If you are a member of a pension fund or have a retirement annuity, two-thirds of your final retirement amount must be used to purchase an annuity income.

However, if your pension or retirement annuity is worth less than R247 000, you can take the full amount without purchasing an annuity.

You can take one-third as a lump sum, but you will be taxed. You receive a R500 000 tax-free benefit, but this could be reduced if you made withdrawals from your pension fund when changing jobs.

If you are a member of a provident fund, you can take the full amount as a lump sum, however, you will have to pay, so it may make more sense to purchase an annuity because this transfer is tax-free.

There are two main options when it comes to purchasing an annuity income – a guaranteed life annuity or a living annuity. What is important to know is that, once you have purchased an annuity, you cannot “undo” it and get your capital back.

Guaranteed income for life

In the case of a guaranteed annuity, you purchase an income for the rest of your life, however, it is not like a bank account, where there is a balance that earns an income. With a guaranteed annuity, you hand over a lump sum in exchange for the guarantee that you will receive a set income, with the option of increasing with inflation, for the rest of your life.

The annuity continues for as long as you live, but stops when you die. This effectively forms a cross-subsidisation between people who may die earlier than expected and those who live well beyond the expected life span.

If you have had health issues prior to retirement, it is worth asking for an underwritten annuity, which is where the insurer takes your health status into consideration when calculating your income.

If your health status indicates that you may not live to the average life expectancy, you would receive a higher monthly income.

Most guaranteed life annuities include a guarantee period where the income continues to be paid to your beneficiaries, even if you die.

For example, there may be a five- or even 10-year guarantee period. You could also opt for your spouse to continue to receive a percentage of the annuity income should you die.

These all affect the cost of the annuity – or, put another way, the amount of income you receive.

You should always opt for an annuity that increases in line with inflation, otherwise your income will not keep up with your expenses.

This will mean less income initially, but during your younger retirement years, you can still supplement your income with ad hoc work, but you do not want to be doing this in your later retirement because your income is not keeping up with your expenses.

Market-related returns

With a living annuity, you have an investment portfolio, which means your income is determined in part by the return of the underlying investments. You can draw down between 2.5% and 17.5% of the capital each year.

This allows more flexibility in terms of your income – you could draw down less in your first years of retirement if you have part-time work, and then increase the amount in your later years.

Any balance in your living annuity is paid to your beneficiaries when you die.

The problem with a living annuity is that the income is not guaranteed and you could run out of money before you die.

income depends on the performance of the underlying assets and recent poor market performance has seen many retirees eating into their capital, which means they have to reduce their drawdown or they will run out of capital.

Ideally, you should not draw more than 5.5% of your capital a year. If you draw more than that, the capital amount will not be able to grow with inflation and your income will be eroded over time.

Unlike a guaranteed annuity, you can withdraw capital from your living annuity, but only if the balance has fallen to R75 000, or R50 000 if you took the one-third lump sum at retirement.

Hybrid annuity

Another option is to consider a combination of a guaranteed annuity and a living annuity. You could purchase a guaranteed annuity that just covers your basic monthly expenses, which means you know you will always have enough to survive.

You can then invest the rest in a living annuity. This gives you the flexibility to draw down when you need to, and any unused funds can be left to your beneficiaries.

How much do you get for R1 million?

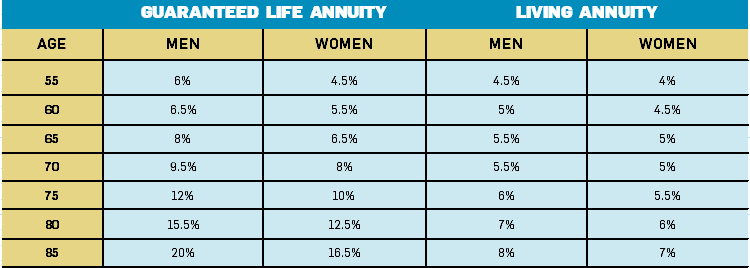

For example, in the year after retirement, a man at the age of 65 with retirement savings of R1 million could expect to receive 8% (R80 000) from the guaranteed life annuity, guaranteed for life, or 5.5% (R55 000) from the living annuity, with a 90% probability of sustaining this level of drawings for life.

In both cases, the income is targeted to grow with inflation each year on consistent assumptions.

Similarly, in the year after retirement, a woman at the age of 60 with retirement savings of R1 million could expect to receive5.5% of this (R55 000) from the guaranteed life annuity, guaranteed for life, or 4.5% of this (R45 000) from the living annuity, with a 90% probability of sustaining this level of drawings for life.

In both cases, the income is targeted to grow with inflation each year on consistent assumptions.

Members of Government Employee Pension Fund

The GEPF has its own set of rules, any lump sum payment and income is determined by a formula based on years of service and contributions. The annuity received tends to be at a better rate than if you bought a guaranteed annuity in the market as the GEPF does not have to pay fees.

The income automatically increases each year at 75% of the official inflation rate, which could be higher depending on the performance of the fund.

On April 1, the increase of 5.2% was in line with inflation. The annuity is guaranteed for 60 months after retirement, which means your beneficiaries will still receive the income until 60 months after retirement date.

It includes a spousal benefit of 50% of the pension should the main member die first. It also provides funeral benefits for the member, spouse and eligible children.

According to retirement provider Just Retirement Life, underwriting at retirement requires a 20-minute confidential phone call with a trained professional to establish whether health or lifestyle factors could reduce your life expectancy – if they do, you may qualify for a higher income for life.

For example, you may qualify for a higher income if you have:

- Earned lower income over your lifetime, which might have meant less access to healthcare and nutritional food; and/or

- Led a lifestyle that exposed you to health risks, such as underground work, smoking, drinking or high body mass; and/or

- Have a life-shortening illness.

Underwriting is optional and will not reduce your income.

DO YOU QUALIFY FOR THE STATE OLD-AGE GRANT?

In December, 3.5 million South Africans received state old-age grants. You qualify for this if you:

- Are a South African citizen living in South Africa and older than 60;

- Are single, earn less than R78 600 a year and have assets worth less than R1 122 000 (excluding the home you live in);

- Are married, earn household income of less than R157 200 a year and have assets worth less than R2 244 000 (excluding the home you live in);

- Do not receive any other social grant and you are not cared for in a state institution.

TALK TO US

Have you thought about your financial options after you retire? Do you feel you have done enough to be able to live off your retirement income? SMS us on 35697 using the keyword RETIREMENT and tell us what you think. Please include your name and province. SMSes cost R1.50. By participating, you agree to receive occasional marketing material. Alternatively, contact Maya Fisher-French at personalfinance@citypress.co.za

Publications

Publications

Partners

Partners