The Government Employees Pension Fund (GEPF) is investigating ways of getting the R1 billion loan it made to Independent Media and related entities repaid.

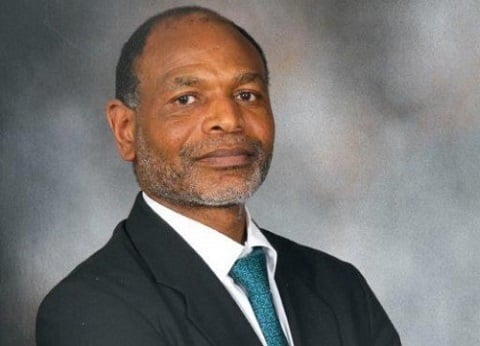

GEPF principal executive officer Abel Sithole said this comes after the multi-platform content company defaulted on a payment that was due in August.

The GEPF is South Africa’s largest pension fund, with 1.2 million active members who are government employees and 450 322 pensioners and beneficiaries.

As at the end of March this year, the fund has R1.8 trillion invested on behalf of all its members, pensioners and beneficiaries.

“There are negotiations to find other ways to get repayment … We still expect payment,” Sithole said during an interview with City Press last week.

“[Independent Media] is not the only non-performing asset [in the GEPF portfolio], we have plenty of those … If an asset manager gets 60% of its decision right, then they are doing well.”

Independent Media is one of South Africa’s largest newspaper companies and publishes The Star, Pretoria News and Cape Times, among other publications.

A GEPF official said during a media conference that the term of the loan was seven years and that Independent Media had only defaulted on one portion of the pension fund’s loan.

“We are currently in negotiations to restructure that payment,” the official added.

It could prove difficult for the GEPF to get any payment for the capital or interest from the Independent Media loan because the documents that went with Sagarmatha Technologies, which failed to list on the JSE, showed that by December 2016 Independent Media had accumulated losses of R617 million. That year, the company made a loss of R534 million after losses of R97 million in 2015 and R69 million in 2014.

Read: Did the PIC break the rules?

Another factor that will make it difficult for Independent Media to repay any GEPF debt is that as at December 2016, its total liabilities – almost R2.8 billion – were greater than its nearly R2.4 billion assets.

The company is technically insolvent in that if it were to sell all its assets it would not be able to pay off all its debts.

In indication of the dire situation the company faces, the GEPF has impaired the full loan it has with the company to zero.

The pension fund impaired a total of almost R7.4 billion of its assets for this financial year, up from almost a R1 billion in impairments in the previous financial year.

Apart from that loan, GEPF also has a 25% stake in the media group. Sithole wasn’t able to say what the fund valued that stake at.

About the Public Investment Corporation (PIC) investment at Ayo Technology Solutions, Sithole said the GEPF had been following up on “some of the questions that had been asked”.

The PIC manages a significant portion of the pension fund’s assets.

“We want to get more clarity around the decision-making process,” he said.

“The broad answer is that when [the PIC] invested in Ayo at the time, the prospects for Ayo were indicative that they were very profitable. Since then there have been developments, certain business promises that they expected to be realised have not been realised and led to a revaluation of the asset,” Sithole said about the questions the GEPF was asking of the PIC regarding how the Ayo investment was valued.

Regarding the R18 billion that the pension fund lost owing to the implosion of Steinhoff, Sithole said what the fund learnt from that failure, which related to investments in general, included the requirement for rigour in the analysis of the investments one makes and the due diligence that follows.

Another key lesson was that the GEPF’s investment in Steinhoff was largely a passive one, where the pension fund followed investment trends when it bought a stake in the international retail holding company.

Sithole defended the GEPF’s passive approach to investment and tracking investment trends, saying generally the approach had “paid off handsomely”.

The GEPF is part of the class action to reclaim Steinhoff investment losses.

President Cyril Ramaphosa has set up an inquiry to probe the affairs of the PIC. Sithole said to date the pension fund had not been asked to participate in the PIC inquiry.

“We are concerned about governance issues at the PIC,” he added.

The GEPF held R87.6 billion in Eskom bonds at the end of March this year. Last month, Eskom reported its latest interim results, which showed the poor financial state the power utility was in along with a gloomy forecast.

“What we want to see is an Eskom that is sorted out in terms of its governance and management,” Sithole said.

Publications

Publications

Partners

Partners