In our tough economy, development finance plays a crucial role in driving the inclusive economy. The Small Enterprise Finance Agency’s Setlakalane Molepo tells Gayle Edmunds how it is filling gaps to support entrepreneurs.

‘We need an approach that goes from the bottom up, with small, medium and micro enterprises [SMMEs] and cooperatives kick-starting this economy,” says Setlakalane Molepo, the acting CEO of the Small Enterprise Finance Agency (sefa).

An agency of the department of small business development, sefa is a wholly-owned subsidiary of the Industrial Development Corporation (IDC). It is an amalgamation of two finance agencies – Khula Enterprise Finance and SA Micro-Finance Apex Fund – and has been in its current form for the past seven years.

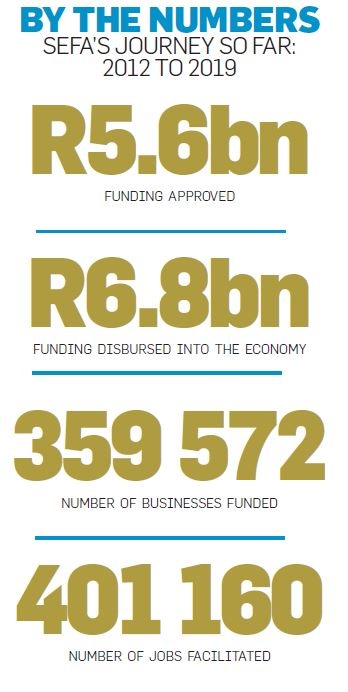

Since its inception, the agency has funded about 360 000 businesses.

Currently, South African SMMEs contribute 34% to the country’s GDP, and government aims to increase this to 50%.

Molepo doesn’t shy away from the very real challenges facing our economy, saying: “We are not seeing the growth we should. We need job absorption industries. The biggest role sefa needs to play is to be a leading catalyst for the development of sustainable SMMEs. The provision of finance is at the core of sefa’s mandate, and the by-product is job creation.”

The other important role sefa needs to address is what Molepo refers to as “market failures”, where sefa will step in as a cash flow financier when the business has no history and no chance of getting finance from a bank.

“We do detailed due diligence to see if there is merit in funding that enterprise,” says Molepo.

“We need to become catalytic in unlocking the latent potential of SMMEs through provision of finance, targeted capacity building and business support to enhance viability and growth.”

To do this, Molepo says, sefa has to develop the right bouquet of products and services to respond to the market and the entrepreneurs’ needs, as well as to ensure that the agency is always aligned to government’s macroeconomic policies.

1.Passion, passion, passion – it must be something that wakes you up in the middle of the night he says.

2.Roll up your sleeves – Molepo says far too many people try to run businesses remotely. “You have to understand the intricacies of what this business is all about.”

3.Like-minded mentors – he says you need like-minded people to help and guide you.

4.Network – no person is an island, you need to form networks around you and tap into them. This is how you get a proliferation of ideas.

“A key objective is to be transformative in the economy. To redress the SMME and cooperatives funding accentuated by the inability to accumulate savings and assets required by commercial banks. This is the riskiest part of the value chain. Most of the entrepreneurs looking for this start-up finance have no business plan and, often, no history of trading. We look at the deficiencies in their strategy and come up with interventions.”

However, Molepo is clear that once funding has been approved and disbursed, it has to be repaid.

“Government has decided that the time for solely providing grants to businesses is gone. We don’t want to create a dependency mentality.”

This doesn’t mean that grants have been eliminated from the total funding packages, but rather that sefa can offer a blended funding model where a combination of a repayable loan and a grant will be given to qualifying enterprises.

It is important for SMMEs to know that, when the loans are paid back, “there is funding available for the next person in the queue with a business opportunity”.

One of sefa’s key criteria is to build an inclusive economy, which means targeting areas such as townships and rural communities that have less access to economic opportunities, as well as funding businesses belonging to those groups that have historically struggled to enter the economy, including women, young people and people with disabilities.

As part of the Gauteng provincial government’s township economy revitalisation programme, sefa partnered with retailer Pick n Pay to help entrepreneurs access the company’s systems and business model to continue to operate township-based retail stores through a programme referred to as Pick n Pay Market Stores.

The programme gives entrepreneurs a competitive edge and ensures consumers don’t have to travel out of the township to get what they require.

Across the development finance eco-system there is a one-stop shop approach being implemented, in addition you can find the agency here:

1. Sefa has 10 regional offices

2. It has 38 core locations countrywide with other development finance institutions.

3. An app is being developed for entrepreneurs to easily access the agency’s services if they are remotely located.

4. Finfind portal - finfind.co.za

5. Sefa website - www.sefa.org.za

To date, sefa has approved funding for eight stores, with seven more set to be supported to bring the total sefa-funded stores to 15, three of which have already been launched in Katlehong, Mbekweni and Bophelong townships.

“The programme with Pick n Pay is enabled by a blended finance model. Pick n Pay contributes R550 000, and the department of small business development adds an R800 000 grant, with sefa providing the balance of the funding in repayable loans. This means that there are market stores with up to 1 300 products on the shelves for shoppers in the township,” says Molepo, adding that the programme allows local entrepreneurs to compete with their peers.

He says success in entrepreneurship needs passion and entrepreneurs who are ready to “roll up their sleeves” and do the hard work.

With these ingredients, success is assured, he says.

“People are looking for a big bang approach to success, however, it is resilience and commitment that brings it.”

- Is the business owned by a young person?

- Is the business located in a rural or township area?

- How many sustainable jobs is the business creating?

- Is the business operating in priority sectors in line with government’s macroeconomic policies?

- What is the business cycle? (Up to three years old, more than three years old; up to five years old, more than five years old.)

A new fund that sefa will launch is the Small Business Innovation Fund, which was created by the department of small business to fund businesses early in their life cycle.

- Ideation encourages those with innovative entrepreneurial ideas to come forward for funding.

- Proof of concept is where ideas are tested for viability.

- Start-up refers to commercialisation.

- Scaling up is taking the business to the next level of development.

As part of this fund, sefa and its partners will look to fund 100 000 enterprises owned by young people over three years.

Another fund that sefa will be implementing is the ESD Fund, which is supported through a partnership with the European Union to the value of R150 million.

.This article is reported by City Press and sponsored by sefa, a wholly-owned subsidiary of the IDC

Publications

Publications

Partners

Partners