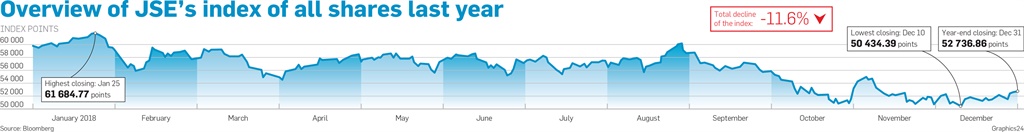

Last year saw the most extreme drop in the value of the JSE since the global economic crisis in 2008 with the all share index losing 11% of its value.

To a large extent, this was caused by Naspers, the single largest company in the index, which lost 20% of its value between August and November – exactly the period the JSE lost ground.

The loss of value was not exclusive to South Africa as many major stock indices around the world had their worst year since the 2008 crisis.

The real economy probably grew by a “rather dismal” 0.9% last year, according to Johann Els, chief economist of the Old Mutual Group.

This year should be better with growth of 2%, he said in a forecast note in December.

If Eskom can keep the lights on, that is.

It would not be surprising if the rand recovered to R12 to the dollar from the exchange rate of R14 – especially if President Cyril Ramaphosa feels emboldened to introduce economic reforms after winning the elections this year.

Falling oil prices have delivered lower regulated fuel prices in the new year, which already reduces inflation.

Independent economic research company Capital Economics has a similar view – it thinks economic growth in South Africa was probably only 0.5% last year, but will be 1.5% this year.

On the other hand, Capital Economics also expects the JSE to continue plummeting. It forecasts that the all share index will fall to 44 950 points by the end of this year – another 12% drop.

Two years of plummeting JSE share prices spell disaster for anyone cashing in funds for retirement as pension and provident funds hold on average 55% of their money in shares.

For the US, it’s tempting to assume that, as things stand, so goes the year. But history shows that using the year’s first day of stock trading as a premise for an annual view of the market is baseless.

Down 1.6% just after trading opened, the S&P 500 Index was briefly threatening its worst start since 2001 before the decline was erased.

Since 1928, gains or losses in any year’s inaugural session have matched the annual direction of US stocks only about half of the time, data compiled by Bloomberg show.

Last year marked stocks’ first appreciable annual decline since 2008 as economic data from China added to concerns about a global economic slowdown.

The S&P 500 fell to the brink of a bear market last month amid lingering US-China trade tension and continued monetary tightening by the US Federal Reserve.

Robert Pavlik, the chief investment strategist at SlateStone Wealth, said: “It sets the tone for the feeling for the market, but, as an investor, you have to be prepared to change and try not to extrapolate. It can change on a dime.”

The inclination to see the first few trading sessions of the year as a harbinger may trace to 2008, when stocks tumbled 1.4%, 2.5% and 1.8% on the first, third and fifth days of the year, respectively.

The S&P 500 went on to fall 38% in the proceeding 12 months, the worst annual retreat since 1937.

But one year does not a strategy make. The S&P 500 greeted 1932 and 2001 with a plunge of 6.9% and 2.8%, respectively, and extended declines for the following 12 months.

However, the next biggest drops, ranging from 1.6% to 2% in 1949, 1980 and 1983, all came at the start of up years.

– Additional reporting by Bloomberg

Publications

Publications

Partners

Partners