New report traces how public funds have been wasted and urges fiscal consolidation

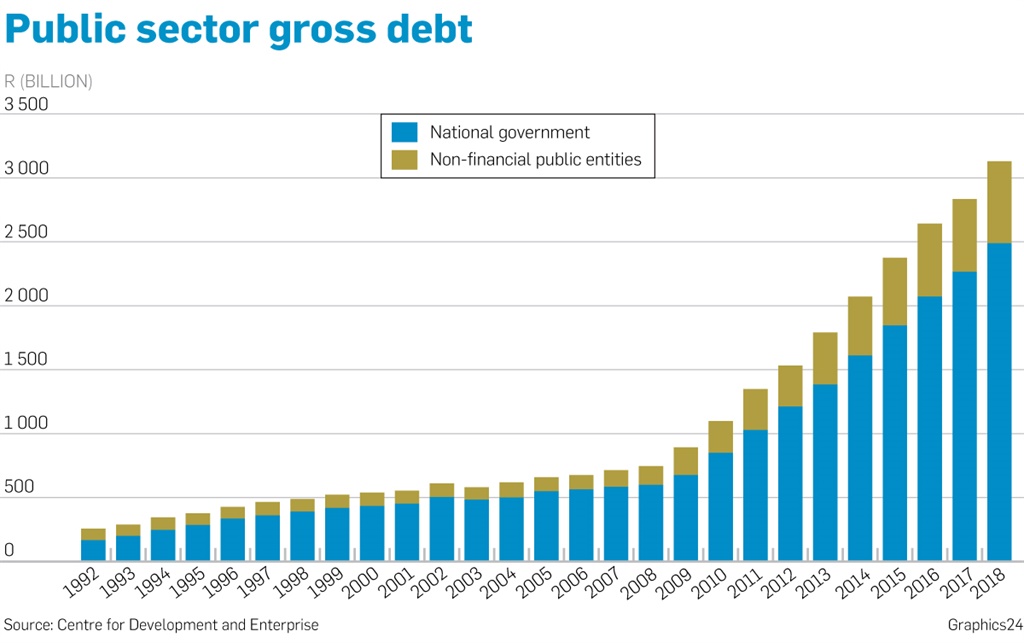

South Africa’s staggering public debt, amounting to almost R3.1 trillion, may not push the country over the fiscal cliff just yet, but there is no doubt that it has led to a slow bleeding of the economy.

This week, independent policy lobby group the Centre for Development and Enterprise (CDE) released a report, titled Running out of Road: South Africa’s public finances and what is to be done.

It paints a devastating picture of the country’s debt explosion, coupled with its anaemic growth, that has built up over the past decade.

Ann Bernstein, the CDE’s executive director, writes in the report that the country’s mounting debt – which equates to R1 billion a day from 2015 to 2022 – has resulted in repayments being the fastest-rising cost in government’s budget.

“This year’s budget estimated that between 2015/16 and 2021/22, government and the major state-owned companies would borrow almost R2.2 trillion – or R1 billion a day, every day, for seven years.

“Our debt repayment costs are roughly the size of our spend on health and twice the expenditure on higher education,” she writes.

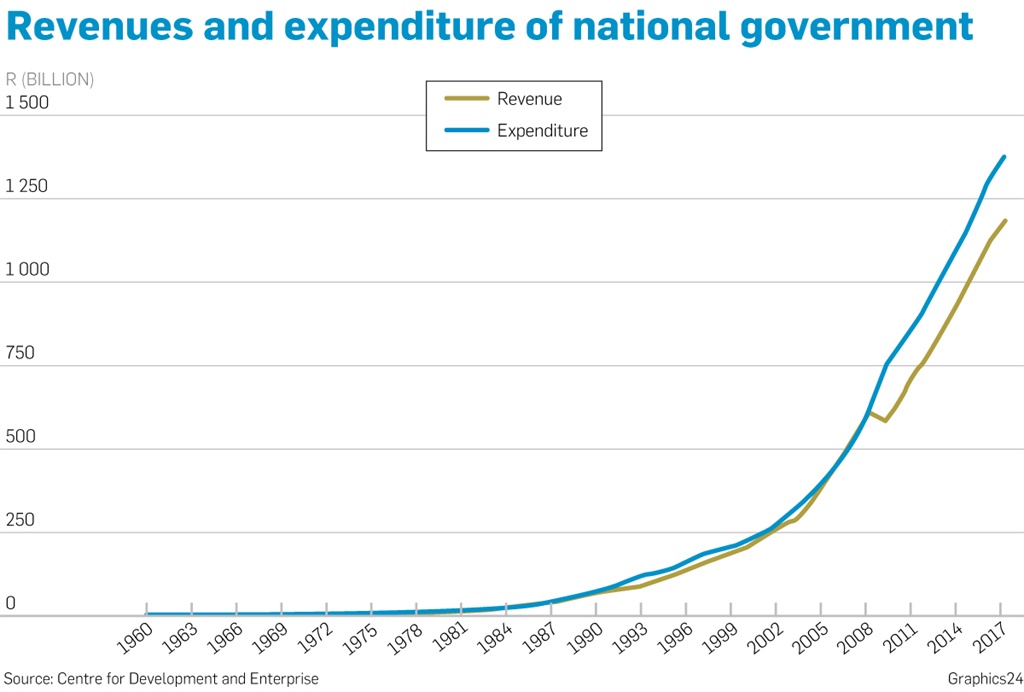

Government, she says, which overestimated growth over the past few years, had budgeted based on unrealistic revenue and is now paying the price.

“Government consistently overestimated growth, and this has led to unrealistic spending plans.

“Spending plans have been woefully slow to adjust to slower growth. The result is large, persistent deficits, leading to vast borrowings.”

Bernstein adds that government and state-owned enterprises (SOEs) have an outstanding debt of more than R3 trillion – almost four times higher than it was in 2008 and 15 times higher than in 1992.

“As a percentage of GDP, debt now exceeds 60% – as high as it was at the end of apartheid. The CDE’s analysis shows that the main reason for the debt explosion is that in the aftermath of the global financial crisis in 2008, a large gap opened up between government spending and its revenues, and that gap has not closed in the intervening years.”

Bernstein goes on to say that most of the loans taken up were not put to good use, such as into income-generating programmes.

“Much of the money has been wasted because the infrastructure it was intended to fund will never produce the revenue needed to repay the loan. We have spent hundreds of millions of rands on power stations that do not produce power and scores of billions on trains that never arrive – the Passenger Rail Agency of SA, in spite of spending billions on modernisation, is transporting 60% fewer people than it did a decade ago.

“South Africa’s current approach is pointing towards an explosive debt path. Government actions thus far are not halting this very worrying trajectory,” she writes.

Some of the parastatals, Bernstein says, must be allowed to fail because they are not competitive.

“Individual markets should be liberalised to increase competition and the private sector allowed to play a larger role in providing efficient, affordable services. State expenditure must be cut.

“Over the past decade, public sector wage increases have grown by an average of nearly 11% per year. This trajectory must change.”

The report recommends that institutions critical to growth and good governance, such as SOEs, must be rebuilt and that a growth-focused policy reform be formulated to rid the economy of overregulation.

“The economy is overregulated and until this failing is addressed, growth will always disappoint,” it reads.

“The key reforms we need include a different attitude to business and to the role of competitive markets from government, addressing the skills constraint and providing reliable and affordable energy, and labour market and regulatory reforms.”

The report also recommends that fiscal consolidation, which requires the imposition of either higher taxes or lower spending, should be weighted to expenditure reductions rather than tax increases.

Speaking to City Press earlier this week on the sidelines of the launch of the report, Bernstein said that public servants should not be paid more than those in the private sector, reiterating how, over the past decade, the state’s wage bill had ballooned.

“The public service should not pay more than the private sector. What happened over the past decade is that the increases have resulted in the cost of civil servants being more expensive than the equivalent in the private sector – and that is clearly not proper,” she said.

Bernstein suggested that, in order to manage the private sector and regulate markets effectively so that public money was not wasted, the state needed competent people who were able to negotiate good value-for-money contracts – something that is currently not happening.

“It is about how we get much better services for less money. This requires thinking hard about professionalising the public service and keeping the right people,” said Bernstein.

“The bottom line is that unless the country deals with its fiscal crisis, growth will not accelerate.

“But the opposite is also true: unless we get growth going, the country will not get on top of its fiscal crisis.”

TALK TO US

What do think about allowing state-owned enterprises that cannot be fixed to fail? Do you think that will save the country from sinking further into debt?

SMS us on 35697 using the keyword DEBT and tell us what you think. Please include your name and province. SMSes cost R1.50. By participating, you agree to receive occasional marketing material

Publications

Publications

Partners

Partners