Let’s be real: in many cases our bad money habits hold us back from reaching the seemingly elusive state of financial freedom. Lots of people fall into the debt trap because they do things they could easily have avoided. Financial success or financial freedom requires you to have a plan. Your plan does not have to be the best plan under the sun, but you need a plan nonetheless. There are two ways in particular in which people get caught out: lifestyle creep and believing that they have to keep up with their peers.

Lifestyle creep or middle class syndrome

You’ve probably heard the saying, “Motho o phela ka sekoloto (You can only live and survive if you have debt).” I first heard someone say this quite early on in my career. It was someone who was older than me and who had been working for much longer than I had. She believed her statement and lived by it throughout her career. With every pay increase, she found another expense on which to spend the money in her budget.

Many people get caught up in lifestyle creep – also known as middle class syndrome – when they get a pay rise. You earn more, so you spend more, and suddenly find that you are living from payday to payday. So you work harder, get another raise and repeat the cycle.

Lifestyle creep can happen to anyone who is not intentional about money. It occurs when your standard of living increases with every pay increase (or discretionary income increase). Often, what happens is that something that was previously a luxury now becomes a “necessity”. For example, I know people who had a standard gym membership when they started out in their career, but as their income increased they upgraded to a nationwide membership – yet their work doesn’t even take them out of town. They have let a luxury become a necessity.

Warren Buffett says this about living from salary to salary: “Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.”

What he means is that when you’re living in this cycle, it can be hard to find the time or, more importantly, the resources to take a step back and address your financial issues at their core, but that trying to patch up the situation rather than address its root cause can perpetuate the cycle. Some examples of patches on the cycle of living from payday to payday are payday loans or “hardship withdrawals” from your retirement fund.

I have personally heard of people who want to quit their jobs so that they can cash in their pension or provident fund to pay off their debts. This is a huge financial mistake. While a financial patch might get you out of a pinch, in the long run it almost always sets you up for failure.

- Looking for regular expenses you can trim;

- Re-evaluating your needs versus your wants; and

- Downgrading on some high-expenditure items.

Even a year of sacrifice can set you apart from others who are in the same sinking boat. If downgrading means that you have to sell your luxury car for a cheaper and more affordable one or move in with a family member, do it. Changing vessels might take time and effort, but it may be a good long-term solution and one that pays high rewards.

Ska ba hemisa, ska ba fa chance (Keeping up with the Khumalos)

Nothing hinders financial progress more than trying to keep up with your peers or friends (some might even call them frenemies). You may have heard young professionals say, “Ska ba hemisa, ska ba fa chance”, which loosely translates as, “Don’t let them breathe, don’t give them a chance to shine.” When I hear someone say this, I want to ask them: “When are you going to give yourself a chance to flourish financially? When are you going to give yourself a chance to build real wealth?”

Internationally known Chinese-Canadian entrepreneur and business magnate Dan Lok says this about the difference between rich and poor: “Before they [the rich] buy the fancy watch, they buy the investments. The investment makes them money, and then they buy the fancy watch. But you don’t want to do that, because you have a big ego. You want to show the world and your family that you’ve ‘made it’. Which you haven’t. You want to look rich versus be rich. You go and buy the expensive watch/car and everybody thinks you’ve made it. You did not make it. You just made yourself poorer. If you can, have the self-discipline and self-control to buy the asset first. Once you buy the assets, you can buy all the luxuries you want. Your assets will pay for them. Your assets make you money. Your investments provide for you; your investments feed you. That’s the difference!”

Spending money you haven’t earned yet

A bad habit many people have is spending money they haven’t earned yet. Let me give you an example: if you work in sales, most companies will offer you an advance against your future earnings. Or, from my own personal experience, I can tell you that when I was asked to write this book, my publisher offered me an advance. But I said, “No, thank you!” I didn’t want to spend money I hadn’t earned yet.

It is even worse when people use their credit card or overdraft to spend money on consumables. When it’s time to pay back the amount owing, they often barely remember what they bought, and the pleasure of owning the item they bought has long since worn off.

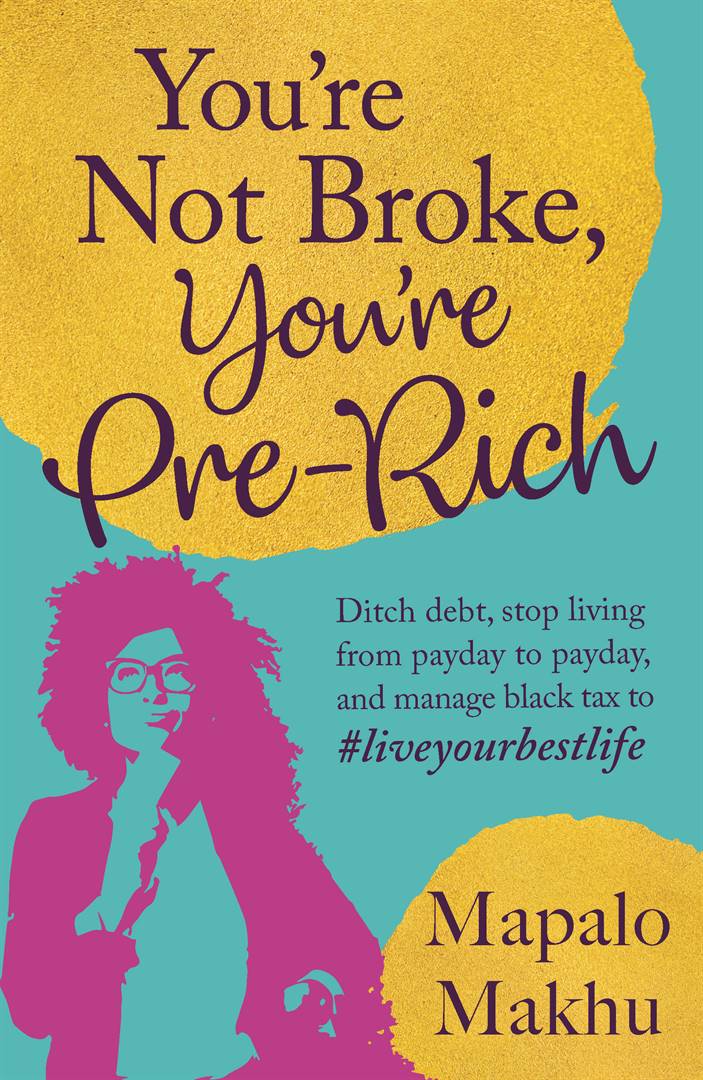

If you are looking for a guide that is easy to read on how to manage your finances, personal finance coach and founder of Woman & Finance Mapalo Makhu has just released her book You’re Not Broke, You’re Pre-Rich.

It’s a great guide on how to ditch debt and stop living from payday to payday, and it also deals with relevant topics such as managing black tax and selecting the right investments to grow your wealth.

You can purchase a copy of the book at any good bookstore.

Publications

Publications

Partners

Partners