Will interests rates go down? This depends on the balance of risks facing the inflation outlook.

The monetary policy committee of the South African Reserve Bank commences its bi-monthly meeting on Tuesday to deliberate a suitable monetary policy stance that will see inflation anchored towards the middle of the inflation target range of 3% to 6%. This committee’s decision is expected to be announced on Thursday.

In March, the improved inflation outlook and moderation in risks to the forecast gave policymakers room for a more accommodative monetary policy stance, allowing the central bank to cut the repo rate by 25 basis points to 6.5%, bringing the prime lending rate to 10%. While inflation continues to move to lower levels, another reduction in interest rates depends on the balance of risks facing the inflation outlook.

Three graphs shed light on the key economic trends to drive this month’s decision:

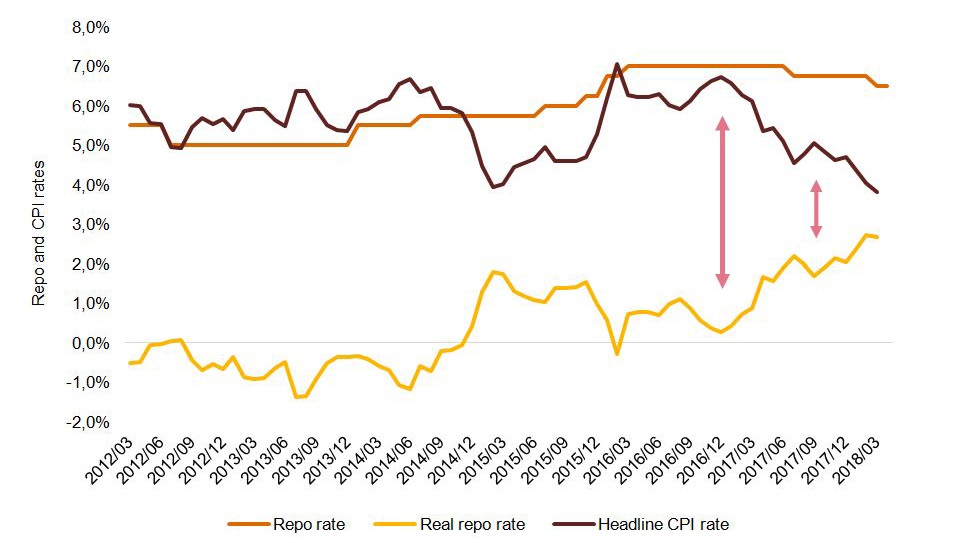

1. Rising real interest rates bring good news for South African savers

The annual headline inflation rate fell to 3.8% in March 2018, which was 0.2 percentage points lower than the corresponding annual rate of 4.0% in February 2018. This result reflects a multi-year low last seen in February 2011

A by-product of the moderation in inflation is the resultant increase in real interest rates. This is good news for South African savers who can expect greater real returns on their domestic investments. However, it also means that South Africans are paying more in real terms to service their ongoing debt commitments. In view of South Africans’ low savings rates, higher real interest rates may encourage savings and foster their long-term financial wellness. Since December 2016, real interest rates increased 8-fold from 0.3% to 2.7% in March this year.

What does it mean for the Reserve Bank’s monetary policy stance? While a number of outcomes are possible, higher real interest rates can curb current consumption as more consumers shift funds into savings, as well as feel the pinch of having to dedicate more resources, in real terms, towards debt repayment. This will likely keep the economy safe from overheating.

Indeed, while the 2018 domestic growth outlook is more favourable, it remains challenging. Following an annual growth rate of 1.3% in 2017, the Reserve Bank said in March it expects growth figures of 1.7%, 1.5% and 2.0% for 2018, 2019 and 2020, respectively. The improved growth outlook is driven primarily by an increase in business and consumer confidence, which may boost fixed capital investment over the forecast period.

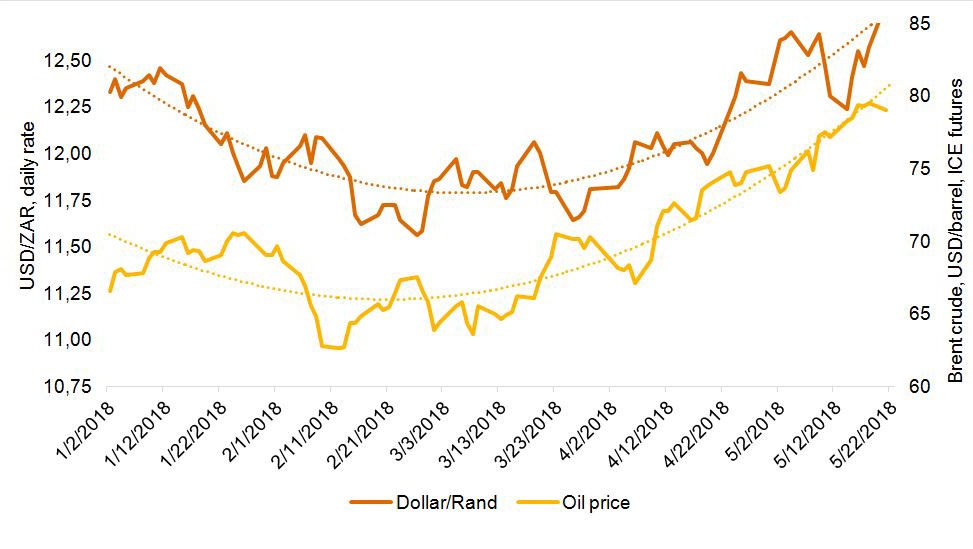

2. International turmoil drives rand performance and oil prices peak at highest levels since 2014

Local political and policy developments that bolstered the rand since the beginning of the year are likely by now to be priced into the value of the rand. Increasingly, investor risk appetites for emerging market assets – in the midst of rising global trade tensions – emerge as the dominant drivers of the rand’s performance.

Since mid-March, the rand has softened somewhat, sliding 7.8% against the greenback, mainly triggered by concerns of an imminent trade war between the US and China and a possible acceleration in the pace of US monetary policy tightening. Global geopolitical tensions and tightening in global liquidity present a key risk to the rand and inflation outlook.

Oil prices present another key risk to the inflation outlook, feeding through to consumer prices in the form of petrol price increases and food price inflation. On 17 May, Brent Crude oil prices broke through the ceiling of $80 a barrel for the first time since 2014. A combination of political events and oil producers’ production cut agreements are likely to continue to fuel oil prices, until US shale oil production ramps up again.

South Africans have seen numerous petrol price hikes in recent weeks, which may continue unless the rand appreciates notably to counteract the impact of higher import prices. Recent predictions by the Automobile Association see the price of petrol potentially escalating to R15.46/litre by June this year.

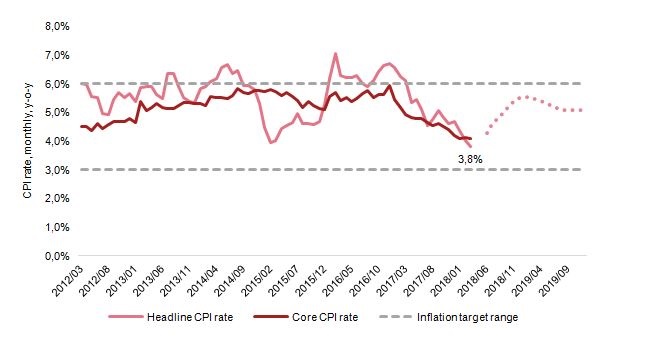

3. Inflation comfortably inside the target range, but likely to pick up in coming months

While the most recent inflation reading is the 12th in a row coming in below the 6% upper target level, inflation is likely to have reached a turning point. In March, Reserve Bank governor Lesetja Kganyago noted headline inflation would likely pick up, potentially peaking towards the upper bound of the target range at 5.5% by the start of 2019. While this remains within the central bank’s target range, the monetary policy committee may not see much room to lower interest rates further in May.

The South African Reserve Bank noted in March that it expects the one percentage point increase in the value-added tax (VAT) rate to add about 0.6 percentage points to the headline inflation trajectory over the next year, with small second-round effects persisting thereafter.

The increase in the VAT rate, rising fuel prices, higher global oil prices and a recent depreciation in the currency will likely reflect in higher inflation readings in coming months. This may limit the monetary policy committee’s scope for additional interest rate cuts in May, with a Reuters survey of economists unanimously predicting no change in interest rates at this month’s meeting.

• Maura Feddersen is an economist at PwC

Publications

Publications

Partners

Partners