Finance Minister Tito Mboweni is likely to be the bearer of tough economic news when he presents his maiden budget speech on Wednesday afternoon.

However, he is expected to announce no major tax increases in the key tax categories of VAT, corporate income tax or personal income tax (PIT).

“With this year’s general elections set for May 8 there is likely to be significant pressure on Treasury to find ways of reassuring the public and maintaining support for the government.

“As such, the upcoming budget speech is expected to contain more populist and political messages than major tax-change announcements,” said David French, the director of tax consulting at Mazars.

Isaac Matshego, a Nedbank economist, said he didn’t believe Mboweni would hike any major taxes and, with an expected shortfall in tax revenue, he could focus on a mix of expenditure adjustments and on limiting the increase in state debt to balance the books.

A key part of Mboweni’s speech would be to appease credit rating agencies.

RATINGS AGENCIES

“Minister Mboweni will need to talk to three specific issues in his budget speech. These are the pace of fiscal consolidation, reforms of state-owned enterprises and measures to lift economic growth.

“By effectively outlining a path forward for the fiscus, the minister will be able to satisfy credit rating agencies and steer the economy away from [a further credit rating downgrade],” PwC said.

Mboweni might cut Treasury’s forecast for this year’s growth from the 1.7% forecast in October last year.

He might have to contend with state tax revenue missing the mark by about R37 billion when compared with the last year’s budget speech target.

“A downward revision in nominal growth forecasts is anticipated, owing to a sluggish growth environment and a positive downward adjustment in the inflation trajectory,” Momentum Investments economists Sanisha Packirisamy and Herman van Papendorp said.

Standard Bank’s chief economist, Goolam Ballim, said last week that the country needed a real annual growth rate of 2.5% to stabilise public debt and deal with jobless growth.

Eskom’s latest power cuts, if they are sustained, could lower economic forecasts further in future.

Investec economist Annabel Bishop said the bank’s GDP growth forecasts this year were at risk of a downgrade from 1.7% previously to potentially between 1% and 1.5%, partly due to local power supply issues.

Ballim said that for every 5% shortfall in electricity supply GDP would be reduced by between 0.3% and 0.5%.

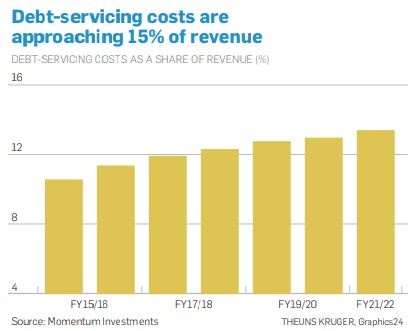

A key aspect of the budget speech was likely to be a continued rise in debt-servicing costs, Momentum Investments said.

Mboweni held two colloquiums, one in December and a second in January, to discuss ways to boost local economic growth.

Ballim said Mboweni’s “immersion in several colloquiums to better understand and discover other growth solutions signals to me a very considered, methodical and unhurried approach and, at the same time, a sufficiently hasty approach to be able to find real solutions to South Africa’s quagmire”.

BUDGET DEFICIT

PwC has forecast that the government budget deficit will widen to 4.3% by the end of March compared with the 4.0% forecast contained in the medium-term budgetary policy statement issued in October due to PwC’s projected R10 billion shortfall in revenue collections compared with the medium-term forecast.

In addition, PwC has forecast the government budget deficit will worsen and reach 4.7% by March 2020.

This compares with the 4.2% worsening in the budget deficit forecast in the medium-term budgetary policy statement.

The rising level of government debt urgently needs to come under control after state debt as a percentage of GDP had doubled in the past 10 years from 27% to 56%, Lullu Krugel, PwC economist, said last week.

“Debt accumulation should lead to better infrastructure and increase economic growth – ineffective spending needs to stop,” she said.

Kyle Mandy, a partner and head of national tax technical at PwC SA, said this year’s tax year revenue was likely to miss last year’s budget forecast of R1.345 trillion by nearly R37 billion for projected tax collections of R1.308 trillion.

In October the medium-term budgetary policy statement revised down this year’s tax year revenue target by R27 billion, largely due to the payout of delayed VAT refunds, but Mandy said he expected tax revenue to be cut by a further R10 billion.

INCOME TAX COLLECTIONS

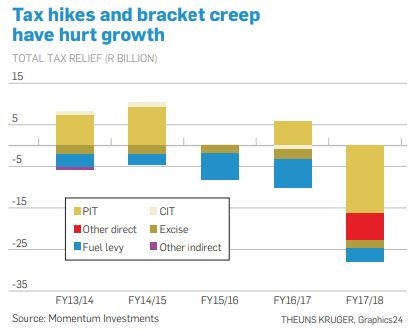

“The primary contributors to this [further R10 billion shortfall] are poor performances in corporate income tax collections, as well as a deterioration in personal income tax collections in recent months.”

Turning to the outlook for next year’s tax year, Mandy said that last year’s budget speech put tax revenue at R1.455 trillion.

In the medium-term budgetary policy statement this was cut to R1.43 trillion and PwC expects this to be cut again in Wednesday’s budget speech to R1.408 trillion.

Mandy said he expected only small tax hikes.

The tax changes he expects are adjustments in PIT to allow for fiscal drag with high-income earners to see the least benefit; medical tax credits will be increased but by less than inflation; a possible hike in the capital gains tax for individuals’ inclusion rate to 50%; a hike in estate duty and donations tax; an expansion in the last of goods that will face ad valorem duties; and a hike in securities transfer tax.

On the VAT front, Mboweni could add white bread flour, cake flour and sanitary pads to the list of zero-rated items.

“Given the increase in the VAT rate in last year’s budget, the significant public outcry over this, as well as the perceived regressivity of VAT, it is certain that there will be no change in the VAT rate,” PwC said, adding: “We don’t expect to see an introduction of higher VAT rates for luxury goods.”

The general fuel levy could increase by between 15c a litre and 20c a litre while the Road Accident Fund levy could rise by at least 30c a litre.

Mandy expects an inflationary increase in both the sugar tax and excise duties on alcohol.

Madelein Grobler, SA Institute of Chartered Accountants project director for tax, said that analysing Treasury’s monthly revenue reports until December, the sugar levy, formally known as the Sugary Beverages Levy (SBL), was bound to outperform all other tax collections with regard to growth estimations, substantially exceeding the initial R1.685 billion estimated.

“It is predicted that the SA Revenue Service will collect 90% more SBL than initially anticipated, ending up with a total of R3.2 billion,” Grobler said.

Mandy expects the implementation of the carbon tax to be postponed to January 2020 from expectations that it would be installed from June this year.

Publications

Publications

Partners

Partners