To avoid any unwanted surprises, make sure you get all the information about how much you need to pay before you buy, and try to put down a substantial deposit, writes Maya Fisher-French.

On a recent flight to Johannesburg from Cape Town, I sat next to a young woman who shared her experience of buying her first home.

She is well educated and has experience working at a bank. Yet, when it came to buying her first home, she was caught off-guard by all the expenses she would incur. She discovered that buying a house is a lot more expensive than just being able to afford the monthly bond repayment and having a 10% deposit.

Had her parents not been able to help, she would have found herself taking out short-term loans and starting out in deeper debt than she had planned.

This is a scenario we often see because, once you have your heart set on a home, you will be prepared to do just about anything to make sure the sale goes through.

You could find yourself unable to afford the additional costs, but you cannot cancel the agreement as it is based on qualifying for a mortgage – not on your affordability of additional expenses.

If you are thinking of buying a home, keep this page on your fridge door.

UPFRONT COSTS:

Geoffrey Lee, managing executive: home loans at Absa, says these are the additional costs you will incur when buying a home.

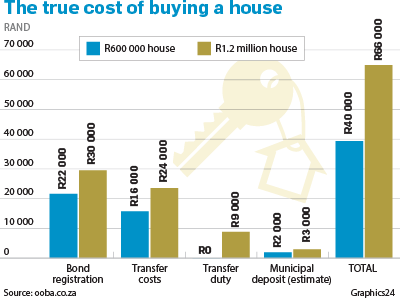

. Transfer costs: These include conveyancing attorney fees to handle the transfer of ownership from seller to buyer. They manage the process with the deed’s office. Added to the attorney fees there are administration costs. The total cost will depend on the value of the property.

. Registration charges: If you are applying for a mortgage, you need to pay another set of attorneys – so it’s double the legal fees. There is a bank initiation fee on the issuing of a new mortgage. Note that you can negotiate the legal fees with the bank.

. Transfer duties: This is a tax paid on properties that cost more than R900 000.

. Municipal connections and deposits: Most municipalities require a deposit to transfer and connect council water and electricity services. These differ between municipalities and need to form part of your upfront investigation. For example, Johannesburg charges two months’ deemed usage as a deposit.

. Relocation (moving costs), telephone and Wi-Fi connections: These will cost extra and may require installation fees.

ONGOING COSTS

The bond repayment is not the only ongoing cost you need to budget for. Lee says that, after deducting your loan payment from your income, you need to consider utility costs such as water, electricity and levies. Your estate agent should provide you with an idea of the average monthly spend on rates and taxes, and water and electricity for the area.

Levies are an important consideration should you be buying a sectional title property and they will form part of your monthly expenses. The estate agent will be able to give you an indication of what the levies are and, importantly, the growth of the levies (rate of increase over a few years).

While you can fix your home loan, levies will continue to increase at least in line with inflation. This means you can expect your levies to double within the next 10 years.

TIPS ON PREPARING FOR A HOME LOAN

. Buy within your means, and always be realistic, open and honest;

. Prepare a detailed budget, review your bank statements and consider all your expenses, however big or small, and remember to include those that are due on an annual or quarterly basis;

. Remember, not being able to afford the instalment of your loan is worse than the fleeting awkwardness of being declined upfront;

. Use the tools available on your banking website and obtain expert advice from an industry specialist, such as a home loans consultant, private banker or mortgage origination consultant;

. Consider the effect of an interest rate hike on your monthly instalment;

. If you are not comfortable with exposing yourself to fluctuating interest rates, a fixed-rate option could be your solution;

. Before you start the home loan application process, double-check that you have all your paperwork ready; and

. It is essential that prospective home buyers understand:

1. What the monthly repayments will be;

2. The potential savings when putting down a larger deposit;

3. Detailed costs of the new home loan, including registration charges, transfer costs and attorney fees.

Source: Absa

HOW A DEPOSIT REDUCES THE COST

A deposit is a lump sum of money that you pay towards the overall cost of the home or land you are buying.

Being able to put down a deposit is an advantage as it lowers the capital amount you have to pay back and, therefore, you pay less interest.

Lee says putting down a 10% deposit on a R1 million home (R100 000) will save you almost R1 000 a month and just short of R240 000 over 20 years.

. A minimum of 10% to 15% of the property purchase price (for the deposit) should be the target for customers, but people who can put in a larger deposit should do so. The larger the deposit, the less you have to pay back;

. A deposit usually strengthens the applicant’s chance of approval;

. Remember, with a deposit, the home loan amount applied for would be lower, thereby reducing the required monthly instalment and positively influencing affordability factors for the applicant; and

. In addition, a deposit can positively influence the interest rate applicable to the loan – the larger the deposit, the more favourable the rate concession.

HOUSE BUYING ADVICE FROM THE RESERVE BANK GOVERNOR

At a recent media lunch, Reserve Bank governor Lesetja Kganyago shared the advice he gives his nephews if they come to him when they want to buy a house.

“I tell them to work out how much it will cost them each month to meet the mortgage repayment. Then I tell them to save that amount each month. When they come to me and tell me they cannot afford to save so much, I tell them: ‘Then you can’t afford a house.’”

That is such great advice and a good way to stress test your budget before buying.

It has the added benefit of creating a deposit to put down on your first home.

Keep in mind that you are aiming for at least a 10% deposit plus another 7% for additional expenses. So, ideally, you should have about 18% to 20% of the purchase price saved before buying.

Publications

Publications

Partners

Partners