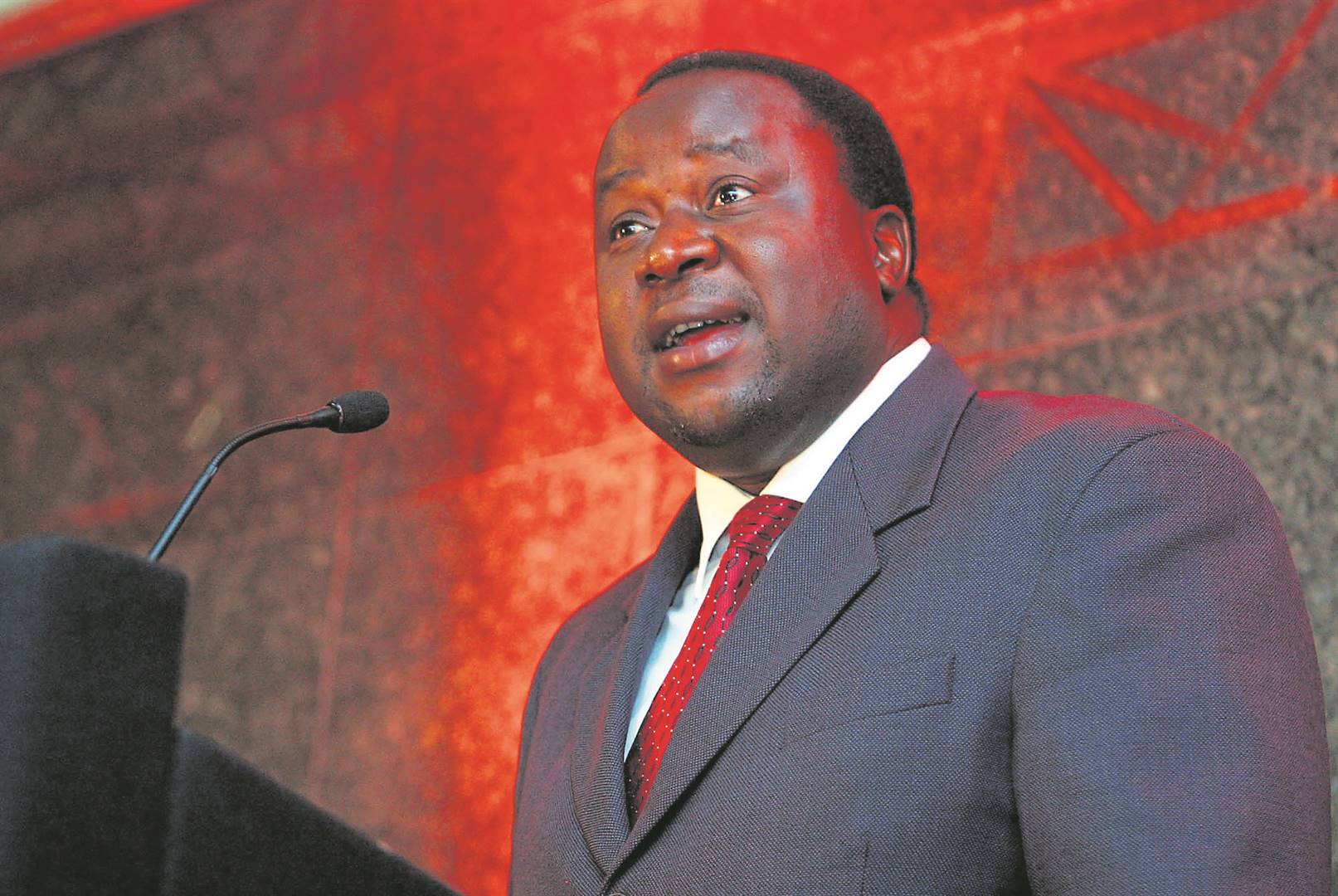

In his budget speech last month, Finance Minister Tito Mboweni announced a R950 million housing subsidy that will be paid out over the next three years.

This is part of government’s Our Help To Buy initiative, which aims to help first-time buyers to own a home.

Given the relatively poor uptake of the existing Finance Linked Individual Subsidy Programme (Flisp), is this R950 million really going to solve the problem, or does it just make a nice budget headline?

The Flisp is a subsidy that assists qualifying households by providing a once-off down payment to those people who have secured mortgage finance to acquire a residential property for the first time.

Megan Sager, founder of Sustainable Solutions, says the real housing challenge is that the cost of new ownership stock is escalating rapidly, mostly due to the scarcity of suitable land and a failure to deliver bulk municipal infrastructure.

This issue falls squarely at the feet of local governments and their inability to deliver services.

“Compounding this, South Africans have high expectations about what they are willing to pay for. They want freehold homes with specifications above RDP housing, which already costs more than R300 000 to deliver,” said Sager.

Dr Christoph Nieuwoudt, the CEO of FNB Consumer, agrees.

While the target income bracket is for individuals with an income of up to R15 000 a month, their maximum affordability is a mortgage of about R300 000.

This is often even lower due to a high exposure to short-term debt.

The subsidy means they could purchase a property for R350 000, but there is very little stock in this price range.

Apart from stock, one of the other challenges with Flisp is the current process.

Nieuwoudt says that, currently, an individual makes an offer on a property subject to qualifying for the Flisp programme.

As this is a conditional offer and it takes time to approve, most sellers would rather sell to a qualified buyer with no conditions attached to their offer.

Sager believes that banks are not incentivised to offer low-value mortgages.

Mortgages are not profitable under Basel III requirements, which has increased the cost of capital.

“They may start offering personal loans to buy homes instead. These will probably not qualify for subsidies.”

LACK OF ACCESS

Nieuwoudt agrees that “a lingering lack of access to a fully functional mortgage market for low-income earners and prohibitive home loan credit rating criteria are still preventing the majority of low-income households from achieving formal home ownership”.

However, the use of personal loans for purchasing a home may also have to do with the current legal situation regarding RDP homes.

Nieuwoudt says that, because people who own RDP homes may not sell their properties for a specified period of time, many of them have sold them illegally for much less than they are worth.

For example, people are buying properties that are worth R300 000 for just R80 000.

This has set a false price for the property market, but also prevents people from accessing home loans for those properties or unlocking their real value.

Nieuwoudt says the non-payment of municipal bills compounds the problem.

A bank may not be prepared to issue a mortgage on a property with a large outstanding municipal bill, and the area may also carry a higher risk rating due to the lack of payment for services.

This is all suppressing the value of property in township areas.

While this may be good for someone who wants to buy a property, it prevents home owners from building up equity in their homes, which is the case in suburbs.

So, how do we unlock affordable housing so that socioeconomic transformation can take place?

Nieuwoudt believes the first solution is to include the subsidy into the pre-approval process for a bond, which would allow the buyer to make an unconditional offer to purchase.

Sager believes that non-bank lenders should be included in the subsidy programme. This includes companies such as Kuyasa and HIP, which operate in the lower-income housing space. Because they are not banks, they are not constrained by Basel III requirements.

Finally, Nieuwoudt argues that, to bring more affordable stock to the market and use property to raise financial wellbeing, a coordinated approach is required.

This will involve local government releasing land in areas where people want to live. Government will also have to work with developers and financial institutions to keep the prices down, and homeowners will have to pay for services so that the properties retain their value.

Publications

Publications

Partners

Partners