The medical aid industry is in trouble, and if nothing is done, it will collapse, forcing millions of members to turn to the public healthcare sector, warns a leading medical executive.

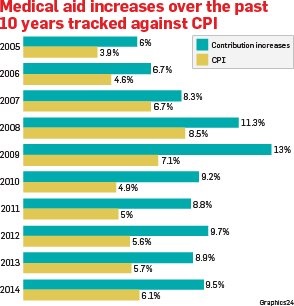

The industry has been paying out more than it collects from members. And, on top of that, contributions have been increasing at a pace that is 50% higher than the inflation rate, while benefits have been shrinking.

It is this lethal combination that makes the chief executive of the Board of Healthcare Funders, Humphrey Zokufa, believe that medical aid schemes are at risk of collapsing.

“What we are seeing right now is that schemes are paying out more than they collect per annum. Some schemes are even using their reserves to pay for claims.

“This is not an ideal situation and it is not sustainable in the long term,” said Zokufa.

The Board of Healthcare Funders represents the interests of 65% of the country’s medical aid schemes, but works with most of them in one way or another.

Zokufa explained that when schemes paid out more than they collected, premiums were bound to go up.

“This is what we have been seeing in the past couple of years, with schemes increasing their premiums far higher than the inflation rate.

“Medical schemes are trying to match what they pay out. The downside to this is that when premiums increase, it’s the members who suffer,” he said.

Elsabé Conradie, general manager of stakeholder relations at the Council for Medical Schemes, agreed, saying that members were the ones who bore the burden of hefty annual increases. She explained that the reason medical aid premiums were escalating every year was primarily because of the high prices charged by service providers, mainly specialists.

She also cited the decline in the number of young, healthy people signing up for medical aid schemes. This group usually cross-subsidises the old and sick members of a medical aid scheme.

Zokufa also pinned the blame on specialists and private hospitals, as both were claiming exorbitant amounts from medical aids.

“Specialists and private hospitals have free rein in this country. They charge whatever they want because their prices are not regulated,” he said.

“When you look at private healthcare expenditure in the last 10 years, you will see that 60% of the budget goes to specialists and private hospitals, while general practitioners and other entities share the remainder of the pie. This situation is not healthy or adequate because it fuels the contribution increases and impacts on the money paid by members to cover the shortfall on their medical bills,” he said.

Although the law allows doctors and private hospitals to charge whatever they want, medical aid schemes have set a cap on how much they will pay for procedures and consultations. That, however, does not help patients. All it means is that when members visit a facility that charges more than their medical aid is willing to pay for a procedure or consultation, members must cover the shortfall themselves.

Last year, medical aid scheme members were compelled to pay R20.7 billion in addition to their premiums to cover shortfalls on medical bills.

The Council for Medical Schemes revealed in its latest annual report that this figure was the tip of the iceberg, as there was a great deal of underreporting when it came to out-of-pocket payments.

Zokufa explained that these out-of-pocket payments were causing much unhappiness among members.

“Imagine being a member paying thousands of rands to a medical scheme every month. And when you need it to settle your medical bills, it pays only a portion of what is claimed by the provider, leaving you to cover the shortfall. You will obviously be unhappy and, when you are unhappy, you will leave the medical scheme.

“This is the risk that medical schemes are also faced with right now.

“Members are not satisfied with the service they are receiving compared with what they are paying.”

Forking out extra because of the paediatrician’s fees

Alison Visser’s one-year-old daughter fell sick in October last year. She was admitted to hospital for suspected encephalitis (acute inflammation of the brain).

The toddler stayed in hospital for a few days while tests were conducted. Results revealed she had a bad ear infection, which was treated successfully.

Visser was of the view that her family’s medical aid scheme would take care of all costs relating to her daughter’s treatment and hospitalisation.

But she was in for a shock early this year when she found that she owed the doctor thousands of rands in unpaid bills and, if she did not pay up, legal action would be taken to recoup the money.

She explains that the shortfall, which was more than R3 000, consisted of fees charged by the paediatrician who had treated her daughter. This worked out to an amount that was above the rate her medical aid was willing to cover.

“I think it was a combination of us being out of savings and the paediatrician not charging the medical aid rates. The medical aid did cover the hospital’s bill in full – it was just the paediatrician’s whopping bill that wasn’t covered in full.”

Visser is a member of Fedhealth and is on its Maxima Standard plan, the highest option for the scheme.

She and her husband contribute more than R6 000 a month to cover them and their two children. “It irks me that I have to fork out for something like that for a medical aid,” she said.

Despite that experience, Visser is still happy with her medical aid scheme, saying it does not make a fuss about making payments and the benefits are better than those of other medical aids.

She blames the paediatrician for charging exorbitant fees, which resulted in her having to make such a big copayment.

‘My medical aid has really messed up my life’

Winnie Mphago is in a financial quandary because her medical aid scheme only paid a portion of her medical bill, leaving her with a R6 000 debt that resulted in her being blacklisted as a bad payer.

Mphago (34), a clinical trial manager at pharmaceutical company Pfizer, said her woes began in July last year when she went for a check-up. Her gynaecologist conducted routine tests and performed an X-ray on her.

A few weeks later, she received letters from her doctor and the pathology lab informing her she had an outstanding bill that needed to be settled immediately.

When she queried it with the service providers, she was told the medical aid had paid a portion of what the gynaecologist and pathology lab had charged.

“I contacted the medical scheme and was told that the amount paid was according to the scheme’s rate and I had to cover the shortfall – I was pissed off.

“How can a medical scheme, to whom I paid thousands, tell me it had paid according to its rates and the rest must be settled by me?” asked an irate Mphago.

A lone member, she contributed R1 200 a month to cover herself for these types of cases.

After back-and-forth communication between Mphago and her medical aid proved unhelpful, she decided to make an arrangement with her gynaecologist to settle the outstanding balance by paying R200 every month.

The pathology lab, however, ended up blacklisting her due to nonpayment. Now each time she applies for credit, it immediately raises a red flag.

“My medical aid has really messed up my life and it will take time for me to recover from this. I can’t buy anything or apply for anything [on credit] without this blacklisting popping up,” she says.

Mphago has since left the medical aid scheme.

* The name of the medical aid has been withheld

Publications

Publications

Partners

Partners