This is not an article about finding an extra couple of hundred rands to put it into your bond each month. It is not about moving your debit order from the 1st to the 25th of the month, or putting half of your annual bonus into your home loan. And it has nothing to do with allocating a portion of your annual increase towards your bond each year.

Make absolutely no mistake – all this definitely helps, but shaving years off your home loan, and hundreds of thousands off your interest bill, can actually be a lot easier than that, and it starts a lot earlier than when you sign up for a bond.

Let’s start by checking how a typical person might go about buying a property.

Meet Peter. Peter has just got a promotion and he has decided that he would like to buy a house.

So, the first question Peter asks himself is how much he can afford to allocate towards a bond repayment each month. He checks his budget, moves some expenses around, deducts the amount he is currently paying for rent, and comes up with R9 650 a month.

Based on this, Peter could qualify for a bond of R1 million. So Peter takes this R1 million and combines it with the size of his deposit to determine the price of the house he can afford.

In other words, Peter goes about things the way a lot of people do – they buy a house for the maximum amount they can afford.

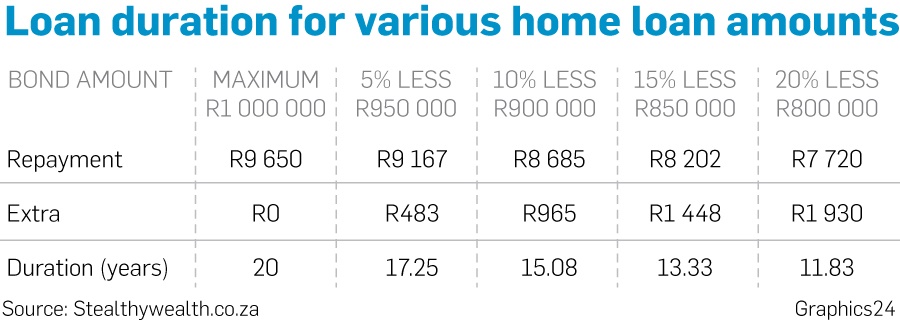

Now, consider if Peter instead decided to buy a house for 10% less than what he could actually afford. In other words, he takes a bond for R900 000 instead of R1 million.

Peter’s bond repayment would now be R8 685 a month. But because Peter could afford R9 650 a month, and he had earmarked the full R9 650 for the bond repayment, he decides to use the R965 a month saving as an extra payment towards his bond.

By doing this, he will pay off his house in just 15 years. A mere 10% reduction in the bond amount saves him 25% of the loan duration. Peter will own his home outright a full five years earlier without having to scrape any additional money together, get creative with debit order dates or be disciplined with annual bonuses. But imagine if he did all that too!

To take it a step further, let’s say Peter took a bond for 20% less than what he could afford (an R800 000 loan at 10% equals R7 720 a month) and put the savings (R1 930) back into his home loan every month. Peter would now be able pay off his house in less than 12 years.

A 20% reduction in the loan results in a 40% reduction in the loan duration.

To summarise, the accompanying table shows the loan duration for various home loan amounts for Peter, who could afford a R1 million bond.

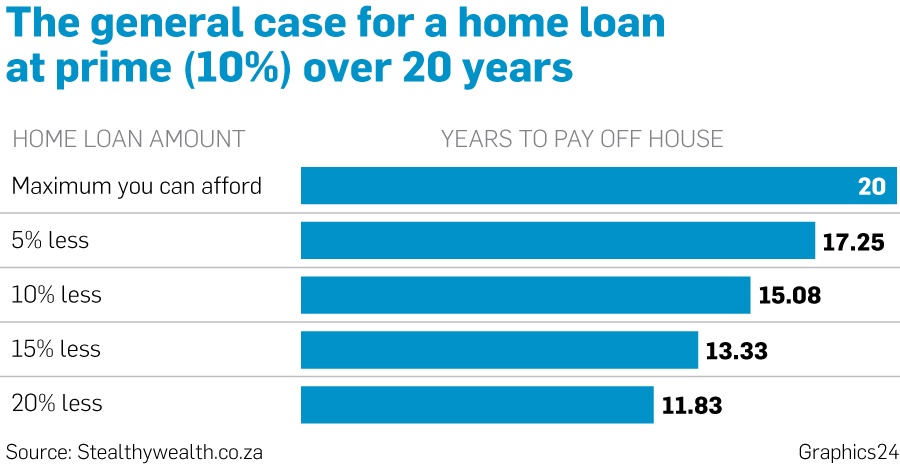

These same duration values apply for all home loan amounts. The table shows the general case for a home loan at the prime interest rate (10%) over 20 years, and how long it would take to pay off a bond that is less than what you can actually afford (assuming the savings are put back into the bond every month).

It must be said that buying for less than you can afford is easier said than done. This also assumes that you will have the discipline to put the savings from the reduced loan amount back into the bond every month. But if you can get it right, you can save hundreds of thousands of rands.

There is a common misconception that you can only take out a home loan over 20 years. This is not true – you can ask your bank for a period as short as five years. The only criterion is that you can afford the monthly repayment over that shorter period.

So if you are buying a property for R500 000 and you can afford nearly R11 000 a month, you can finance it over five years. If you want to give yourself some flexibility, you can opt for a 10-year repayment period but aim to pay it off over five years. – Maya Fisher-French

And, finally, don’t forget about the other advantages of buying for less than what you can afford:

- If there are sudden interest rate increases, you will at least have some wiggle room to manage it. Buying for the maximum you can afford could lead to an uncomfortable situation should interest rates go up.

- A cheaper property generally means lower associated costs, including lower insurance premiums, lower levies, and lower rates and taxes.

- The smaller the home loan amount, the higher the chance more banks will approve the loan, which means you have a better shot at getting a lower interest rate – imagine if you put the additional interest rate savings into your home loan as well.

So, for those who have yet to take the home ownership plunge, hopefully you will keep this article in mind when the time comes.

StealthyWealth is a personal finance blogger at stealthywealth.co.za

If you have been paying extra money into your home loan and have settled it before the required date, you need to decide whether you wish to keep the bond in place.

If you want to cancel the bond, you will be required to give the bank that gave you the loan 90 days notice of your intention to do so.

According to Lee Mhlongo, the CEO of FNB Home Finance, the bank will help you through the cancellation process, which involves providing final settlement figures and a consultation with bond cancellation attorneys, as the bond needs to be cancelled at the deeds office. If you are cancelling the bond, your attorney will work with the bank to return your title deed to you. Attorney fees will apply.

Another option is to keep the bond in place as a line of credit. In this case, the bank will retain the title deed. It is important to note that you only receive the title deed back when you cancel the bond – not just when it is paid off.

Mhlongo says that, if you are simply paying it off and not cancelling it, no notice is required.

“You are able to transfer any funds into your home loan at any time, saving yourself interest, and if you have a Flexi facility from FNB, you can access those prepaid funds immediately should you need them,” he says.

To keep your home loan open, simply don’t cancel it and you will continue to have access to any prepaid funds via your Flexi facility or access bond.

Keep in mind that you will pay a monthly service fee, normally R57.50, for home loans that fall under the National Credit Act.

This means that you delay your cancellation until you want to sell or until the end of your 20-year home loan term.

WHAT IS THE DIFFERENCE BETWEEN A HOME LOAN AND A MORTGAGE BOND?

Mhlongo says these are practically the same thing. There is a slight difference in that the home loan is the credit facility that the bank grants, while the mortgage bond refers to the legal agreement that is in place (the bond is registered at the deeds office), but, for all practical purposes, they are the same thing.

- by Maya Fisher-French

Publications

Publications

Partners

Partners