Analysts welcome conservative budget, but warn it’s short on detail and outlook remains negative

South Africa’s credit rating remains at risk of ultimately being downgraded to junk status despite the measures announced by Finance Minister Pravin Gordhan this week in his budget speech.

A key concern expressed by analysts was that the budget contained no new announcements about boosting stagnant growth, and the actual details of the state’s restraint in spending were questioned too.

Peter Attard Montalto, a London-based Nomura economist, said Gordhan’s fiscal stance was “highly convervative, as expected, but still very disappointing”.

“There were no microeconomic structural reforms announced or evidence of a shift in growth policy ...

“The market has taken this negatively,” he added.

On Wednesday, after Gordhan delivered his spending plan, the rand weakened by as much as 45c against the dollar.

“We still see, after this budget, South Africa on the path to sub-investment grade in the coming 18 months,” Montalto said.

However, Gordhan told news agency Bloomberg that he delivered a credible budget to avoid a credit rating downgrade to junk and that financial markets probably overreacted by expecting more austere measures.

On a positive note, Standard & Poor’s (S&P) this week allayed fears that South Africa’s credit rating was on the brink of being downgraded to junk.

The financial services company said that, based solely on the developments described in the budget, no rating actions were warranted.

Kristin Lindow, a Moody’s Investors Service spokesperson, raised concern that the specific revenue measures that would accomplish the smaller deficits predicted for 2017/18 and 2018/19 have not yet been identified.

Konrad Reuss, S&P managing director for Africa, said despite “bold revenue targets” set in the budget speech, South Africa’s economic outlook remained negative.

Speaking at the Bloomberg Africa Business and Economic Summit in Cape Town this week, Reuss said: “The budget had fairly bold revenue targets. But what will be done to bring growth back into the South African market?

“Despite the conservative budget, the outlook remains negative for South Africa.”

Gordhan’s budget contained bad news for struggling South Africans.

Slow growth, which is forecast at below 1% this year, means South Africans are, on average, getting poorer.

“South Africa’s gross domestic product (GDP) growth has now fallen behind the rate of population increase, resulting in declining per capita incomes,” National Treasury said in its 2016 Budget Review.

Gordhan told reporters there had been a “radical shift” in the government’s key spending plan – in particular, the state’s budget deficit was forecast to decline.

He announced that the budget deficit was forecast to drop to 2.4% by the 2019 fiscal year, down from 3.9% in the 2016 fiscal year.

However, S&P said South Africa’s fiscal discipline remained vulnerable to lower-than-expected GDP growth and shortfalls in revenues.

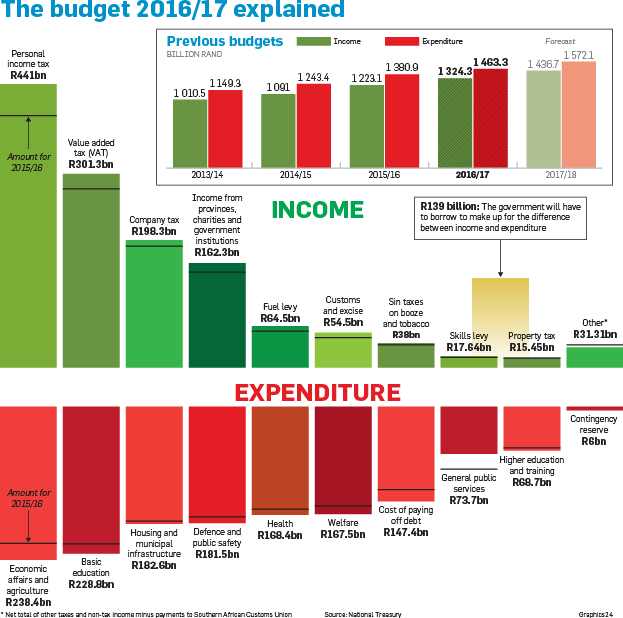

The reduction in the budget deficit is forecast to take place by hiking tax revenue at a faster pace over the next three years than the growth in government expenditure.

Over the next three years, government revenue is forecast to rise by 28.5% to R1.572 billion by February 2019, while state expenditure is expected to climb by 22.7% to R1.695 billion by February 2019.

The government would raise an extra R48 billion in taxes over the coming three years by increasing the rate of tax on a number of fronts, Gordhan announced.

He said the tax hikes chosen for this budget were aimed at avoiding the situation where growth was dampened.

Annabel Bishop, an economist with Investec Bank, agreed with Gordhan’s strategy, saying the finance minister had delivered a “sound outcome”.

At the same time, government would cut its expenditure ceiling over the next three years by R25 billion, mainly by curtailing personnel spending, Gordhan added.

Effective from April 1 2016, appointments for noncritical vacant posts would be blocked on government’s payroll system, pending the submission of revised human resources plans, said National Treasury.

As a result, the cost of general public services is set to drop by 24.4% in the 2016 fiscal year to R73.7 billion.

Gordhan said the government would not be imposing “austerity on our people”.

“There will not be any cuts in social grants, and no cuts in hospital services,” he added.

Extra spending had been accommodated through “stringent cost-containment measures” across all departments, Gordhan said.

On the expenditure front, the fastest-growing item will be debt-service costs, which will rise by 38.3% – or an average of 11.4% a year – to R178.6 million by the 2019 fiscal year.

This comes as state debt this year is forecast to rise beyond R2 trillion.

“Debt-service costs … consume 12c of every rand of state revenue,” National Treasury said.

Finance Minister Pravin Gordhan this week in his Budget Speech.

A key concern expressed by analysts was that the budget contained no new announcements about boosting stagnant growth and the actual details of the state restrain were questioned too.

Peter Montalto, a London-based Nomura economist, said that Gordhan’s fiscal stance was ‘highly convervative as expected but still very disappointing’.

“There were no microeconomic structural reforms announced or evidence of a shift in growth policy... The market has taken this negatively,” he added.

On Tuesday, after Gordhan delivered his spending plan the rand weakened by as much as 45 cents against the US dollar.

“We still see after this budget SA on the path to sub-investment grade in the coming 18 months,” Montalto said.

However, Finance Minister Pravin Gordhan told Bloomberg that he delivered a credible budget to avoid a credit-rating downgrade to junk and financial markets probably overreacted by expecting more austere measures.

On a positive note, Standard & Poor’s (S&P) this week allayed fears that South Africa’s credit rating was on the brink of being downgraded to junk.

In a statement, S&P said that based solely on the developments described in the budget that no rating actions were warranted.

Kristin Lindow, a Moody’s Investors Service’s spokesperson, said raised concern that the

specific revenue measures that would accomplish the smaller deficits predicted for 2017/18 and 2018/19 have not yet been identified.

Konrad Reuss, S&P managing director for Africa, said despite “bold revenue targets” set in the Budget Speech South Africa’s economic outlook remained negative.

Reuss speaking at the Bloomberg Africa Business and Economic Summit in Cape Town this week said: “(The) budget had fairly bold revenue targets. But what will be done to bring growth back into the South African market? Despite conservative budget, the outlook remains negative for South Africa.”

The Budget Speech this week had bad news for struggling South Africans.

Slow growth, which is forecast at below 1 percent this year, means South Africans are, on average, getting poorer.

“South Africa’s gross domestic product growth has now fallen behind the rate of population increase, resulting in declining per capita incomes. In other words, the average South African is becoming poorer,” the National Treasury said in its 2016 Budget Review.

Gordhan told reporters that there had been a ‘radical shift’ in the government’s key spending plan, in particular the state’s budget deficit was forecast to decline.

He announced that the budget deficit was forecast to drop to 2.4 percent by the 2019 fiscal year down from 3.9 percent in the 2016 fiscal year.

However, S&P said in a statement that South Africa’s fiscal discipline remains vulnerable to lower-than-expected GDP growth and shortfalls in revenues.

The reduction in the budget deficit is forecast to take place by hiking tax revenue at a faster pace over the next three years than the growth in government expenditure.

Over the next three years, government revenue is forecast to rise by 28.5 percent to R1.572 billion by February 2019 while state expenditure is expected to climb by 22.7 percent to R1.695 billion by February 2019.

The government will raise an extra R48 billion in taxes over the coming three years by increasing the rate of tax on a number of fronts, Gordhan announced.

Gordhan said the tax hikes chosen were aimed at avoiding the situation where growth was dampened.

Annabel Bishop, an economist with Investec Bank, agreed and said that Gordhan had delivered a ‘sound outcome’.

At the same time, the government would cut its expenditure ceiling over the next three years by R25 billion mainly by curtailing personnel spending, Gordhan he added.

Effective April 1, 2016, appointments for non-critical vacant posts will be blocked on government’s payroll system, pending the submission of revised human resources plans, the National Treasury said.

As a result, the cost of general public services is set to drop by 24.4 percent in the 2016 fiscal year to R73.7 billion.

Gordhan said that the government would not be imposing ‘austerity on our people”. “There won’t be any cuts in social grants and no cut in hospital services,” he added.

Extra spending had been accommodated through ‘stringent cost containment measures’ across all departments, Gordhan added.

On the expenditure front, the fastest growing item will be debt-service costs, which will rise by 38.3 percent or an average of 11.4 percent a year, to R178.6 million by the 2019 fiscal year.

This comes as state debt this year is forecast to rise beyond R2 trillion. “Debt-service costs….consume 12 cents of every rand of state revenue,” the National Treasury said.

Publications

Publications

Partners

Partners