The Competition Commission’s Health Market Inquiry report, released earlier in the week, paints a bleak picture of how corporates in that sector are writing their own profit cheques and mostly their own rules, too.

The inquiry, chaired by retired Judge Sandile Ngcobo, released the long-awaited report in Sandton and handed it to Economic Development Minister Ebrahim Patel and Deputy Health Minister Joe Phaahla.

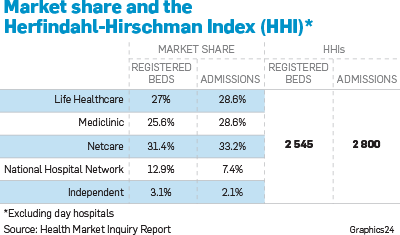

The report, the cost of which exceeded R200 million in April when the panel requested more money, found that the three major hospital groups, Netcare, Mediclinic and Life Healthcare together controlled almost 90% of the market, based on beds and admissions in 2016.

The level of concentration in the facilities market, the report said, made it more vulnerable to collusion and the three groups had, collectively and individually, managed to produce consistent significant profit year on year.

Ngcobo said the three groups made it difficult for newcomers to survive and dictated year-on-year price and cost increases for healthcare funders who passed the cost on to members.

“The hospital groups make it very hard for newcomers and fringe-players to grow and to compete on merit.

“The three groups are able to distort and prevent competition by binding the best medical specialists to their hospitals with lucrative inducement programmes, with associated exclusionary effects on innovative newcomers,” Ngcobo said.

There were few, if any, designated service providers which did not include at least two of the big three hospital groups as they dominated such providers’ arrangements relative to other hospitals,he said.

According to the report, the three facilitate and benefit from excessive use of healthcare services, without the need to contain costs, and they continue to invest in new capacity beyond justifiable clinical need without being disciplined by competitive forces.

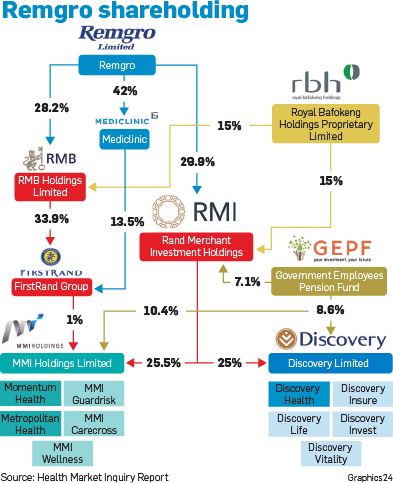

The report found that Discovery Health, with Medscheme and Metropolitan, accounted for about 80% of the administrator market and had earned “high profits over a prolonged period, without the realistic threat of competitive challenges and entry”.

The three, the report states, potentially have the ability to control prices and member volume, as well as maximise fee charges to schemes and beneficiaries.

Medical scheme market

The medical scheme market has almost halved between 2000, when 163 schemes operated, and 2017 when the number of schemes was 81.

In the open scheme market, Discovery Health had its market share grow from 35% in 2005 to 56% in 2017; the next-largest scheme in the same category was Bonitas which increased its share from 10% to 15% in the same period. The other 19 open schemes each had less than 6% market share.

Though the restricted schemes market almost mirrors the open scheme market, it comprises more schemes.

“In 2017 the Government Employees Medical Scheme (Gems) had a market share of 46% with the SA Police Service Medical Scheme being the next-largest restricted scheme with 13%.

The remaining 58 schemes each had a market share below 6%.

“For the most part, restricted schemes do not compete for members and will experience growth only if the employer group or industry in which they operate grows.”

Among its recommendations, the report highlighted that the commission should review its approach towards creeping mergers to reduce the high levels of concentration and establish a dedicated supply-specific healthcare regulatory authority, which would regulate suppliers of services, including facilities and practitioners, a side of the sector, Ngcobo said, that was largely unregulated. It should also set up a tariff “bargaining council-type” forum which would serve as a multilateral negotiating forum for all practitioners to set maximum tariffs and prices.

Regulation

“We recommend that regulation of the supply-side of the market is essential and ideally administered through a new regulatory authority that we have called a supply-side regulator for health. We have considered with great care the establishment of this regulator and have made a proposal where the net number of regulators will not change.

“We further consider it to be a positive contribution to the private and public sector. The UK National Health Service has shown that even a mature single public purchaser system requires regulatory oversight of suppliers by an industry-specific regulator.

“Moreover, those suppliers are, and need to be, subject to competition laws and to enforcement action by competition authorities,” Ngcobo said.

The report recommended that the Health Professions Council of SA also needed to change its rules and make it mandatory that curriculums for all health practitioners at both undergraduate and postgraduate level include training to ensure that graduates were aware of the cost implications oftheir decisions.

Ngcobo said: “We have identified features that alone or in combination, prevent, restrict or distort competition.

“The market is characterised by highly concentrated funders and facilities markets, disempowered and uninformed consumers, a general absence of value-based purchasing, practitioners, who are subject to little regulation, and failures of accountability at many levels.”

What do you make of the private healthcare sector in the country? Should it be more regulated?

SMS us on 35697 using the keyword HEALTH and tell us what you think. Include your name and province. SMSes cost R1.50. By participating, you agree to receive occasional marketing material

|

| ||||||||||||

| |||||||||||||

Publications

Publications

Partners

Partners