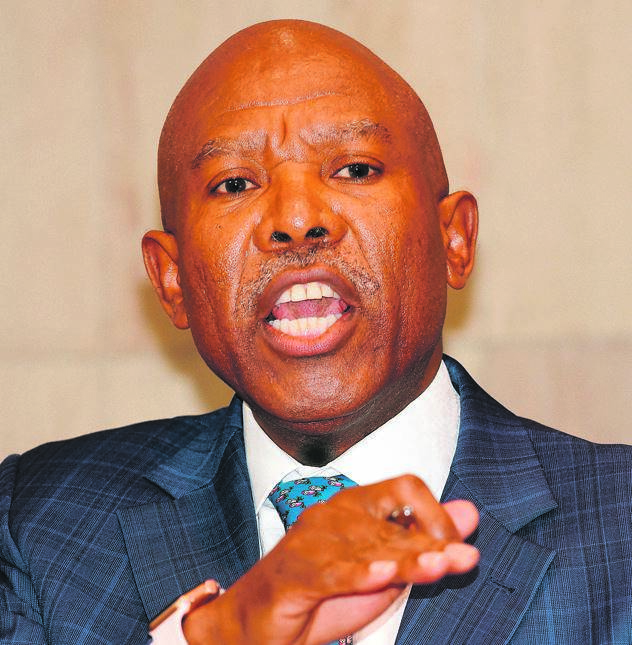

I call on President Cyril Ramaphosa to give the SA Reserve Bank governor his second term in November this year. He has earned it through hard work and honesty, writes Lumkile Mondi.

In 1996, the Government of National Unity adopted the Growth, Employment and Redistribution: A Macroeconomic Strategy for SA framework. Its focus was on fiscal consolidation, which would occur by cutting expenditure and thereby reducing the budget deficit to a targeted 3% level as a percentage of GDP.

It was during this period that Lesetja Kganyago, led by Maria Ramos, who was National Treasury director-general, and Trevor Manuel, who was finance minister, fine-tuned his skills of negotiating with domestic and international financial institutions to sell South African debt to finance the budget deficit.

Kganyago had been enticed to the Treasury after spending time at the SA Reserve Bank’s treasury, thereby joining a formidable team that would move South Africa from “junk” status to achieve an investment-grade rating from the three top ratings agencies. He played a critical role in modernising the Treasury, including the introduction of an inflation-linked bond and the outsourcing of primary dealers to the private sector, which made a market of government stock.

He also coordinated with the Eskom and Transnet treasury departments, which eventually underpinned the Bond Exchange of SA that is now part of the JSE Securities Exchange.

When Ramos completed her term at Treasury in 2005, Kganyago was promoted to the position of director-general.

As though he expected a market correction and economic crisis, Kganyago was the architect of the budget surplus. A budget surplus ensures that government is resilient during periods of financial crisis and can support its economic programmes without rushing to the markets to borrow.

In an interview I conducted with him in August last year, he shared with me that the Harvard team, led by Ricardo Hausmann, had recommended a much higher budget surplus of about 8% of GDP, which was politically impractical given the criticism that the Treasury was already facing from the governing ANC and its allies on macroeconomic management.

When the 2008 global economic and financial crisis hit, South Africa was in a far better position and could support its social programmes and soften the economic shocks that were soon to happen.

As the director-general of National Treasury, Kganyago played a critical role in macroeconomic coordination with the Reserve Bank.

This was perhaps one of the biggest policy errors in the democratic era – interest rates were reduced by the Reserve Bank’s monetary policy committee by 500 basis points between December 2008 and August 2009 in an environment of expansionary fiscal policy focusing on infrastructure investment, the 2010 Soccer World Cup and the Industrial Policy Action Plan.

South Africans know these projects were captured by rent-seeking interest groups and this has been the subject of various probes.

Kganyago was at pains in our interview to tell me about the opportunity costs of throwing away all the hard work and sacrifices through short-termism, malfeasance, corruption and state capture in the name of radical economic transformation.

In 2011, Kganyago rejoined the central bank as a deputy governor. At the time, those in power perhaps thought they had found a person they could manipulate as they were doing with many others at Transnet and Eskom.

In 2014, Kganyago was appointed as the governor of the Reserve Bank. This was a period of heightened activity related to capturing and repurposing institutions for the sole purpose of stealing.

In this role, Kganyago was expected by some to effect instructions and use his influence on banks to do favours for a select few who were politically connected. He was also expected to reduce interest rates and stimulate the economy through cheap money.

His most difficult period was in 2017 when Public Protector Busisiwe Mkhwebane faulted the Reserve Bank for not recovering R1.125 billion from Absa following a bail-out of Bankorp between 1985 and 1995, which the embattled watchdog declared unlawful. The Public Protector urged the Reserve Bank to recover the funds and recommended the central bank’s mandate be changed. Kganyago and the Reserve Bank stood their ground by relying on their constitutional mandate.

In August 2017, the Reserve Bank won its application to have Mkhwebane’s remedial action to change its constitutional mandate set aside. In February last year, the Johannesburg High Court set aside Mkhwebane’s report regarding the Bankorp bail-out.

The independent stance and articulation of the constitutional mandate by the central bank earned Kganyago the governor of the year award at the fifth annual Central Banking Awards ceremony last year.

In December 2017, the governing ANC made a decision that the Reserve Bank should be nationalised and instructed government to institute such action.

The EFF also has the nationalisation of the Reserve Bank in its sights.

The EFF’s position on the matter is that the creation of a state bank and the nationalisation of the central bank constitute an immediate task essential to the development of the South African economy, as it can be progressively positioned to improve the existence of state-owned development finance institutions to finance new industries.

However, the policy remains silent about the strategy and the operational model and structure within the central bank required in respect of either a state bank or the Reserve Bank to achieve these vague policy objectives.

However, President Cyril Ramaphosa reiterated his unequivocal support in his state of the nation address on Thursday.

He said: “The Reserve Bank is a critical institution of our democracy, enjoying wide credibility and standing within the country and internationally ... Today, we reaffirm this constitutional mandate, which the Reserve Bank must pursue independently, without fear, favour or prejudice. Our Constitution also requires that there should be regular consultation between the Reserve Bank and the minister of finance to promote macroeconomic coordination, all in the interests of employment creation and economic growth.”

Kganyago symbolises what many young South Africans should aspire to – work through the ranks, learn, develop and achieve the highest post in your career over a period of time. Kganyago teaches us that meritocracy, pragmatism, and being ethical and honest is rewarding.

I call on President Ramaphosa to give Kganyago his second term. He has earned it.

Mondi is a senior lecturer at the University of the Witwatersrand’s School of Economic and Business Sciences

Publications

Publications

Partners

Partners