Studies show that companies that provide employee benefits are more likely to attract and retain talent. Employee benefits provide a financial safety net and security for employees.

Companies can provide an array of benefits, from retirement savings to medical aid, and risk benefits such as life cover, funeral cover and disability cover.

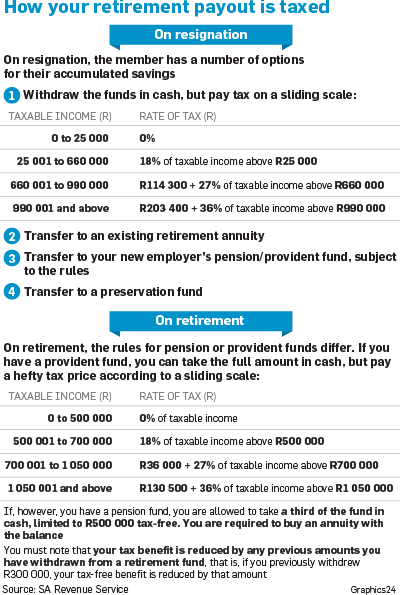

In South Africa, where there is a lack of a savings culture, having an employer-funded pension or provident fund helps employees save for their nest egg.

Unfortunately, many employees simply sign on the dotted line and do not interrogate the benefits. They just have a vague idea of which benefits they have.

UNDERSTANDING YOUR RETIREMENT FUND

- CONTRIBUTIONS: Whether you have a pension or provident fund, both you and your employer will contribute a percentage towards the retirement fund. To maximise your retirement savings, it is advisable to choose a higher percentage of contribution. In most cases people opt for the lowest percentage possible to have more money in their pockets. If your employer matches your contribution, you should take advantage of this.

- FUND SELECTION: Depending on the member’s age and risk appetite, they can select between conservative, moderate and aggressive funds. Although member education is provided, people are often confused by the options available. Be sure to ask your HR manager or benefits manager about the different fund options. If they are not comfortable, they should refer you to the investment consultants on the fund.

- GROUP RISK BENEFITS: Other companies go further and provide their employees with group risk benefits.

- LIFE COVER: Over and above the accumulated savings in a retirement fund, on the death of a member, their beneficiaries will receive a death lump sum, which is normally a multiple of the members’ salary.

- APPROVED LIFE COVER: Approved life cover means the retirement fund is the policyholder; this means that in the case of death of the member, the trustees will have the final say in how the death benefit will be distributed to the deceased’s family members All contributions to approved funds are tax deductible up to 27.5% of taxable income, capped at R350 000 a year, but the pay-out will be subject to tax. All benefits paid from an approved retirement fund are exempt from estate duty.

- UNAPPROVED LIFE COVER: Unapproved life cover means that the policyholder is the employer on behalf of the member. This means that in the event of death, the benefit will be paid directly to the beneficiaries of the deceased employee. With unapproved life cover, contributions are not tax deductible but the payout is tax-free. Unapproved death benefits are included as deemed property in determining the estate duty liability.

With both approved and unapproved life cover, it is very important to remember to nominate your beneficiaries. Even though with approved life cover, the trustees have the final say in who they will distribute the benefit to, it is still advisable to write down your beneficiaries for them to use as a guideline and perhaps speed up the payout process.

Other benefits that employers offer are funeral, disability, income protection and severe illness.

Beware and familiarise yourself with all the benefits that your employer offers. This helps you to plan your overall financial life.

- Makhu is a personal finance coach

Publications

Publications

Partners

Partners