Wednesday’s budget speech will be one of the most critical since the advent of democracy in 1994.

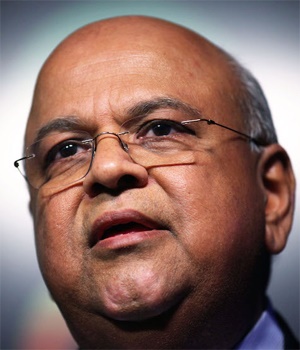

Finance Minister Pravin Gordhan will present his spending plan, expected to be R1.45 trillion, for 2016 just over two months after President Jacob Zuma fired Nhlanhla Nene, which shocked the country and investors, and replaced him with little-known ANC MP David “Des” van Rooyen.

The move knocked the rand to an all-time low and JSE stocks lost tens of billions of rands in value. Days later, in an effort to restore confidence, President Zuma reappointed Gordhan to the job.

As Gordhan steps up to the podium, for his first budget since 2014, and says “Madam Speaker” in Parliament, he will know that he needs to address a number of tough challenges.

These include international ratings agencies breathing down his neck with the possibility of a downgrade to junk status, an economy on the brink of recession, declining tax revenues, high unemployment, rising interest rates, falling commodity prices, a devastating drought and looming municipal polls.

To balance the government books, Gordhan is expected to limit or cut expenditure and hike tax rates.

Nedbank economists Nicky Weimar, Dennis Dykes and Isaac Matshego said this week: “Gordhan has the unenviable task of producing a budget in exceedingly tough economic times that will convincingly illustrate government’s determination to restore fiscal discipline to avoid a further downgrade of South Africa’s sovereign risk rating to speculative status, and restore public and investor trust in National Treasury after the confidence-sapping events of December last year.”

Peter Montalto, a London-based economist for Nomura, said: “We expect a mixture of tax increases and expenditure cuts to offset higher spending on education and debt service costs, as well as the marked impact of lower growth on revenues.”

The country got its first investment grade rating from Moody’s Investors Service in May 1995. Now, almost 21 years later, that status is at risk.

A credit rating is used by sovereign wealth funds, pension funds and other investors to gauge a country’s credit worthiness, and is key to determining interest rates.

A cut to junk would hike local interest rates, weaken the rand and result in billions of rands in foreign money exiting the country.

To try to avert a downgrade, local business, especially the banks, which will be among the hardest hit by such an event, have met with President Zuma and Gordhan a number of times in recent months to stress the importance of creditworthiness and to propose plans to avoid junk status.

“High up on our agenda is to prevent a sovereign downgrade,” President Zuma said in Parliament this week during a debate on his state of the nation address, according to Bloomberg.

Montalto said he expected Moody’s could slash the country’s rating to sub-investment grade by the end of June and Standard & Poor’s may cut South Africa to junk by the end of this year.

Last year, Nene hiked the income tax rate for the first time in 20 years, and Gordhan is likely to increase it again this week.

“Personal tax rates are likely to increase, while the rates applying to indirect taxes will probably be raised even more aggressively than in past years,” said Nedbank economists.

Johann Els, Old Mutual Investment Group economist, said the options available to Gordhan included hiking VAT, which would bring in more than R20 billion.

However, Eugene du Plessis, head of tax at Grant Thornton, said: “Gordhan is unlikely to meddle with the VAT rate in this local government election year. According to the Davis Tax Committee, research

shows that the effect of increased VAT is far greater on the poor.”

On the other hand, Els said that increasing a number of other tax rates – including hiking the top marginal rate, capital gains tax, dividend tax, fuel levy tax, estate duty and excise taxes – would raise R25.3 billion.

On the issue of expenditure, Nedbank said that Gordhan would have to reflect considerable constraint in spending to convince ratings agencies that the government was serious about restoring fiscal discipline.

Nomura’s Montalto said that there was unlikely to be “major set-piece” expenditure cuts, with a large number of smaller cuts and unspecified cuts pushed down to line ministries and provinces more likely.

“Failure to show measures which will actually boost economic growth and markedly curtail current government expenditure [particularly spend on civil servant remuneration] will likely prove insufficient to avoid a downgrade ... over the next three years,” wrote Investec Bank economist Annabel Bishop.

Old Mutual’s Els said that Gordhan would need to accommodate extra expenditure like the R6.8 billion university funding and an estimated R5 billion of drought relief within their existing spending ceiling.

The International Monetary Fund, the World Bank and the SA Reserve Bank have all slashed their forecasts for local growth this year to less than 1%.

In October last year, Nene projected growth of 1.7% for this year.

Gordhan is also expected to reduce the government’s growth forecast.

Publications

Publications

Partners

Partners