This was one of the most tax-friendly budgets we have seen in years. For the first time in three years, taxpayers will receive tax relief in the form of above-inflation adjustments to the tax tables.

This will result in real tax relief of R2 billion, which will be offset by increases in carbon tax and a further levy on plastic bags.

Potential home owners will pay less tax when buying a home, and there was an increase, albeit quite small, in the medical tax credits.

Even the usual sin taxes and excise duties are muted, at an average increase of 4.4% – in line with inflation. In comparison, last year the average excise duty increase was 7.7%.

There appears to be an intention to shift more of the tax burden on to indirect taxes, particularly those related to environmental factors, such as plastic bags, incandescent light bulbs and fossil fuels.

Rather than increasing tax rates, the budget review stated that it would focus on improved tax collection from the SA Revenue Service (Sars).

At a press conference, Sars commissioner Edward Kieswetter said that tax policy was only one of the ways to improve tax revenue and that there was now a focus on improving tax compliance and collection capability.

In other words, the focus will be on making sure that those who should be paying taxes are, rather than further taxing the tax-compliant.

TAX RELIEF

- PERSONAL TAX RELIEF: In the past three years government increased personal income tax through inflation. It did this by not adjusting the tax brackets for inflation-adjusted salary increases.

This year, not only did government adjust the tax tables to accommodate a 4.4% inflation increase, but it also gave real tax relief.

For example, someone earning R300 000 a year will pay R1 542 less tax during 2020/21 – or R128 less a month.

The bulk of the tax relief went to individuals earning less than R120 000 a year. South Africans under the age of 65 can earn R83 100 a year before paying tax.

Taxpayers over the age of 65 and 75 can receive an income of R128 650 and R143 850 a year, respectively, without paying tax.

- PROPERTY TRANSFER TAX: Property buyers will also receive tax relief as the threshold on paying property transfer tax has been increased from a property value of R900 000 to R1 million.

On a property purchase of R2 million, this will result in a R9 750 tax saving.

- MEDICAL TAX CREDITS: Medical tax credits are increased from R310 to R319 for the first two beneficiaries, and from R209 to R215 for remaining beneficiaries.

This only increases the tax credit by 2.8%, which is lower than inflation, and certainly much lower than increases to medical scheme contributions.

This limited increase is to help fund the roll-out of the National Health Insurance.

- TAX-FREE SAVINGS ACCOUNTS: The maximum annual contribution allowed for tax-free savings accounts has been increased from R33 000 to R36 000, although currently the R500 000 lifetime limit still applies.

INCREASED TAXES

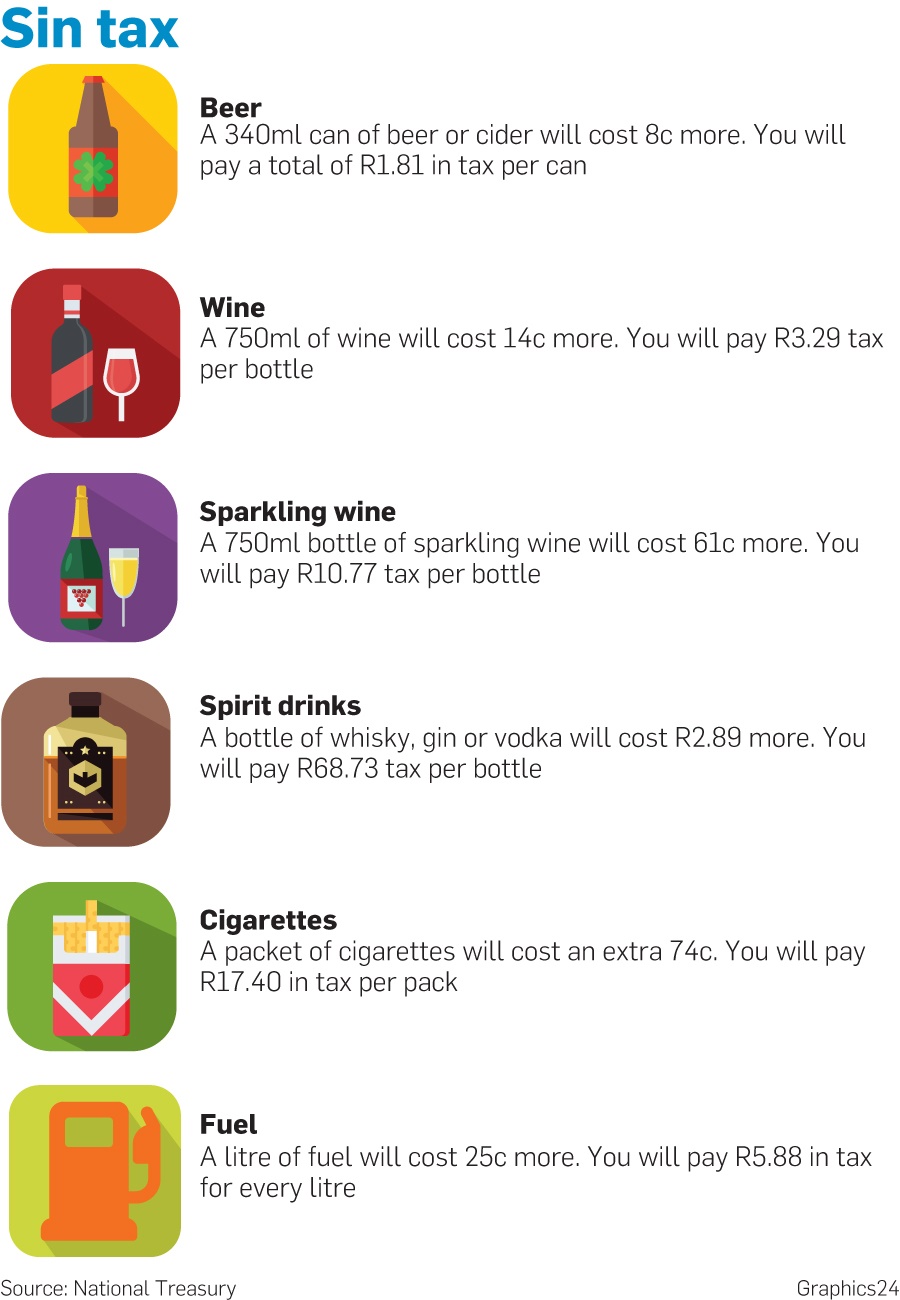

- FUEL TAXES: As from April 1, we will see an additional 25c in taxes made up of a fuel levy increase of 16c and Road Accident Fund of 9c. This means that we will be paying R5.88 in taxes on a litre of petrol and R5.74 for diesel.

In an interview, Chris Axelson, chief director of economic tax analysis at the National Treasury, said that VAT on fuel was being considered.

However, this will be done in conjunction with a review of the fuel levy so that motorists are not suddenly faced with a 15% increase in their fuel bill.

- ENVIRONMENTAL TAXES: Statements in the budget review made it clear that there would be a greater focus on using taxes to curb environmentally harmful products.

Meanwhile, the plastic bag levy increases from 12c to 25c, and there will be a R2 increase in the incandescent light bulb levy to R10.

Apart from an increase in the carbon tax, purchase tax on motor vehicle emissions has been increased, making gas-guzzling cars less affordable.

Government is considering restructuring the general fuel levy to include a local air pollution emissions component.

Car licences may incur an annual carbon dioxide tax and the tax treatment of company cars will be reviewed to incentivise more fuel-efficient vehicles.

- SIN TAXES: There were the usual tax increases on wine, cigarettes and beer. Government also started focusing on vaping this year. As the definition of the chemicals used is still being clarified – government does not want to inadvertently tax medication used in nebulisers – the first step is a tax on heated tobacco products that are inhaled.

Government is also looking at introducing a tax on electronic cigarettes next year.

Publications

Publications

Partners

Partners