vital for Mboweni to find a way to ignite economic growth and get the economy to start creating jobs.

It will also be important for him to ensure South Africa regains an investment-grade rating across the board.

Moody’s Investor Service is the only major rating agency that has South Africa on an investment-grade rating, prior to issuing its latest review on Friday. But S&P Global Ratings and Fitch Ratings have South Africa at “junk” status.

Schultz said the high turnover of finance ministers was “extremely unsettling”.

It was critical for Mboweni to ensure Treasury did not lose more key and skilled staff members.

Another key task will be for Mboweni to re-establish the credibility of the Public Investment Corporation (PIC), which has been involved in alleged dubious deals.

The PIC manages R2 trillion in funds on behalf of state clients. Mboweni will have to conclude the job his predecessor started in establishing an inquiry into the PIC’s affairs.

And he will also have to play a key role in resurrecting the SA Revenue Service. Under suspended commissioner Tom Moyane, Sars’ ability to collect tax and its overall credibility and public trust were wrecked.

State-owned enterprises, especially Eskom and SA Airways, have proved to be a huge drain on the fiscus for many years. Mboweni needs to stop the rot.

The cost of the mooted National Health Insurance has yet to be properly budgeted. Mboweni needs to confirm how it will be funded and at what cost.

Mboweni's to-do list

(1) Get the economy out of recession so that it grows and creates jobs.

For the first half of this year the economy has been in recession, which means that the for two quarters in a row the economy has contracted and jobs continue to be lost. It will be key for Mboweni to find a way to ignite economic growth and get the economy to start creating jobs.

(2) South Africa needs to regain an investment grade rating across the board.

Moody’s Investor Service is the only major international rating agency that has South Africa on an investment grade rating prior to issuing its latest review on Friday. Moody’s has South Africa on the last rung of investment grade status. However, S&P Global Ratings and Fitch Ratings both have South African at ‘junk’ status.

(3) Re-establish the credibility of the Public Investment Corporation (PIC)

The reputation of the PIC, which manages R2 trillion in funds on behalf of government clients, has taken a battering of late especially regarding a number of allegedly dubious deals.

Mboweni needs to finish the job that his predecessor Nhlanhla Nene started in establishing an inquiry into the affairs of the PIC.

(4) Re-establish the National Treasury’s credibility.

With five different finance ministers tenures in under three years, the credibility of the National Treasury has taken a battering. Mboweni will has this work cut out to re-establish the credibility of the institution.

(5) Deliver a credible ‘Mini Budget’.

On October 24, Mboweni will have to present the Medium Term Budget Policy Statement (MTBPS), which outlines the outlook for the economy and the government finances. MTBPS mainly outlines the government’s budgeting plan over the next three years. Mboweni will have to rapidly get himself with all the complex issues related to the MTBPS and deliver the statement in an effective and credible way.

(6) Fix the South African Revenue Service (Sars)

Under suspended Sars Commissioner Tom Moyane, Sars’ ability to collect tax and its overall credibility and public trust was wrecked. Over Moyane’s tenure, SARS missed its revenue targets by close to R100 billion. Mboweni needs to play a key part in resurrecting Sars.

(7) Helping fix State Owned Enterprises (SOEs)

SOEs, especially Eskom and SAA, for many years have proved to be a huge drain on the fiscus. Mboweni needs to stop the rot on this front.

(8)NHI properly costed

The cost of the mooted National Health Insurance has yet to be properly budgeted. Mboweni needs to ensure the costly and how it is funded its properly studied.

Publications

Publications

Partners

Partners