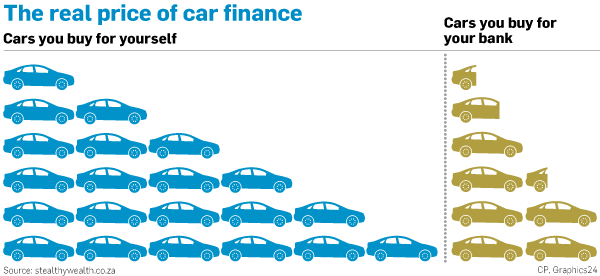

Due to the way we finance our cars, most South Africans end up buying their bank a car. In fact, some even end up buying their banks three or four cars over their lifetime.

To illustrate this, let’s consider a hypothetical South African. We will call him Peter.

Peter starts his working career at age 20 and soon realises he needs a car. Because he has only just started working, he has no savings and his only choice is to finance his first car.

Read: A car or an apartment?

Peter is somewhat conservative in his approach, and he decides on a second-hand car for R100 000. He takes out a loan for 100% of the purchase price and manages to get finance over 60 months with an interest rate of 12%.

Time moves on, and Peter diligently makes his monthly payments. After five years, his car debt has been fully settled. At this point, he would have paid a total of R133 467.

In other words, Peter would have paid an additional third of the original R100 000 purchase price to the bank in the form of interest.

While this is not ideal, Peter didn’t really have a choice, and he can probably be forgiven.

The real problem is what most people do after this point.

After the five years, Peter has climbed a few rungs up the corporate ladder, and now earns a slightly better salary. He no longer has that annoying car payment to deal with and he feels flush.

He tells himself that he works hard for his money, and he deserves to drive a better car. So he trades in his current car as a deposit and finds a newer car, which again requires a R100 000 finance deal over five years at 12% interest.

The finance deal runs its course and, again, after the five years are up, Peter has paid another one-third of a car over to his bank in the form of interest. In total, Peter has now bought his bank two-thirds of a car.

At this point, he has also progressed further up the corporate ladder, earns slightly more and now, of course, deserves an even better car.

I think you can see where this is going. After the third iteration of this pretty normal behaviour, Peter would have bought his bank an entire car.

- This can continue for many more finance deals on many more cars . For every three cars financed at 12% over five years (such as Peter did), you would end up buying your bank a car.

Over a 60-year period (for example, from age 20 to age 80) a person could easily go through six cars. And if each of these cars is bought and financed in a similar way to how Peter did it, the bank will end up getting two cars.

IS THERE A BETTER WAY?

If you want to avoid buying your bank too many cars, you could try the following approach, which could leave you hundreds of thousands of rands better off in the long run:

1. Try to pay extra towards any current car debt. The sooner you can settle outstanding debt, the sooner you can free up the money you’ve needed to pay every month (and the extra interest payment).

2. A paid-off car is not a signal that it is time to buy a new car. With modern manufacturing methods and quality, the chances are that you can easily get 10 to 15 – possibly even 20 – years out of a car. Drive your current car for as long as possible.

3. And now the key to really getting ahead – once you have the money freed up from (1) and you are still driving your current car (2), start saving some of the freed up money so you can purchase your next car with cash in a few years’ time.

All of this seems really easy in theory. In practice? Well, just take a look at any South African parking lot.

Stealthy Wealth is a personal finance blogger at stealthywealth.co.za

Publications

Publications

Partners

Partners